Tech Dividend Stocks That Will Add Value To Your Portfolio

The technology sector is generally characterised as full of innovation, competition and growth. It is also known to be highly cyclical and volatile since companies tend to find it difficult to create sustainable competitive advantage. However, those that build successful economic moats are exceptionally profitable and some pay strong dividends as a result. I’ve made a list of other value-adding dividend-paying stocks in the tech industry for you to consider for your investment portfolio.

Cogeco Inc. (TSX:CGO)

CGO has a good-sized dividend yield of 2.46% and their payout ratio stands at 18.81% . CGO’s last dividend payment was CA$1.56, up from it’s payment 10 years ago of CA$0.28. They have been consistent too, not missing a payment during this 10 year period. Dig deeper into Cogeco here.

Evertz Technologies Limited (TSX:ET)

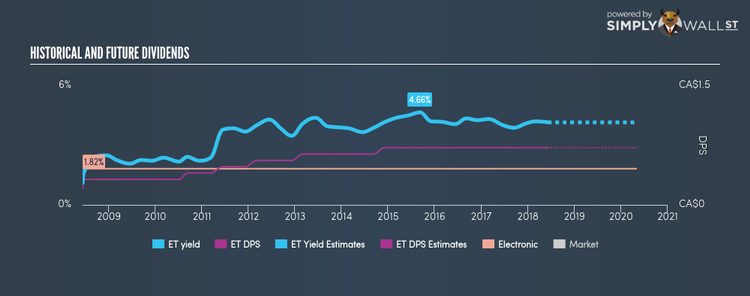

ET has a juicy dividend yield of 4.15% and the company has a payout ratio of 83.64% . In the last 10 years, shareholders would have been happy to see the company increase its dividend from CA$0.20 to CA$0.72. They have been consistent too, not missing a payment during this 10 year period. More on Evertz Technologies here.

Corus Entertainment Inc. (TSX:CJR.B)

CJR.B has a sumptuous dividend yield of 17.14% and is currently distributing 109.67% of profits to shareholders . CJR.B has increased its dividend from CA$0.60 to CA$1.14 over the past 10 years. Much to the delight of shareholders, the company has not missed a payment during this time. Corus Entertainment’s earnings growth over the past 12 months has exceeded the ca media industry, with the company reporting an EPS growth of 172.11% while the industry totaled -15.34%. More on Corus Entertainment here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.