Strong week for Viridian Therapeutics (NASDAQ:VRDN) shareholders doesn't alleviate pain of three-year loss

Viridian Therapeutics, Inc. (NASDAQ:VRDN) shareholders should be happy to see the share price up 15% in the last week. But only the myopic could ignore the astounding decline over three years. In that time the share price has melted like a snowball in the desert, down 85%. So we're relieved for long term holders to see a bit of uplift. Of course the real question is whether the business can sustain a turnaround. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

The recent uptick of 15% could be a positive sign of things to come, so let's take a lot at historical fundamentals.

View our latest analysis for Viridian Therapeutics

We don't think Viridian Therapeutics' revenue of US$2,595,000 is enough to establish significant demand. You have to wonder why venture capitalists aren't funding it. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. For example, they may be hoping that Viridian Therapeutics comes up with a great new product, before it runs out of money.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Some Viridian Therapeutics investors have already had a taste of the bitterness stocks like this can leave in the mouth.

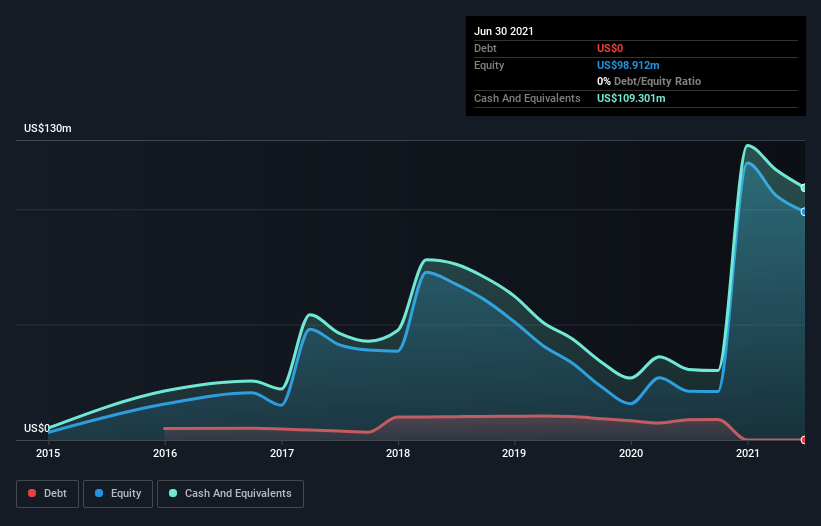

Viridian Therapeutics had cash in excess of all liabilities of US$90m when it last reported (June 2021). That's not too bad but management may have to think about raising capital or taking on debt, unless the company is close to breaking even. We'd venture that shareholders are concerned about the need for more capital, because the share price has dropped 23% per year, over 3 years. The image below shows how Viridian Therapeutics' balance sheet has changed over time; if you want to see the precise values, simply click on the image.

Of course, the truth is that it is hard to value companies without much revenue or profit. What if insiders are ditching the stock hand over fist? I would feel more nervous about the company if that were so. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

A Different Perspective

Over the last year, Viridian Therapeutics shareholders took a loss of 15%. In contrast the market gained about 33%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. However, the loss over the last year isn't as bad as the 23% per annum loss investors have suffered over the last three years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It's always interesting to track share price performance over the longer term. But to understand Viridian Therapeutics better, we need to consider many other factors. For instance, we've identified 5 warning signs for Viridian Therapeutics (2 don't sit too well with us) that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.