Targa (TRGP) Stock Shines SInce Q2 Earnings Beat: Here's Why

The stock of midstream energy infrastructure provider Targa Resources TRGP, has gained 6.8% since its second-quarter results were announced on Aug 4. The positive response could be attributed to the company’s comfortable earnings beat and investor confidence in the Lucid Energy buyout.

What Did Targa Resources’ Earnings Unveil?

Targa Resources reported second-quarter 2022 net income per share of $1.61, comprehensively beating the Zacks Consensus Estimate of $1.06 and skyrocketing from the year-ago profit of 15 cents. The outperformance was led by an elevated commodity price environment and strong volumes across the company’s Permian-related systems.

The company’s adjusted EBITDA climbed from $460 million a year earlier to $666.4 million in the second quarter of 2022.

Second-quarter 2021 distributable cash flow was $533.4 million, 57.1% higher than $339.5 million in the year-ago period. Targa Resources paid out a dividend of 35 cents per share, while adjusted free cash flow rose 30.5% from the second quarter of 2021 to $334.1 million. TRGP repurchased shares worth $74.1 million during the April-June period.

Moreover, total revenues of $6.1 billion were 77.3% higher than the year-ago quarter and beat the Zacks Consensus Estimate of $5.9 billion.

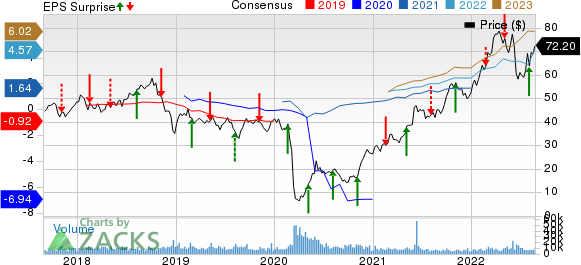

Targa Resources, Inc. Price, Consensus and EPS Surprise

Targa Resources, Inc. price-consensus-eps-surprise-chart | Targa Resources, Inc. Quote

Operational Performance

Gathering and Processing: The segment recorded operating margin of $474.7 million during the quarter, up 57.6% from the $301.2 million achieved in the year-ago period. The jump primarily reflects higher Permian Basin volumes that increased 13% year over year to average 3,125.3 million cubic feet per day.

Logistics and Transportation: This unit mainly reflects Targa Resources’ downstream operations. The segment operating margin of $322.3 million was up 10.6% year over year. TRGP saw fractionation volumes rise from 643.7 thousand barrels per day to 737.2 thousand barrels per day, which is a 14.5% increase year over year. Moreover, NGL pipeline transportation volumes were up significantly too, 25.7% year over year in fact, while NGL sales improved 8.8%.

Costs, Capex & Balance Sheet

Targa Resources, carrying a Zacks Rank #2 (Buy), reported product costs of $5 billion in second-quarter 2022, rising 86.3% from the year-ago quarter.

In the reported quarter, TRGP spent $199.3 million on growth capital programs compared to $83.4 million in the year-ago period. As of Jun 30, the company had cash and cash equivalents of $154 million and long-term debt of $7 billion, with a debt-to-capitalization of 61.6%.

Guidance

Taking into account contribution from the recently completed acquisition of Lucid Energy Delaware (a privately held natural gas processor in the Permian Basin), Targa Resources upwardly revised its full-year adjusted EBITDA estimate to $2.85-$2.95 billion. The company now anticipates 2022 growth capital expenditures between $1 billion and $1.1 billion, with net maintenance capital spending reierated at $150 million.

Other Energy Picks

Apart from Targa Resources, investors interested in the energy sector might look at Equinor ASA EQNR, ExxonMobil XOM and Earthstone Energy ESTE, each carrying a Zacks Rank #1 (Strong Buy), currently.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Equinor: Equinor is valued at some $136.2 billion. The Zacks Consensus Estimate for EQNR’s 2022 earnings has been revised 14.5% upward over the past 60 days.

Equinor, headquartered in Stavanger, Norway, delivered an 8.3% beat in Q2. EQNR shares have surged 92.5% in a year.

Earthstone Energy: ESTE beat the Zacks Consensus Estimate for earnings in each of the last four quarters. The company has a trailing four-quarter earnings surprise of roughly 27%, on average.

Earthstone Energy is valued at around $2.3 billion. ESTE has seen its shares gain 85.6% in a year.

ExxonMobil: ExxonMobil is valued at some $410.9 billion. The Zacks Consensus Estimate for XOM’s 2022 earnings has been revised 23.6% upward over the past 60 days.

ExxonMobil, headquartered in Irving, TX, has a trailing four-quarter earnings surprise of roughly 1.6%, on average. XOM shares have gained 77.7% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Targa Resources, Inc. (TRGP) : Free Stock Analysis Report

Earthstone Energy, Inc. (ESTE) : Free Stock Analysis Report

Equinor ASA (EQNR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research