T. Rowe Price Equity Income Fund's Top 5 Trades

- By Sydnee Gatewood

The T Rowe Price Equity Income Fund (Trades, Portfolio) released its third-quarter portfolio earlier this week.

Managed by Brian Linehan, the fund, which is part of Baltimore-based asset management firm T. Rowe Price, seeks to achieve high levels of dividend income and long-term capital growth by investing in stocks that are undervalued or have a strong track record of paying dividends.

Based on these criteria, the fund established eight new positions during the quarter, sold out of three holdings and added to or trimmed a slew of other investments. Notable trades included a new stake in Coca-Cola Co. (NYSE:KO), the divestment of its holding in CenterPoint Energy Inc. (NYSE:CNP) and reductions of its Kimberly-Clark Corp. (NYSE:KMB), JPMorgan Chase & Co. (NYSE:JPM) and TC Energy Corp. (NYSE:TRP) positions.

Coca-Cola

Having previously exited a position in Coca-Cola in the second quarter of 2016, the fund entered a new 1.72 million-share stake, allocating 0.61% of the equity portfolio it. The stock traded for an average price of $48.09 per share during the quarter.

The Atlanta-based beverages company, which is known for its famous namesake soda, has a $214.73 billion market cap; its shares were trading around $49.99 on Friday with a price-earnings ratio of 23.58, a price-book ratio of 12.28 and a price-sales ratio of 6.29.

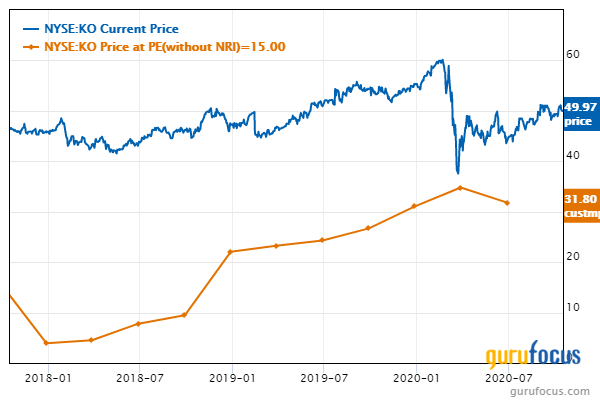

The Peter Lynch chart shows the stock is trading above its fair value, suggesting it is overpriced. The GuruFocus valuation rank of 2 out of 10 also supports this assessment since the price-book and price-sales ratios are approaching 10-year highs.

GuruFocus rated Coca-Cola's financial strength 5 out of 10. Although the company has issued approximately $2 billion in new long-term debt over the past three years, it is still at a manageable level due to having adequate interest coverage. It has a strong Altman Z-score of 3.5, which suggests the company is in good standing despite recording a decline in revenue per share over the past five years. The return on invested capital also surpasses the weighted average cost of capital, suggesting the company is creating value.

The company's profitability fared a bit better, scoring a 7 out of 10 rating on the back of an expanding operating margin, strong returns that outperform a majority of competitors and a moderate Piotroski F-Score of 4, which indicates business conditions are stable. Coca-Cola also has a predictability rating of one out of five stars. According to GuruFocus, companies with this rank typically return, on average, 1.1% annually over a 10-year period.

Of the gurus invested in Coca-Cola, Warren Buffett (Trades, Portfolio) has the largest stake with 9.31% of outstanding shares. Other top guru shareholders include Pioneer Investments (Trades, Portfolio), Jeremy Grantham (Trades, Portfolio), Yacktman Asset Management (Trades, Portfolio), Steven Cohen (Trades, Portfolio) and the MS Global Franchise Fund (Trades, Portfolio).

CenterPoint Energy

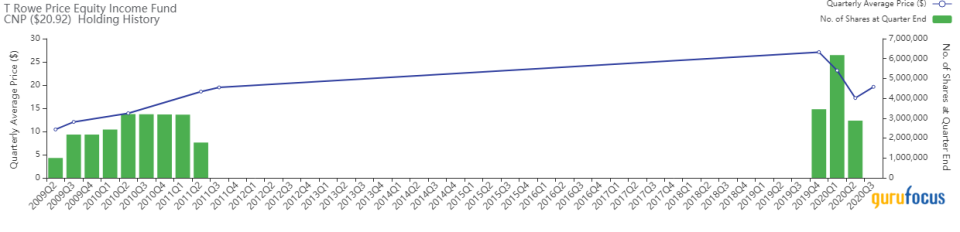

With an impact of -0.38% on the equity portfolio, T. Rowe Price closed out of its 2.87 million-share position in CenterPoint Energy. Shares traded for an average price of $19.62 each during the quarter.

GuruFocus estimates the fund lost 9.45% on the investment.

