Stryker's (SYK) Citrefix to Boost Foot and Ankle Surgeries

Shares of Stryker SYK moved up 1.9% earlier this week, on Dec 13, following the launch of a suture anchor system for foot and ankle surgical procedures — Citrefix. However, shares of the company are down 1.7% since Dec 12, especially due to the broader market sell-off on Dec 15, following hawkish Fed minutes.

The Citrefix anchor system uses Stryker’s award-winning bioresorbable material, Citregen — which is designed to mimic the chemistry and structure of native bone.

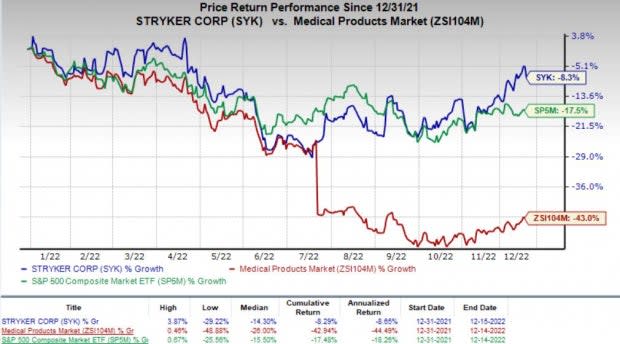

Stryker’s shares have lost 8.3% this year compared with the industry’s decline of 43%. The S&P 500 has declined 17.5% in the same period.

Image Source: Zacks Investment Research

Significance of the Launch

Stryker believes that the recently launched anchor system will benefit its customers from the expanded use of one of the most innovative bioresorbable materials available for use in foot and ankle procedures. The specially designed Citregen used in the Citrefix anchor system will likely lead to controlled resorption without chronic inflammation. The unique chemical and mechanical properties of Citregen will also help grafted tissue heal and healthy bone to grow when used in orthopedic surgical applications.

Using the Citrefix anchor system will provide orthopedic surgeons with a system that has higher pull-out strength compared with other suture anchors. The new system will come in a sterile-packed set that will include a cartridge with a preloaded implant and eyelet, a drill bit, a drill guide and a pre-assembled inserter.

The launch of the Citrefix anchor system expands Stryker’s Citregen portfolio, which will be further expanded with new launches in 2023. Last year, the company launched its first product using Citregen — Citrelock. The product had a successful launch.

Industry Prospects

Per a report by Future Market Insights, the foot and ankle devices market is anticipated to account for $4.4 billion in 2022. It is anticipated to reach $7.8 billion by 2032 at a CAGR of 5.9%. Factors like the use of bioresorbable implants and the emergence of technological advancements are expected to drive the market.

Given the market potential, the recent full-market release is likely to provide a boost to Stryker’s business globally.

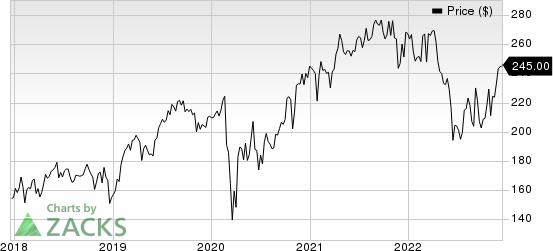

Stryker Corporation Price

Stryker Corporation price | Stryker Corporation Quote

Zacks Rank & Stocks to Consider

Stryker currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader medical space are ShockWave Medical SWAV, Merit Medical Systems MMSI and HealthEquity HQY, each carrying a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for ShockWave Medical’s earnings per share has been stable at $2.57 for 2022 and has risen from $3.42 to $3.56 for 2023 in the past 60 days. SWAV has rallied 25.2% so far this year. ShockWave Medical delivered an earnings surprise of 146.1%, on average, in the last four quarters.

Estimates for Merit Medical Systems have improved from earnings of $2.47 to $2.57 for 2022 and $2.77 to $2.82 for 2023 in the past 60 days. MMSI stock has risen 19.4% so far this year. Merit Medical Systems delivered an earnings surprise of 25.35%, on average, in the last four quarters.

HealthEquity’s earnings per share estimates have increased from $1.28 to $1.29 for fiscal 2023 and $1.76 to $1.79 for fiscal 2024 in the past 60 days. HQY has rallied 36.7% so far this year. HealthEquity’s earnings are anticipated to improve 26.3% over the next five years.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report