The Subtle Win for McDonald's Earnings (NYSE:MCD)

First published on Simply Wall St News on July 27th.

Summary:

MCD beat analysts' earnings expectations by 3.39%, posting an adjusted EPS of $2.55 vs. the estimated $2.47.

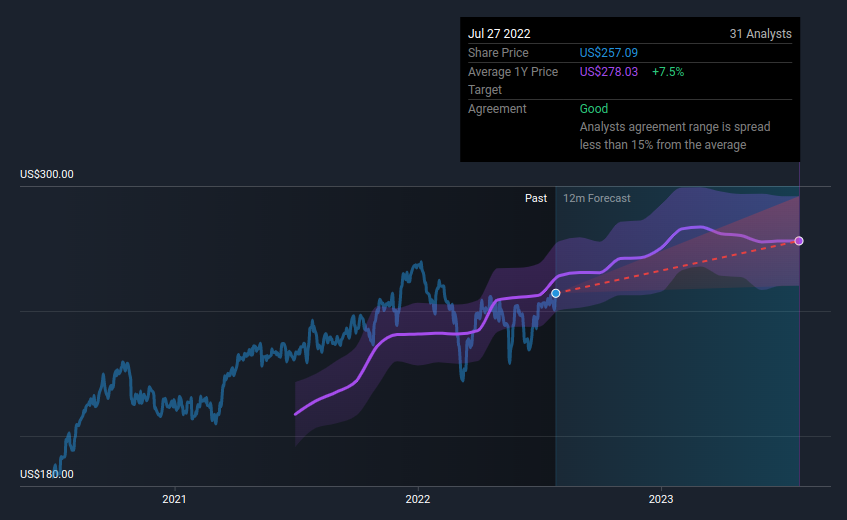

The company is trading consistently with analysts' price targets and has a potential 1-Year upside of 7.5%.

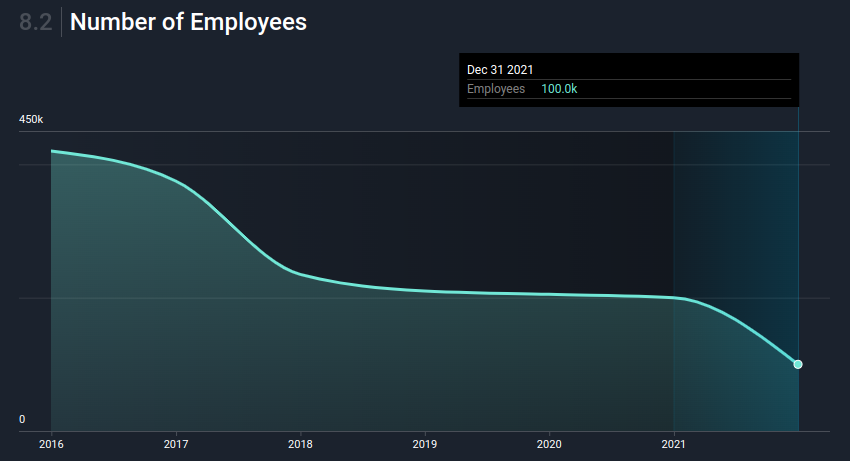

The reduction in headcount and successful digital transformation are making McDonalds a higher return enterprise for investors.

McDonald's Corporation ( NYSE:MCD ) just posted its Q2 earnings . While they are not great on the surface, investors are willing to gloss over the financial hit as they expect the company to recover and grow. The company posted a loss on a GAAP basis, but both adjusted metrics and outlook show resilience, here is what that may mean for the stock.

McDonald's Earnings Highlights

Sales increased 9.7%, reflecting positive comparable sales across all segments. Consolidated revenues decreased 3%.

Diluted EPS were $1.60, a decrease of 46%. Excluding extraordinary items, diluted EPS was $2.55, an increase of 8%. The expected ajd. EPS of $2.47, were beaten by 3.39%.

Operating income decreased 36%, primarily due to the sale of assets in Russia - adjusting for this, operating income comes up flat.

The business took some extraordinary hits, but the core operations are going strong and are slowly increasing in profitability. An important growth factor is the company's successful digital strategy , where they stress that the "MyMcDonald’s" rewards program continues to drive sales. Digital sales in their top six markets exceeded $6 billion for Q2, making up nearly one-third of total System wide sales of $27.3b.

What do the Earnings Imply for MCD Stock?

One way to track a company's stock performance is to compare it with the analysts price targets . When a company like McDonald's exceeds earnings expectations, the stock may gain a bump if investors think that analysts have done a good job at setting price targets. Looking at the 1-Year price targets for McDonald's shows us a consistent picture between earnings performance and the stock price:

We can see that the stock performance is closely tied to the average price target set by the 31 analysts covering the company. The close spread of estimates also gives us some consistency when comparing the stock to the price target. Using this approach, we can see that the stock is estimated to be stable, with a slight 7.5% upside potential.

From the Counter to the Smartphone: Why McDonald's Digital Strategy is Working

McDonald's is pushing further expansion and reinvestment. The company is still spending CapEx for opening new restaurants where it estimates a $2 to $2.2 billion spend in 2022 to open over 1700 restaurants and continue digital modernization.

We can see the effects of modernization on both the previously mentioned digital loyalty programs, and also on the decrease of costs for services. By looking at the chart below, we can see that McDonald's has managed to increase returns on capital (21.8%) with a smaller headcount costs over time:

See our latest analysis for McDonald's

This is an important aspect of the business, as besides increasing profitability, lower employee count decreases the risk of a business.

Conclusion

While McDonald's GAAP performance took a hit this year, it is clear that the company is executing on their broader strategy and slowly increasing returns to investors. The stock price seems to closely follow analysts' price targets and seems to be in stable growth.

Finally, we have a decline in the employee count and a retention of profit levels. While it may seem that McDonald's has a stable growth performance over time, that is only part of the picture, as the business has internally undergone a vast transformation since 2016.

Looking ahead, we've compiled three aspects you should consider in your research:

Risks : For example, we've discovered 2 warning signs for McDonald's that you should be aware of before investing here.

Future Earnings : How does MCD's growth rate compare to its peers and the wider market? Dig deeper into the analyst consensus number for the upcoming years by interacting with our free analyst growth expectation chart .

Other Solid Businesses : Low debt, high returns on equity and good past performance are fundamental to a strong business. Why not explore our interactive list of stocks with solid business fundamentals to see if there are other companies you may not have considered!

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here