TE Connectivity (TEL) Q1 Earnings & Sales Beat, Rise Y/Y

TE Connectivity Ltd. TEL has reported first-quarter fiscal 2021 adjusted earnings of $1.47 per share, beating the Zacks Consensus Estimate by 13.9%.

Further, the figure rose 26.7% sequentially and21% on a year-over-year basis. Bottom-line growth was driven by strong operational performance.

Net sales in the reported quarter were $3.5 billion, which surpassed the Zacks Consensus Estimate of $3.3 billion. Further, the figure rose 8% from the previous quarter and 11% from the year-ago quarter.

Strong performance delivered by the Communication and Transportation segments drove top-line growth in the reported quarter.

Notably, the company witnessed growth in its total orders, which was $4 billion, up 25% and from the prior-year quarter.

However, uncertainties related to the coronavirus pandemic have been concerning.

Nevertheless, the company’s global manufacturing strategy, continued solid execution of its plans (especially cost reduction), and footprint-consolidation initiatives remain key catalysts.

Additionally, TE Connectivity’s growing momentum across hybrid and electric vehicle platform technology, and strength across data connectivity remain other positives.

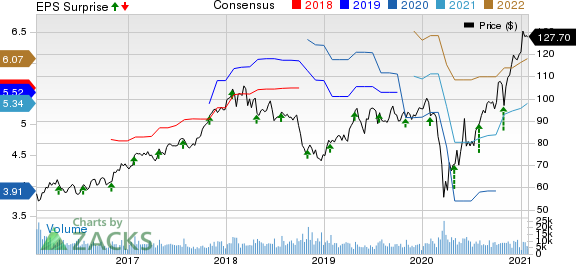

TE Connectivity Ltd. Price, Consensus and EPS Surprise

TE Connectivity Ltd. price-consensus-eps-surprise-chart | TE Connectivity Ltd. Quote

Top Line in Detail

TE Connectivity operates in three organized segments.

Transportation Solutions: The company generated sales worth $2.2 billion (63.1% of net sales) in the reported quarter, up 19% on a year-over-year basis. This can be attributed to strong content growth and supply-chain benefits, which led to 16% growth in the company’s automotive sales. Further, commercialtransportation sales grew 28% year over year on the back of electronification trends and content growth. Also, positive contributions from the First Sensor buyout and solid momentum across auto applications led to 29% year-over-year growth in the sensor business.

Industrial Solutions: The segment generated sales of $873 million (24.8% of net sales), which fell 6% year over year. This was primarily due to sluggishness in the commercial aerospace that led to a decline of 19% year over year in sales generated from aerospace, defense and marine markets in the reported quarter.

Moreover, delays in elective procedures due to the ongoing pandemic led to a year-over-year decline of 13% in medical sales. Also, energy sales were down 2% from the year-ago quarter due to COVID-related headwinds.

Nevertheless, the company witnessed growth of 12% in the industrial equipment sales from the year-ago quarter on strong momentum across factory-automation applications.

Communications Solutions: The segment generated sales of $425 million (12.1% of net sales), improving 14% year over year. This was driven by 7% growth in data and device sales, owing to solid demand for cloud applications. Further, strong appliance sales, which grew 24%, thanks to improvement inthe housing market, contributed well.

Operating Details

Per management, gross profit was $1.1 billion, up 11.3% year over year. As a percentage of revenues, the figure remained almost flat with the year-ago quarter.

We note that R&D expenses were $162 million, which rose0.6% year over year. Further, selling, general and administrative expenses were $361 million, down 1.6% year over year.

However, acquisition and integration expenses totaled $8 million, increasing 14.3% from the year-ago quarter. Also, restructuring costs jumped from $24 million in the year-ago quarter to $167 million.

TE Connectivity’s adjusted operating margin was 17.7%, expanding 190 bps from the prior-year quarter.

Balance Sheet & Cash Flow

As of Dec 25, 2020, TE Connectivity’s cash and cash equivalents were $1.1 billion, higher than $945 million as of Sep 25, 2020.

Long-term debt was $3.5 billion, up from $3.4 billion in the previous quarter.

The company generated $640 million of cash from operations in the reported quarter, which decreased from $720 million in the prior quarter.

Further, free cash flow of $529 million was generated in the reported quarter. Additionally, TE Connectivity returned $286 million to its shareholders during the reported quarter.

Guidance

The company projects net sales at $3.5 billion for second-quarter fiscal 2021, suggesting year-over-year growth of 10% on a reported basis.

The Zacks Consensus Estimate for fiscal first-quarter sales is pegged at $3.3 billion.

Further, TE Connectivity projects adjusted earnings at $1.47 per share. The Zacks Consensus Estimate for the same is pegged at $1.30.

Zacks Rank & Other Stocks to Consider

Currently, TE Connectivity carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the broader technology sector are Square, Inc. SQ, Alphabet Inc. GOOGL and Garmin Ltd. GRMN. All three companies currently carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The long-term earnings growth rates of Square, Alphabet and Garmin are pegged at 32.99%, 16.93% and 6.8%, respectively.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.4% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TE Connectivity Ltd. (TEL) : Free Stock Analysis Report

Garmin Ltd. (GRMN) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Square, Inc. (SQ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research