AT&T: A Reasonably Valued Yield Candidate

- By Ishan Majumdar

Telecom behemoth AT&T (NYSE:T) kickstarted 2021 with a strong earnings result. The company added 2.7 million HBO Max subscribers, driven by the success of its day-and-date theatrical strategy.

The company has been steadily strengthening its post-Covid content slate and boosting subscription revenue. The management continues to invest heavily in 5G and the fiber business and added as many as 595,000 post-paid phone subscribers in the quarter.

Given that AT&T has been a dividend aristocrat for many years and has been a favorite among yield investors, let's take a look at whether its growth prospects and yield are worth the current valuation.

Recent financial performance

AT&T reported a strong first-quarter result, backed by increased post-paid and HBO Max subscriptions.

The company's top-line of $43.94 billion represented 2.71% growth as compared to the $42.78 billion in revenue reported in the corresponding quarter of 2020. AT&T surpassed the average Wall Street estimate of $42.67 billion.

The company's revenues translated into a gross margin of 52.01% and an operating margin of 26.73%, which was higher than in the same quarter of 2020.

AT&T reported net income of $7.55 billion and adjusted earnings per share (EPS) of 86 cents, which was 8 cents above the analyst consensus estimate.

In terms of cash flows, AT&T reported negative free cash as its $9.93 billion worth of operating cash flows were well below its $26.85 billion spent in investing activities, most of which went towards 5G investments.

The new 5G+ service

In May 2021, AT&T introduced 5G+ at Lumen Field, which is essentially 5G delivered using millimeter wave spectrum. It is most suitable for high-traffic areas. AT&T customers with a compatible device and qualifying plan will now have access to the super-fast speeds and increased connectivity optimal for popular venues like Lumen Field.

In addition to fans, first responders on FirstNet, a high-speed broadband communications platform for agencies like the Seattle Fire Department, will also have access to 5G+ at Lumen Field.

The management believes that AT&T 5G+ will take sports and fan experience to the next level, where they will enjoy the in-game enhancements that will come with increased connectivity.

Apart from this, AT&T and Cradlepoint are expanding their joint network offerings with a broad portfolio of 5G solutions in the U.S. using AT&T Wireless Broadband. The new solutions combine the clean-slate-designed Cradlepoint 5G wideband adapters, routers and the NetCloud Service, with AT&T's nationwide wireless broadband network and data plans making it a holistic offering.

There is also an AT&T management option for Cradlepoint devices. This gives businesses the flexibility to choose the solution, speed, quality of service and management structure that fits their requirements, with no overage charges.

Overall with these recent developments, it looks like AT&T remains on track to compete with rivals like T-Mobile (NASDAQ:TMUS) and Verizon (NYSE:VZ), who have been particularly aggressive on the 5G front.

Developments around HBO Max

AT&T's direct-to-consumer plans around HBO Max are gaining momentum with WarnerMedia adding 2.7 million net new domestic HBO Max customers during the quarter, taking the total to 44.2 million.

Subscription revenues in Q1 grew by nearly 35% globally for WarnerMedia's Direct-to-Consumer business. It is interesting to highlight that WarnerMedia plans to price an ad-supported version of its HBO Max streaming service at $9.99 a month starting in June 2021 in a process to better compete with Netflix (NASDAQ:NFLX), Disney (NYSE:DIS) and other streaming services. This move will allow the service to be cheaper than Netflix, whose standard price remains $13.99 per month, thereby gaining a wider audience.

The management expects HBO Max and HBO to gain between 120 million and 150 million subscribers by the end of 2025. Also, ad-supported HBO Max will be able to expand the product's potential audience to more cost-conscious consumers. In addition, the company plans to launch HBO Max in 60 international markets in the second half of 2021 which reflects the management's confidence in producing consistent subscriber growth.

Final thoughts

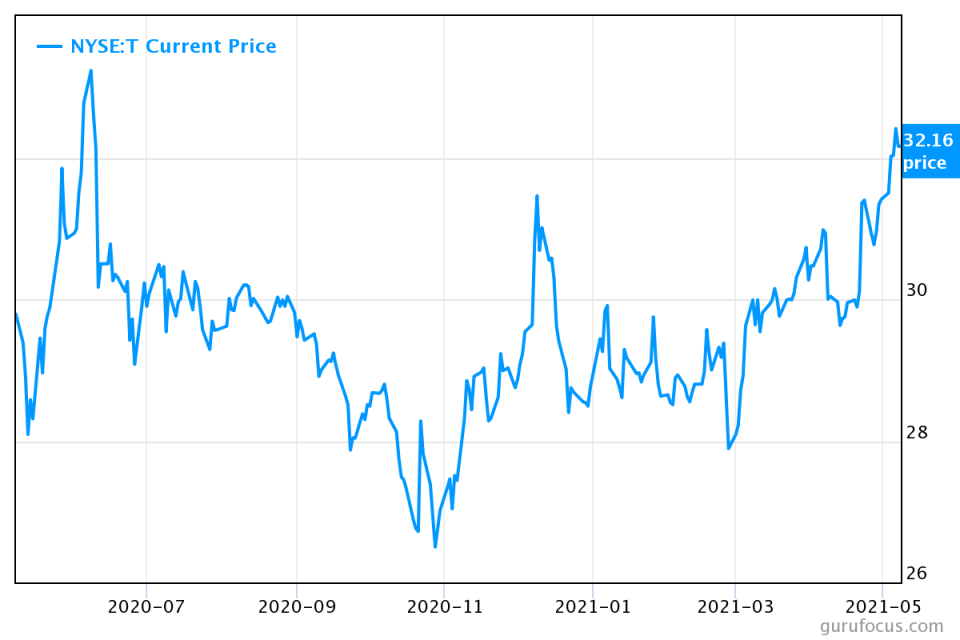

As we can see from the chart above, the stock price of AT&T hasn't shown much upward movement in the past 12 months given the slow recovery of advertising revenues and the movie business.

HBO Max is expected to gradually increase its subscriber base, but the growth may be slow and the company continues to face intense competition from Verizon and T-Mobile in the 5G technology expansion.

From a valuation standpoint, AT&T is trading at an enterprise-value-to-revenue multiple of 2.53, which is slightly more than the median range of the telecommunication services industry. In my opinion, AT&T might lack the steam that growth investors seek, which they can find in companies like Netflix, but it is still not a bad bet for dividend seekers. While the company may not have increased dividends for the past few quarters given the heavy outlay associated with the 5G and HBO Max expansion, it still has a forward dividend yield as high as 6.4%. With a reasonable stock valuation and a good forward yield, I think AT&T is a solid choice for divident investors to hold on to in 2021.

Disclosure: No positions.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.