Is Sturm, Ruger & Co. a Buy?

There hasn't been a lot of good news for Sturm, Ruger & Co. (NYSE: RGR) in 2018. Its sales and earnings have been falling since the 2016 election, and there's no indication sales will pick up soon. And the favorable political environment in Washington for the gun industry has been the biggest drag on the gunmaker's shares.

However, with Sturm, Ruger & Company stock down 11% over the past year, the question for investors is whether or not this should be viewed as a buying opportunity.

Image source: Getty Images.

Why Sturm, Ruger & Co. is down

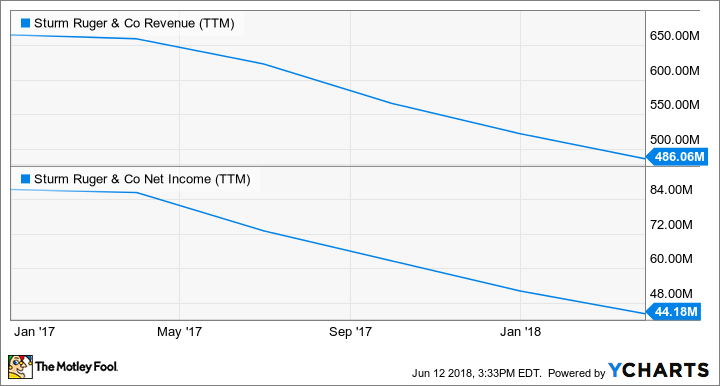

The gun industry has been on a steady downward slope since the beginning of 2017. After Sturm, Ruger & Co.'s sales peaked in the fourth quarter of 2016, its trailing-12-month revenue has fallen 27%, and net income has dropped by nearly 50%.

RGR Revenue (TTM) data by YCharts

Gun manufacturers are taking a hit both from lower demand and lower sale prices. According to Sturm, Ruger's 2017 10-K, adjusted NICS background checks fell 11.2% last year to 14.0 million, and the company estimates it sold 1.66 million units to retailers, down 17% year over year.

The lower sales volumes are in turn leaving the retailers oversupplied, pushing down sale prices, and thus sending revenue down even faster than unit volume. Not surprisingly, gross margins are down as well, falling from 33.3% in 2016 to 29.8% in 2017 and just 27.6% in the first quarter of 2018. These are all bad trends for Sturm, Ruger & Co., and if gun sales don't pick up, its future doesn't look bright.

There's no real hope for a short-term recovery

What's troubling for investors in the gun industry is that there's no reason to think sales will improve significantly in the next two and a half years. All the levers of power in government are controlled by pro-gun rights politicians, and in recent history, any time gun enthusiasts have had no fears that tighter regulations might be enacted, gun sales have stagnated or dropped.

It's also unlikely management will be able to cut operating expenses enough to offset the decline in gross profits. In Q1 2018, sales expenses fell 38% to $8.3 million, but general and administrative expenses were up 6.5% to $8.9 million. Sticky operating costs like executive salaries, accounting, and other overhead expenses will be tough to cut if sales and margins don't recover. In other words, net income is going to be down for the foreseeable future.

There's no value in Sturm, Ruger & Co.

A company doesn't have to be growing for its stock to offer a good value to investors, but if its earnings are stagnant or shrinking, that stock has be trading at a discount to be worth buying. I'm not seeing any kind of discount on Sturm, Ruger & Co. stock today. Shares trade at 24 times earnings, and the dividend yield is a paltry 1.7%.

Unless an unforeseen catalyst arrives that drives gun sales higher, I see the entire industry facing more headwinds. I don't see any reason to buy shares of Sturm, Ruger & Company right now and I'm bearish enough on the stock to put a thumbs down call on My CAPS page, predicting the stock will underperform the market long-term.

More From The Motley Fool

Travis Hoium has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.