Synopsys (SNPS) Q3 Earnings and Revenues Beat Estimates

Synopsys SNPS reported third-quarter fiscal 2022 non-GAAP earnings of $2.10 per share, beating the Zacks Consensus Estimate of $2.04. The bottom line improved 16% year over year.

Revenues surged 18.1% year over year to $1.25 billion, driven by growth across its business segments. The top line beat the Zacks Consensus Estimate of $1.22 billion.

Synopsys benefited from the increasing demand for its products amid the rapid adoption of Big Data, faster computation and Machine Learning. Complex, connected, specialized, and secure chips and systems witnessed strong momentum and drove Synopsys’ quarterly performance.

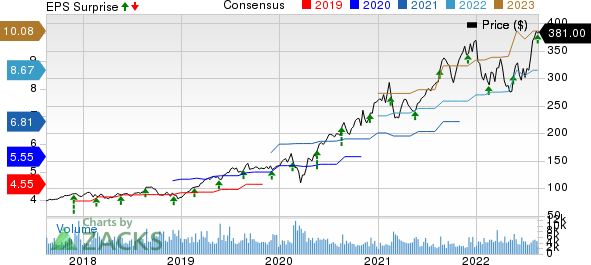

Synopsys, Inc. Price, Consensus and EPS Surprise

Synopsys, Inc. price-consensus-eps-surprise-chart | Synopsys, Inc. Quote

Quarter in Detail

In the license-type revenues group, Time-Based Product revenues (60.4% of total revenues) of $754.3 million were up 13.3% year over year. Upfront Product revenues (21.5%) surged 32% to $268.6 million. Maintenance and Service revenues (18%) increased 19.4% year over year to $224.9 million from the year-ago quarter’s $188.3 million.

Segment-wise, Semiconductor & System Design revenues (91% of total revenues) were $1.13 billion, up 17.8% year over year. Within the segment, Electronic Design Automation revenues (50% of revenues) were $623 million, while IP &Systems Integration revenues (41% of revenues) amounted to $495.9 million.

Software Integrity revenues totaled $118.3 million, contributing approximately 9% to the top line in the reported quarter.

Geographically, Synopsys’ revenues in North America (47% of the total) and Europe (10%) were $591.8 million and $127.3 million, respectively. Revenues from Korea (10%), China (15%) and Other (17%) were $125.3 million, $189.1 million and $214.2 million, respectively.

Non-GAAP operating margin was 31.4%, contracting 50 basis points (bps) year over year.

Semiconductor & System Design delivered an adjusted operating margin of 33.7%, shrinking 60 bps on a year-over-year basis. Software Integrity margin expanded 70 bps year over year to 9.5%.

Balance Sheet & Cash Flow

Synopsys had cash and short-term investments of $1.53 billion as of Jul 31, 2022, compared with $1.72 billion as of Apr 30, 2022.

Total long-term debt was $22 million in the reported quarter, down from $107 million as of Jul 31, 2021.

During the first nine months of fiscal 2022, operating cash flow was $1.35 billion.

Guidance

For the fourth quarter of fiscal 2022, Synopsys expects revenues between $1.263 billion and $1.293 billion. Management estimates non-GAAP earnings between $1.80 and $1.85 per share. Non-GAAP expenses are anticipated in the band of $919- million to $929 million.

For fiscal 2022, Synopsys raised guidance. The company now projects revenues to be $5.060-$5.090 billion compared with the prior range of $5.000-$5.050 billion.

Non-GAAP earnings for the fiscal year are now expected to be between $8.80 and $8.85 per share, compared with the earlier guidance of $8.63 and- $8.70 per share.

Non-GAAP expenses are estimated in the range of $3.395 billion to $3.405 billion compared with the previously guided range of $3.350 billion to $3.380 billion. Synopsys now forecast an operating cash flow of $1.600-$1.650 billion, up from the prior estimate of $1.550-$1.600 billion.

Zacks Rank & Key Picks

Synopsys currently carries a Zacks Rank #3 (Hold). Shares of SNPS have increased 31.1% in the past year.

Some better-ranked stocks from the broader Computer and Technology sector are Clearfield CLFD, Silicon Laboratories SLAB, and Taiwan Semiconductor TSM. While Clearfield and Silicon Laboratories flaunt a Zacks Rank #1 (Strong Buy), TSM carries a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Clearfield's fourth-quarter fiscal 2022 earnings has been revised 10 cents upward to 80 cents per share over the past 30 days. For fiscal 2022, earnings estimates have moved 36 cents north to $3.13 per share in the past 30 days.

Clearfield’s earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 33.9%. Shares of CLFD have soared 184.3% in the past year.

The Zacks Consensus Estimate for Silicon Laboratories’ third-quarter 2022 earnings has increased 22.9% to $1.02 per share over the past 30 days. For 2022, earnings estimates have moved 14.2% up to $4.18 per share in the past 30 days.

Silicon Laboratories’ earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 63.6%. Shares of SLAB have decreased 9.5% in the past year.

The Zacks Consensus Estimate for Taiwan Semiconductor's third-quarter 2022 earnings has been revised 10 cents northward to $1.69 per share over the past 30 days. For 2022, earnings estimates have moved 41 cents north to $6.30 per share in the past 30 days.

TSM's earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 3.9%. Shares of the company have decreased 19.3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

Silicon Laboratories, Inc. (SLAB) : Free Stock Analysis Report

Clearfield, Inc. (CLFD) : Free Stock Analysis Report

To read this article on Zacks.com click here.