The utility company, which is headquartered in Houston, has a market cap of $11.29 billion; its shares were trading around $20.74 on Friday with a price-book ratio of 1.89 and a price-sales ratio of 1.08.

According to the Peter Lynch chart, the stock appears to be trading near its fair value. The GuruFocus valuation rank of 6 out of 10, however, leans more toward undervaluation.

CenterPoint Energy's financial strength was rated 3 out of 10 by GuruFocus. As a result of issuing approximately $1.9 billion in new long-term debt over the past three years, the company has poor interest coverage. In addition, the Altman Z-Score of 0.47 warns the company could be in danger of going bankrupt since its assets are building up at a faster rate than revenue is growing. It also appears to be destroying value since the WACC eclipses the ROIC.

The company's profitability scored a 6 out of 10 rating. In addition to declining margins, CenterPoint is being weighed down by negative margins that underperform a majority of industry peers. While it is supported by a moderate Piotroski F-Score of 4, the one-star predictability rank is on watch as a result of slowing revenue per share growth over the past 12 months.

With 0.73% of outstanding shares, Barrow, Hanley, Mewhinney & Strauss is the company's largest guru shareholder. Pioneer, NWQ Managers (Trades, Portfolio), Jim Simons (Trades, Portfolio)' Renaissance Technologies, Paul Tudor Jones (Trades, Portfolio) and Joel Greenblatt (Trades, Portfolio) also have positions in the stock.

Kimberly-Clark

Continuing its trend of the past several quarters, the Equity Income Fund curbed its Kimberly-Clark holding by 28.65%, selling 530,000 shares. The transaction had an impact of -0.53% on the equity portfolio. The stock traded for an average per-share price of $150.09 during the quarter.

It now holds 1.32 million shares total, which account for 1.40% of the equity portfolio. According to GuruFocus, the fund has gained 72.38% on the investment since establishing it in the third quarter of 2017.

The Irving, Texas-based consumer packaged goods company, which owns brands like Huggies, Kotex, Kleenex and Cottonelle, has a $52.53 billion market cap; its shares were trading around $154.03 on Friday with a price-earnings ratio of 20.69, a price-book ratio of 195.97 and a price-sales ratio of 2.8.

Based on the Peter Lynch chart, the stock appears to be overvalued. The GuruFocus valuation rank of 3 out of 10 aligns with this analysis since the share price, price-book ratio and price-sale ratio are all close to multiyear highs.

GuruFocus rated Kimberly-Clark's financial strength 5 out of 10. Despite issuing approximately $60 million in new long-term debt over the past three years, it is still at a manageable level since the company has sufficient interest coverage. It also has a robust Altman Z-Score of 4.47, indicating it is in good standing, and is creating value since the ROIC surpasses the WACC.

Driven by operating margin expansion, the company's profitability fared even better with a 7 out of 10 rating. Kimberly-Clark also has strong returns that outperform a majority of competitors, a high Piotroski F-Score of 7, which suggests business conditions are healthy, and a one-star predictability rank.

Diamond Hill Capital (Trades, Portfolio) is Kimberly-Clark's largest guru shareholder with 0.55% of outstanding shares. Other guru investors are Pioneer, Simons' firm, Greenblatt, Mairs and Power (Trades, Portfolio), Grantham, Ken Fisher (Trades, Portfolio), Jones, Dodge & Cox and Mario Gabelli (Trades, Portfolio).

JPMorgan Chase

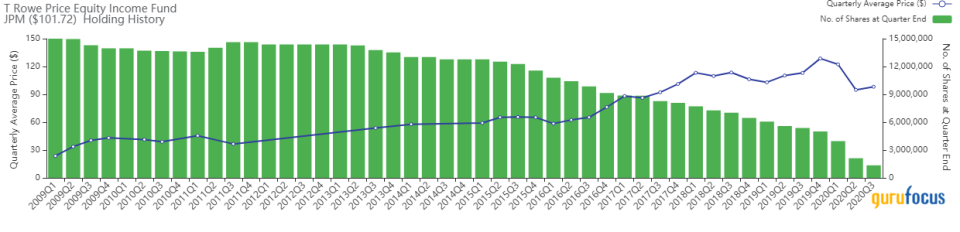

The fund trimmed its stake in JPMorgan Chase by 36.17%, selling 765,000 shares. The trade had an impact of -51% on the equity portfolio. During the quarter, the stock traded for an average price of $98.20 per share.

It now holds 1.35 million shares total, representing 0.94% of the equity portfolio. GuruFocus data shows the fund has gained approximately 248.04% on the investment.

The bank, which is headquartered in New York, has a market cap of $303.39 billion; its shares were trading around $101.45 on Friday with a price-earnings ratio of 13.27, a price-book ratio of 1.29 and a price-sales ratio of 2.66.

