Tandem Diabetes (TNDM) Q3 Earnings Top Estimates, Sales View Up

Tandem Diabetes Care, Inc. TNDM reported GAAP net earnings per share (EPS) of 9 cents for the quarter, a significant improvement from the year-ago net loss of 15 cents. The Zacks Consensus Estimate is pegged at 8 cents.

Revenues

Revenues in the quarter came in at $179.6 million, up 45.3% year over year and beat the Zacks Consensus Estimate by 3.5%. The strength in the top line was driven by new customer demand and increasing renewal purchases from the company’s installed base.

Quarter in Detail

Tandem Diabetes registered international sales of $46.5 million in the quarter under review, recording a 189% rise from third-quarter 2020. Domestic sales totaled $133.1 million, up 24% year over year.

International pump shipments surged 209% to 11,262 units. Domestic pump shipments jumped 10% year over year to 20,296 units.

The company believes that the surge in pump shipments resulted from continued adoption of t:slim X2 technology by both new and existing customers and more healthcare providers prescribing the t:slim X2 than ever before.

Margins

Gross profit in the third quarter was $96.7 million, marking 48.1% year-over-year growth. Gross margin was 53.9%, indicating an expansion of 102 basis points (bps).

Selling, general and administrative expenses rose 29.3% to $64.9 million in the quarter under review. Research and development expenses also increased 49.8% to $24.1 million.

Overall operating income was $7.7 million against the year-ago loss of $1 million.

Financial Position

Tandem Diabetes exited third-quarter 2021 with cash and cash equivalents, and short-term investments of $595 million compared with $545.3 million at the end of second-quarter 2021.

2021 Sales Guidance

For 2021, the sales projection has been raised to $685-$695 million, indicating annual sales growth of 37% to 39% (earlier projection for 2021 was $670-$685 million). The Zacks Consensus Estimate for 2021 revenues is pegged at $681.09 million.

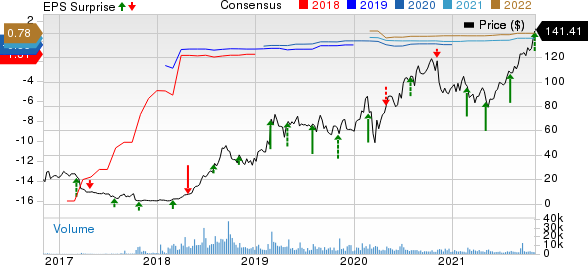

Tandem Diabetes Care, Inc. Price, Consensus and EPS Surprise

Tandem Diabetes Care, Inc. price-consensus-eps-surprise-chart | Tandem Diabetes Care, Inc. Quote

Full-year international sales are expected in the range of $168-$173 million, which suggests annual sales growth of 102% to 108%. This also represents a significant improvement from the prior guidance of $160-$165 million.

Our Take

Tandem Diabetes delivered better-than-expected revenues for the third quarter of 2021. The top line registered year-over-year growth despite pandemic-led business disruptions. Solid performance in the quarter was driven by both new customer demand and increasing renewal purchases from the company’s installed base. Strong domestic and international pump sales along with robust domestic and international pump shipments are impressive. Continued adoption of the company’s t:slim X2 insulin pumps by both new and existing users looks encouraging as well. Strong worldwide demand for Control-IQ technology buoys optimism. Expansion of gross margin and a raised 2021 sales forecast bode well for the stock.

However, the unabated spread of coronavirus continues to pose challenges to the company’s operations. A rise in operating costs is discouraging as well.

Zacks Rank and Key Picks

Tandem Diabetes currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader medical space that have announced quarterly results are Medpace Holdings, Inc. MEDP, Thermo Fisher Scientific Inc. TMO and West Pharmaceutical Services, Inc. WST.

Medpace, currently carrying a Zacks Rank #1 (Strong Buy), reported third-quarter 2021 adjusted EPS of $1.29, surpassing the Zacks Consensus Estimate by 20.6%. Revenues of $295.57 million beat the Zacks Consensus Estimate by 1.2%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Thermo Fisher Scientific reported third-quarter 2021 adjusted EPS of $5.76, which surpassed the Zacks Consensus Estimate by 23.3%. Revenues of $9.33 billion outpaced the Zacks Consensus Estimate by 12%. It currently carries a Zacks Rank #1.

West Pharmaceutical Services, carrying a Zacks Rank #2 (Buy), reported third-quarter 2021 adjusted EPS of $2.06, which beat the Zacks Consensus Estimate by 13.2%. Revenues of $706.5 million outpaced the consensus mark by 3.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST) : Free Stock Analysis Report

Tandem Diabetes Care, Inc. (TNDM) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research