Sun Life Financial (SLF) Q1 Earnings Increase Year Over Year

Sun Life Financial Inc. SLF delivered first-quarter 2021 net income of $937 million, which grew more than two-fold year over year.

Underlying net income of $671.1 million (C$850 million) was up 16.9% year over year. This improvement was driven by business growth, favorable morbidity experience in the United States and favorable credit experience in Canada, partially offset by lower investing activity gains in both the countries.

Insurance sales decreased 0.4% year over year to $576.4 million (C$730 million), attributable to a drop in sales in Canada. However, increased sales in Asia limited the downside.

Wealth sales increased 16.3% year over year to $52 billion (C$65.9 billion) in the quarter under review driven by higher sales in Asia.

Value of new business declined 22.5% to $219.5 million (C$278 million).

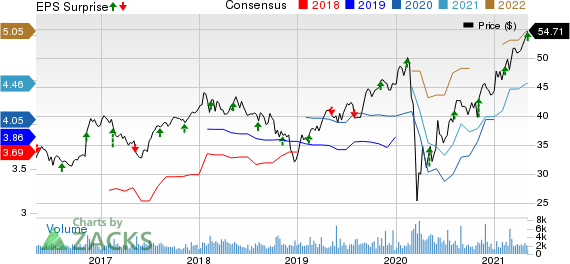

Sun Life Financial Inc. Price, Consensus and EPS Surprise

Sun Life Financial Inc. price-consensus-eps-surprise-chart | Sun Life Financial Inc. Quote

Segment Results

SLF Canada’s underlying net income increased 18% year over year to $225 million (C$285 million) driven by favorable credit experience, business growth, gains on the initial public offering of Dialogue of $9 million and favorable mortality experience. These factors were partially offset by lower investing activity gains and unfavorable morbidity experience.

SLF U.S.’ underlying net income was $135 million (C$171 million), up 12.5% from the prior-year quarter driven by favorable morbidity experience in medical stop-loss and long-term disability. This was partially offset by lower investing activity, lower AFS gains and unfavorable mortality experience.

SLF Asset Management’s underlying net income of $229.8 million (C$291 million) increased 28% year over year, driven by higher average net assets (ANA) in MFS.

SLF Asia reported underlying net income of $125.5 million (C$159 million), which rose 8.6% year over year owing to business growth and new business gains, partially offset by unfavorable mortality experience, primarily in International Hubs.

Financial Update

Global assets under management were 1034 billion (C$1,304 billion), up 41.6% year over year.

Sun Life Assurance’s Minimum Continuing Capital and Surplus Requirements (LICAT) ratio was 124% as Mar 31, 2021, down 300 basis points from 2020 end level.

The LICAT ratio for Sun Life (including cash and other liquid assets) was 141%, down 600 basis points (bps) from 2020-end level.

Sun Life’s return on equity was 16.9% in the first quarter, up 970 bps year over year. Underlying ROE of 15.3% expanded 110 basis points year over year.

Leverage ratio of 22.7% improved 80 bps from 2020-end level.

Dividend Update

On May 5, the company’s board of directors approved a dividend of 55 cents per share. The amount will be paid out on Jun 30, 2021 to shareholders of record at the close of business on May 26.

Zacks Rank

Sun Life currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Insurance Releases

First-quarter earnings of Assurant, Inc. AIZ, Prudential Financial, Inc. PRU and Everest Re Group, Ltd. RE beat the respective Zacks Consensus Estimate.

Zacks Top 10 Stocks for 2021

In addition to the stocks discussed above, would you like to know about our 10 best buy-and-hold tickers for the entirety of 2021?

Last year's 2020 Zacks Top 10 Stocks portfolio returned gains as high as +386.8%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2021 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Prudential Financial, Inc. (PRU) : Free Stock Analysis Report

Everest Re Group, Ltd. (RE) : Free Stock Analysis Report

Assurant, Inc. (AIZ) : Free Stock Analysis Report

Sun Life Financial Inc. (SLF) : Free Stock Analysis Report

To read this article on Zacks.com click here.