My System is Signaling This is the No. 1 Rated ETF to Buy

Almost every month, we see an economic report that includes a note about aircraft orders being a bright spot in the economy. For example, the most recent report on orders for durable goods began with: "A surge in aircraft orders in June masked weakness across much of the U.S. factory sector, underscoring the economy's paltry growth in the second quarter."

In large and small businesses, orders are the first step toward profits, and the strength in aircraft orders is a positive for aircraft manufacturers. Analysts are optimistic that aircraft manufacturers will benefit from the strong orders and see steady profits over the next few years. Boeing (BA), for example, is expected to deliver average earnings per share (EPS) growth of 12.9% in the next five years, more than three times greater than the average growth of 3.9% seen in the past five years.

For ETF investors, iShares Dow Jones US Aerospace & Defense (ITA) is a way to benefit from this trend, and my 26-week rate of change (ROC) system is confirming that ITA is a buy. ITA offers exposure to Boeing and other companies involved in the aircraft sector. Many of these companies are diversified beyond aircraft, and that diversification should help them deliver steady earnings.

United Technologies (UTX) is ITA's largest holding. The company's Pratt & Whitney division makes aircraft engines, and the Sikorsky division manufactures helicopters. But UTX also has divisions that make elevators and heating systems, which provide steady revenue for the company.

Other large holdings in ITA are also diversified, and analysts are uniformly optimistic that these companies will provide steady growth.

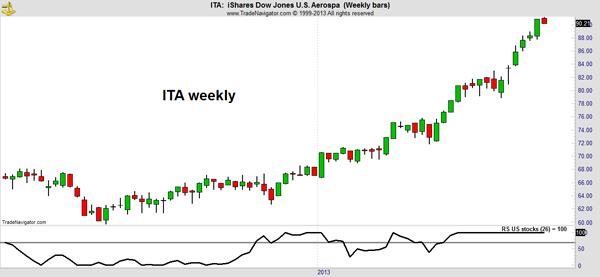

In the weekly chart, we can see that ITA has been among the market's top performers recently.

In the monthly chart, we can see that ITA still offers significant potential even after the large gain seen this year.

The ETF has recently broken out of a multi-year trading range. This type of pattern is often followed by a gain equal in magnitude to the depth of the trading range. The price projection of $110 a share is about 20% above the recent price of ITA.

We can also see that ITA has been in a steady uptrend, reaching a series of higher highs and higher lows since 2009 with one jarring exception. On the monthly chart, a wide-ranging candlestick occurred in May 2010 during the Flash Crash.

ITA fell from $58 to $20 in a matter of minutes, and then immediately recovered along with hundreds of other stocks that day. Many traders with stop-loss orders suffered losses, but other investors were able to hold through the volatility. This is a reminder that stop-loss orders entered into the market can be executed at the worst possible time.

ITA will be replacing iShares Dow Jones US Broker-Dealers (IAI) in the portfolio. IAI was added in late February, and has gained 18% since then. Over that same time frame, SPDR S&P 500 (SPY) gained 12%.

IAI is still a buy according to most indicators and has a high relative strength (RS) rank of 93. It is being sold because it is no longer among the top-ranked ETFs in my 26-week ROC system. On the list of 22 sector ETFs that I follow, IAI is now the sixth strongest with ITA being the strongest.

After completing these trades, the 26-week ROC portfolio will be holding four positions:

Related Articles

Under $10 Silver Stock Offering Income Traders a Shot at 45% a Year