Strong Production to Drive Devon Energy's (DVN) Q3 Earnings

Devon Energy Corporation DVN is set to report third-quarter earnings on Nov 1, after market close. This oil and gas company delivered an earnings surprise of 8.82% in the last reported quarter.

Let’s discuss the factors that are likely to be reflected in the upcoming quarterly results.

Factors at Play

Devon Energy’s domestic focus and multi-basin high-quality assets ensure strong production volumes. Acquisition of RimRock Oil and Gas LP in the Williston Basin at the beginning of the third quarter is likely to be accretive to its earnings.

Strong oil production from the high-margin Delaware Basin region is expected to have boosted third-quarter oil production. Strong commodity prices are also likely to have enhanced performance.

A high percentage of DVN’s third-quarter production volumes are liquids. To safeguard against the sudden fluctuation in commodity prices, Devon has hedged 20% of its production volume, which will safeguard it against price fluctuation.

Expectations

The Zacks Consensus Estimate for third-quarter oil production is pegged at 293,000 barrels of oil equivalent per day (Boe/d). The Zacks Consensus Estimate for third-quarter natural gas liquid (NGL) production is pegged at 153,000 Boe/d.

Devon Energy expects total production for the third quarter in the range of 593,000-613,000 Boe/d.

What Our Quantitative Model Predicts

Our proven model does not conclusively predict an earnings beat for Devon Energy this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is not the case here, as you will see below.

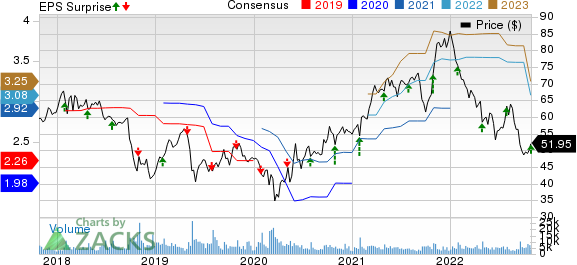

Devon Energy Corporation Price and EPS Surprise

Devon Energy Corporation price-eps-surprise | Devon Energy Corporation Quote

Earnings ESP: Devon Energy has an Earnings ESP of -0.01%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Devon Energy currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks to Consider

Investors can also consider the following players from the same industry that have the right combination of elements to beat on earnings in this reporting cycle.

Chesapeake Energy Corporation CHK is scheduled to release third-quarter 2022 numbers on Nov 1. CHK has an Earnings ESP of +0.42% and has a Zacks Rank of 2.

Chesapeake Energy’s long-term (three to five-year) earnings growth is 6.27%. The Zacks Consensus Estimate for third-quarter 2022 earnings of Chesapeake imply a year-over-year growth of 88.2%.

Murphy Oil Corporation MUR is scheduled to release third-quarter 2022 numbers on Nov 3. MUR has an Earnings ESP of +0.79% and carries a Zacks Rank of 3.

The Zacks Consensus Estimate for third-quarter 2022 earnings of Murphy Oil implies year-over-year growth of 550%.

Diamondback Energy FANG is scheduled to release third-quarter 2022 numbers on Nov 8. FANG has an Earnings ESP of +0.63% and has a Zacks Rank of 3.

FANG’s long-term earnings growth is 21.9%. The Zacks Consensus Estimate for third-quarter 2022 earnings of Diamondback Energy implies year-over-year growth of 119.4%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Devon Energy Corporation (DVN) : Free Stock Analysis Report

Chesapeake Energy Corporation (CHK) : Free Stock Analysis Report

Murphy Oil Corporation (MUR) : Free Stock Analysis Report

Diamondback Energy, Inc. (FANG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research