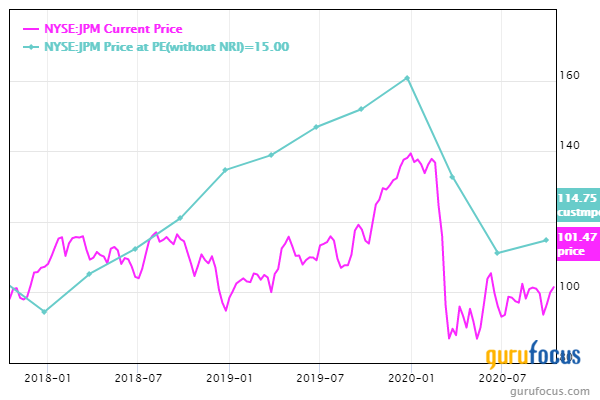

The Peter Lynch chart suggests the stock is undervalued, while the GuruFocus valuation rank of 5 out of 10 indicates it is more fairly valued.

JPMorgan's financial strength was rated 3 out of 10 by GuruFocus. While the cash-to-debt ratio of 1.52 is outperforming versus peers and its own history, the company appears to be destroying value since its WACC significantly surpasses its ROIC.

The company's profitability scored a 5 out of 10 rating on the back of margins and returns that outperform over half of its industry peers as well as a moderate Piotroski F-Score of 5 and a one-star predictability rank.

With a 0.73% stake, Buffett is JPMorgan's largest guru shareholder. PRIMECAP Management (Trades, Portfolio), Dodge & Cox, Chris Davis (Trades, Portfolio), Andreas Halvorsen (Trades, Portfolio), Fisher, Barrow, Hanley, Mewhinney & Strauss, Tom Russo (Trades, Portfolio), Pioneer, Simons' firm, Richard Pzena (Trades, Portfolio), Glenn Greenberg (Trades, Portfolio), Diamond Hill, Stanley Druckenmiller (Trades, Portfolio) and David Carlson (Trades, Portfolio) also have significant positions in the stock.

TC Energy

Impacting the equity portfolio by -0.41%, T. Rowe Price reduced its TC Energy holding by 25.38%, selling 1.33 million shares. During the quarter, shares traded for an average price of $45.71 each.

The fund now holds 3.9 million shares, which make up 1.1% of the equity portfolio. It has lost an estimated 0.30% on the investment since the third quarter of 2017 according to GuruFocus.

The Canadian natural gas company has a $41.14 billion market cap; its shares were trading around $43.58 on Friday with a price-earnings ratio of 12.66, a price-book ratio of 1.91 and a price-sales ratio of 4.68.

According to the Peter Lynch chart, the stock is undervalued. The GuruFocus valuation rank of 3 out of 10, however, leans more toward overvalued territory even though the price ratios are all near multiyear lows.

GuruFocus rated TC Energy's financial strength 3 out of 10. As a result of issuing approximately 7.4 billion Canadian dollars ($5.6 billion) in new long-term debt over the past three years, the company has poor interest coverage. The Altman Z-Score of 0.75 also warns the company could be in danger of going bankrupt, especially since its revenue per share has been in decline for the past five years.

The company's profitability scored a 7 out of 10 rating, driven by an expanding operating margin, returns that outperform a majority of competitors and a moderate Piotroski F-Score of 6. TC Energy also has a one-star predictability rank.

Of the gurus invested in TC Energy, the Equity Income Fund has the largest stake with 0.42% of outstanding shares. Pioneer, Simons' firm, Grantham and Gabelli are also shareholders.

Additional trades and portfolio performance

Other new positions T. Rowe Price established during the quarter were in Caterpillar Inc. (NYSE:CAT), Charles Schwab Corp. (NYSE:SCHW), TJX Companies Inc. (NYSE:TJX), Cummins Inc. (NYSE:CMI), Sanofi SA (XPAR:SAN), Marriott International Inc. (NASDAQ:MAR) and Magna International Inc. (MGA).

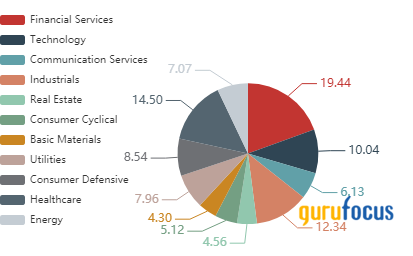

The fund's $13.88 billion equity portfolio, which is composed of 107 stocks, is largely invested in the financial services sector at 19.44%, followed by smaller holdings in the health care (14.50%) and industrials (12.34%) spaces.

According to its website, the Equity Income Fund returned 26.58% in 2019, underperforming the S&P 500's return of 31.49%.

Disclosure: No positions.

Read more here:

Steven Cohen Dives Further Into SPACs With Stake in FinTech Acquisiton Corp III?

Ron Baron Has High Hopes for SpaceX

The Top 5 Trades of the Parnassus Endeavor Fund

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.