Student Loan Forgiveness May Hurt Credit Scores — Financial Expert Predicts ‘Uphill Battle’

President Biden’s Aug. 24 announcement regarding student loan relief measures has come as welcome news to many of the 43 million Americans that carry a large balance. But there have been some financial experts and social advocates that have expressed concerns about the accessibility of the funding and the long-term ramifications.

Student Loan Forgiveness: Economists Drastically Disagree on Future Inflationary Effects

Poll Results: Should Student Loans be Forgiven? Americans Are Divided

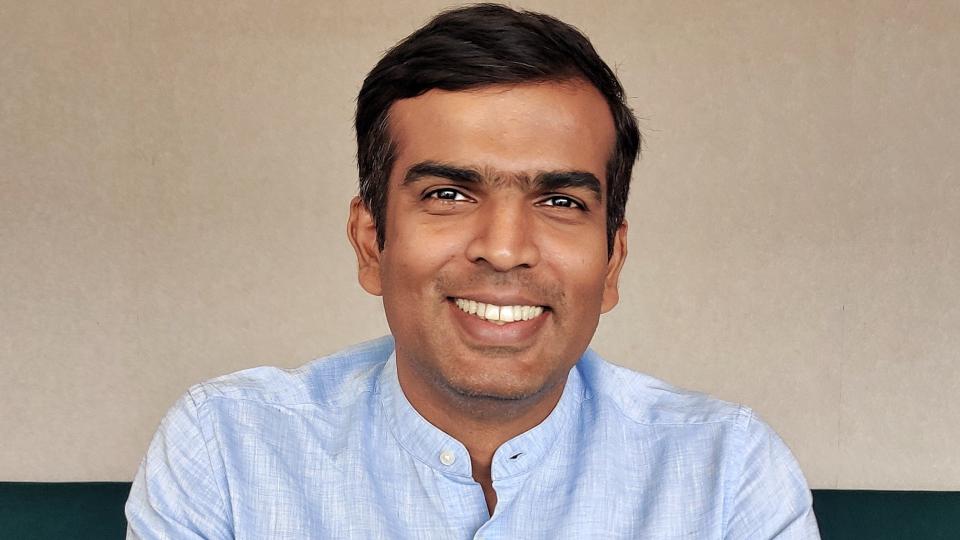

One of them is entrepreneur and investor Raghunandan G (“Raghu”), who’s also the CEO and co-founder of Zolve, a crossborder neobank that helps people moving into a new country with access to credit building based on their credit profile in their home country.

Raghu believes one of the issues with student loan forgiveness is that it might impact a benefactor’s credit score.

“Without a strong credit history and credit score, student loan borrowers will face an uphill battle for decades,” he said. “While the recent actions of President Biden will allow borrowers time and additional resources to improve their credit scores in a positive direction, these gains do not guarantee a successful change in the interest rate for the loans.”

Part of the issue, in Raghu’s perspective, is that a student loan is a large part of someone’s credit mix, which impacts their overall score. And not having this type of regular installment repayment loan could bring that score down.

“A student loan is one part of the credit mix. The credit cards that students have, that is another part of the mix. … And if they’re showing good behavior on the repayment, everything adds up,” Raghu explains. “Now, if there is any student who only has a student loan [and no other debt], and then because of the forgiveness, right now they don’t have a student loan, their ability to build a credit score immediately stops. And that’s where the real challenge happens, as they’ll want to continue to build their credit score.”

Raghu added even if all your student loan debt isn’t forgiven, the $10,000 cancellation will undoubtedly shorten the length of the loan. “When the length of the credit loan is shortened, that has a negative bearing on the credit score,” he pointed out.

And it’s not just being able to get loans in the future that will impact students who aren’t able to build up their credit score. It could harm their ability to get employment once they graduate, too.

“[Many] employers have a credit history check. So a student’s employment opportunities also can get a bit more stretched out, primarily if they’re not able to build their credit score. And any loans, any insurance that they take up at a later date, everything becomes expensive if they don’t really have a great credit score. In the long run, it hurts students,” Raghu noted.

See: Credit Scores Remain at All-Time Highs, but That Could Change as COVID-Era Stimulus Programs End

Find: Can You Have a Bad Credit Score Even With a Good Income?

While he clarified that loan forgiveness is a great thing, “When it comes to building a credit score for a student, it wouldn’t really help them much at all. If they don’t have any other credit products, they need to start seeking other credit products now.” He suggested opening credit cards and lines of credit for items like cable, rent, smart phones, and other items — but always spend within your means to pay off the balance each month.

“Channelizing some of their regular spends through some of these credit builder products, rent payments and items like that, would also help anyone build their credit history.”

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Student Loan Forgiveness May Hurt Credit Scores — Financial Expert Predicts ‘Uphill Battle’