Sunoco (SUN) Gains More Than 5% as Q3 Earnings Beat Estimates

Sunoco LP SUN reported third-quarter 2020 earnings of 96 cents per unit, beating the Zacks Consensus Estimate of 84 cents. The bottom line also improved from 57 cents in the year-ago quarter. The strong quarterly earnings were aided by higher contributions from fuel distribution and marketing business.

Quarterly revenues of the partnership totaled $2,805 million, beating the Zacks Consensus Estimate of $2,799 million. However, the figure declined from $4,331 million in the prior-year quarter.

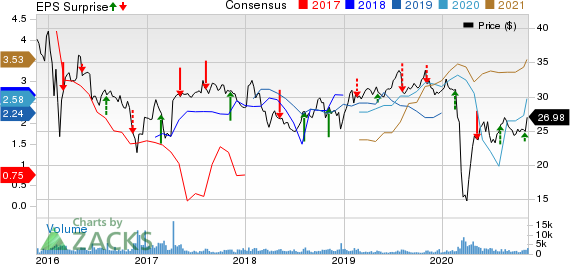

Sunoco LP Price, Consensus and EPS Surprise

Sunoco LP price-consensus-eps-surprise-chart | Sunoco LP Quote

Notably, following the announcement of strong earnings on Nov 4, the stock has gained 5.2%.

Segmental Performance

The partnership reports financial statements through two reportable segments — Fuel Distribution and Marketing, and All Other.

Fuel Distribution and Marketing: Total gross profit from the segment increased to $265 million from $236 million in the comparable period of 2019, primarily due to higher motor fuel sales.

All Other: This unit reported gross profit of $43 million compared with $56 million in the comparable period of 2019. The year-over-year decline can be attributed to lower non-motor fuel sales and motor fuel sales.

In terms of volumes, the partnership sold 1.9 billion gallons of fuel in the reported quarter, down 12.1% year over year owing to the coronavirus pandemic. Notably, motor fuel gross profit per gallon was recorded at 12.1 cents in the quarter, higher than the year-ago level of 11.6 cents.

Distribution

For the quarter ended Sep 30, 2020, Sunoco declared a quarterly cash distribution of 82.55 cents per unit or $3.3020 on an annualized basis. Markedly, this distribution was flat on a sequential basis.

Adjusted distributable cash flow was $139 million in the third quarter, suggesting an improvement from the year-ago quarter’s $133 million.

Expenses & Capital Expenditure

Total cost of sales and operating expenses in the reported quarter decreased to $2,658 million from $4,214 million a year ago.

The partnership incurred gross capital expenditure of $20 million in the quarter under review, comprising $14 million in growth capital and $6 million of maintenance capital.

Balance Sheet

As of Sep 30, 2020, Sunoco had cash and cash equivalents of $63 million. At third quarter-end, it had net long-term debt of $2,877 million, representing a debt to capitalization ratio of 0.82.

Outlook

For 2020, the partnership projects adjusted EBITDA for 2020 at or more than $740 million. The company’s expectation for 2020 growth capital spending was a minimum of $75 million. Moreover, the company projects 2020 operating expenses in the band of $460 to $475 million.

Zacks Rank & Key Picks

Sunoco currently has a Zacks Rank #3 (Hold). Meanwhile, a few better-ranked players in the energy space include PDC Energy Inc. (PDCE), Matador Resources Company MTDR and Antero Resources Corporation AR. While PDC Energy sports a Zacks Rank #1 (Strong Buy), Matador and Antero carry a Zacks Rank #2 (Buy).You can see the complete list of today’s Zacks #1 Rank stocks here.

PDC Energy is likely to see earnings growth of 13.3% in 2020.

Matador has seen upward estimate revisions for its 2020 bottom line in the past 30 days.

Anterohas seen upward estimate revisions for 2020 bottom line in the past 30 days.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sunoco LP (SUN) : Free Stock Analysis Report

PDC Energy, Inc. (PDCE) : Free Stock Analysis Report

Matador Resources Company (MTDR) : Free Stock Analysis Report

Antero Resources Corporation (AR) : Free Stock Analysis Report

To read this article on Zacks.com click here.