Synopsys' (SNPS) Q2 Earnings Match Estimates, Revenues Beat

Synopsys Inc. SNPS reported second-quarter fiscal 2018 results, wherein the bottom line came in line with the Zacks Consensus Estimate while revenues beat the same. The results also marked year-over-year improvement.

The company reported non-GAAP earnings per share of $1.08, which came in 22.7% higher than the year-ago quarter’s non-GAAP earnings of 88 cents.

Quarter in Detail

The company’s fiscal second-quarter revenues jumped 14.2% year over year to $776.8 million and were within the guided range of $765-$790 million. Reported revenues surpassed the Zacks Consensus Estimate of $775 million.

On a year-over-year basis, revenues were positively impacted by increased adoption of Synopsys’ products, strength in IP and hardware products, as well as the Black Duck acquisition. The company is gaining from Black Duck’s brand recognition as well as cross-selling options.

Segment wise, License revenues (including time-based and upfront) came in at $656.7 million, up nearly 12.3% from the year-ago quarter. Maintenance and service revenues jumped 25.7% year over year to $120.1 million.

The company is positive about its EDA design solutions which are helping in designing of new artificial intelligence (AI) engines. Management stated that the newly launched Fusion Technology also received accolades from Samsung Electronics, STMicroelectronics, Toshiba, and Ansys ANSS, which is a major tailwind in this respect.

The company’s collaboration with Taiwan Semiconductor Manufacturing Company for delivering IP and logic libraries is expected to be a positive for the top line going ahead. The company is continuing with its investments in high-speed SerDes IP to address the needs of “data-intensive applications such as machine learning, cloud computing and networking.” The acquisition of Silicon and Beyond is a testament to the fact. Management is also positive about the recently completed acquisition of PhoeniX, which will enhance the company’s photonic design capabilities.

Management stated that the company’s total addressable market has increased largely due to the Software Integrity group that deals with software security. The buyout of Black Duck has further enhanced the company’s capabilities in this respect, which is on track to reach the company’s target of reaching $55 million to $60 million by 2018.

Total non-GAAP costs and expenses was $587 million, up 14.4% from the year-ago quarter. Synopsys’ non-GAAP operating income rose 13.8% on a year-over-year basis and came in at $190.1 million. However, operating margin shrunk 10 bps year over year to 24.5%. Higher operating expenses impacted the operating results.

The company’s non-GAAP net income for the reported quarter came in at $165 million, marking year-over-year growth of 21.5%.

Balance Sheet & Cash Flow

Synopsys exited the fiscal second quarter with cash and cash equivalents of $570.8 million compared with $605.9 million reported at the end of the previous quarter. Accounts receivables, net were $568.4 million compared with $499.4 million recorded in the last quarter.

During the quarter, the company generated $4.1 million of cash from operational activities. The company repurchased $35 million worth of its common stock during the quarter in addition to the completion of the previous $200 million accelerated share repurchase. It has $490 million remaining in its current authorization.

Guidance

Buoyed by splendid quarterly performance, Synopsys raised its fiscal 2018 outlook. The company now expects 2018 revenues to be in the range of $3.07-$3.10 billion (mid-point $2.935), up from the earlier guidance of $2.92-$2.95 billion (mid-point $3.085). The Zacks Consensus Estimate for revenues is pegged at $2.95 billion.

Non-GAAP earnings per share are now projected between $3.76 and $3.83 (mid-point $3.795 per share), up from the prior projection of $ 3.76 and $3.74 (mid-point $3.705 per share). The Zacks Consensus Estimate is pegged at $3.72.

The company noted that the acquisition of Black Duck will be dilutive to its earnings initially but will be accretive over the long run. Management reiterated that the acquisition is expected to be dilutive to 2018 non-GAAP EPS by 12 cents to touch breakeven in the second half of 2019.

Operating cash flow is expected to be within $500-$550 million.

In addition to these, the company initiated guidance for the fiscal third quarter as well. It estimates revenues in the range of $760-$785 million (mid-point $772.5 million). The Zacks Consensus Estimate for revenues is pegged at $699.5 million. The company expects non-GAAP expenses within $605-$615 million. Management predicts non-GAAP earnings per share in the range of 89-93 cents. The Zacks Consensus Estimate is pegged at 77 cents.

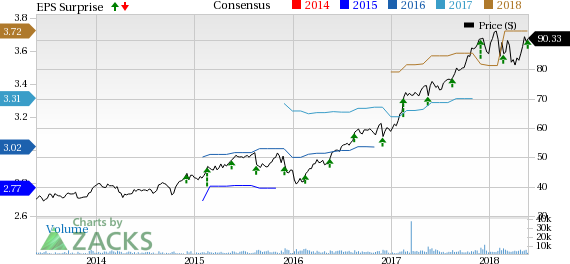

Synopsys, Inc. Price, Consensus and EPS Surprise

Synopsys, Inc. Price, Consensus and EPS Surprise | Synopsys, Inc. Quote

Conclusion

Synopsys fared well in second-quarter fiscal 2018 on the back of robust performance of all the product groups. Management is optimistic about the 10% growth predicted for semiconductor sector for 2018, which, in turn, will be accretive for the top line of this vendor of electronic design automation (EDA) software for the semiconductor and electronics industries.

We believe the company’s recent product launches, acquisitions and customer addition will be beneficial for financials going ahead. Furthermore, unique intellectual properties and global support provided by the company are likely to drive its near-term performance.

However, escalating costs and expenses, which have been dampening margins, remain headwinds. Additionally, uncertainty regarding the exact time of realizing acquisition synergies and heightening competition from the likes of Cadence Design Systems Inc. CDNS are other concerns.

Currently, Synopsys carries a Zacks Rank #3 (Hold).

A better-ranked stock in the broader technology sector is NVIDIA Corporation NVDA, sporting a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

NVIDIA has a long-term expected EPS growth rate of 10.3%.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

ANSYS, Inc. (ANSS) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

To read this article on Zacks.com click here.