The T Rowe Price Equity Income Fund Cuts DuPont, State Street

- By Tiziano Frateschi

The T Rowe Price Equity Income Fund (Trades, Portfolio) sold shares of the following stocks during the first quarter of 2021, which ended on March 31.

DuPont de Nemours

The DuPont de Nemours Inc. (DD) position was trimmed by 51.11%, impacting the portfolio by -1.31%.

The chemicals company has a market cap of $40.38 billion and an enterprise value of $60.22 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The return on equity of -7.62% and return on assets of -4.25% are underperforming 88% of companies in the chemicals industry. Its financial strength is rated 4 out of 10 with a cash-debt ratio of 0.12.

The largest guru shareholder of the company is the Barrow, Hanley, Mewhinney & Strauss with 1.39% of outstanding shares, followed by Lee Ainslie (Trades, Portfolio)'s Maverick Capital with 0.90% and Mason Hawkins (Trades, Portfolio) with 0.48%.

State Street

The fund reduced its position in State Street Corporation (STT) by 36.67%, impacting the portfolio by -0.50%.

The company, which provides financial services, has a market cap of $27.39 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. While the return on equity of 8.63% is outperforming the sector, the return on assets of 0.75% is underperforming 57% of companies in the asset management industry. Its financial strength is rated 3 out of 10. The cash-debt ratio of 7.64 is below the industry median of 18.16.

The largest guru shareholders of the company include Dodge & Cox with 5.76% of outstanding shares, Bill Nygren (Trades, Portfolio) with 1.24% and Yacktman Asset Management (Trades, Portfolio) with 1%.

Morgan Stanley

The firm curbed its position in Morgan Stanley (MS) by 22.69%. The trade had an impact of -0.49% on the portfolio.

The investment bank has a market cap of $143.32 billion and an enterprise value of $292.70 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. While the return on equity of 14.51% is outperforming the sector, the return on assets of 1.37% is underperforming 53% of companies in the capital markets industry. Its financial strength is rated 2 out of 10 with a cash-debt ratio of 0.44.

The largest guru shareholders of the company are PRIMECAP Management (Trades, Portfolio) with 0.67% of outstanding shares, Ken Fisher (Trades, Portfolio) with 0.51% and ValueAct Holdings LP (Trades, Portfolio) with 0.46%.

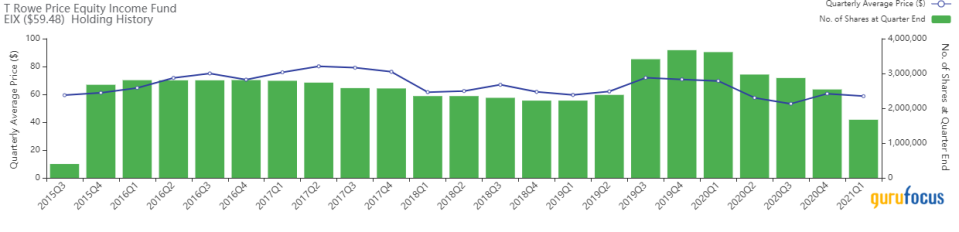

Edison

The firm curbed its Edison International (EIX) stake by 34.25%. The portfolio was impacted by -0.34%.

The company has a market cap of $22.56 billion and an enterprise value of $48.52 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 5.38% and return on assets of 1.3% are underperforming 71% of companies in the utilities - regulated industry. Its financial strength is rated 3 out of 10 with a cash-debt ratio of 0.2.

The largest guru shareholder of the company is Richard Pzena (Trades, Portfolio) with 2.12% of outstanding shares, followed by Barrow, Hanley, Mewhinney & Strauss with 1.02% and Pioneer Investments (Trades, Portfolio) with 0.15%.

Philip Morris

The firm reduced its Philip Morris International Inc. (PM) stake by 18.51%. The portfolio was impacted by -0.34%.

The international tobacco company has a market cap of $146.52 billion and an enterprise value of $171.72 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 21.58% and return on assets of 194.76% are outperforming 78% of companies in the tobacco products industry. Its financial strength is rated 4 out of 10 with a cash-debt ratio of 0.13.

The largest guru shareholder of the company is First Eagle Investment (Trades, Portfolio) with 0.67% of outstanding shares, followed by Tom Russo (Trades, Portfolio) with 0.54% and John Rogers (Trades, Portfolio) with 0.28%.

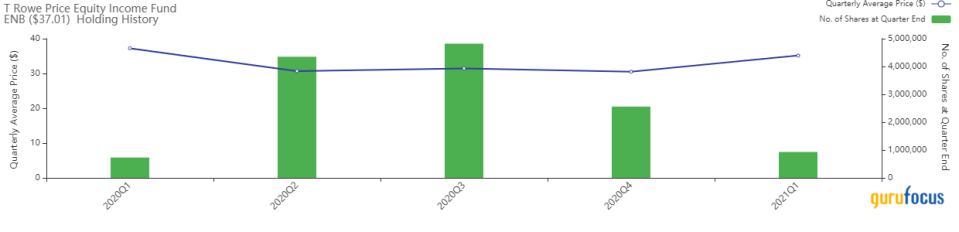

Enbridge

The firm trimmed its Enbridge Inc. (ENB) stake by 63.67%. The portfolio was impacted by -0.32%.

The U.S. energy generation, distribution and transportation company has a market cap of $74.99 billion and an enterprise value of $135.99 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 4.55% and return on assets of 2.05% are outperforming 72% of companies in the oild and gas industry. Its financial strength is rated 3 out of 10 with a cash-debt ratio of 0.01.

The largest guru shareholder of the company is Pioneer Investments (Trades, Portfolio) with 0.30% of outstanding shares, followed by Barrow, Hanley, Mewhinney & Strauss with 0.05% and Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.03%.

Disclosure: I do not own any stocks mentioned.

Read more here:

FPA Crescent Fund Cuts Jeffries Financial, Alphabet

5 Cheap Stocks Paying High Dividend Yields

5 Predictable Stocks With a Margin of Safety

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.