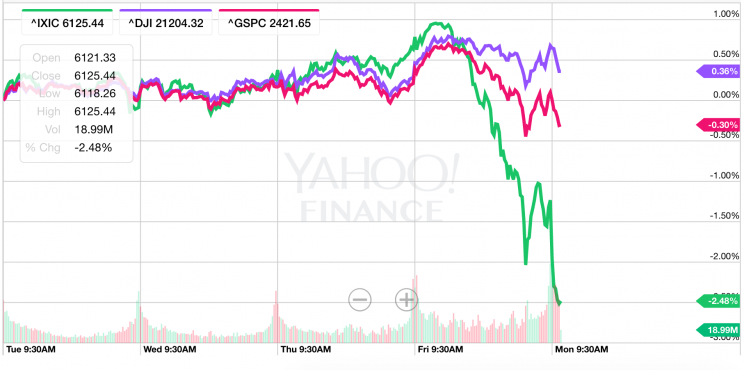

Tech stocks are getting slammed on Monday

After tech stocks were pummeled on Friday, the sector is selling off again to start the week.

Just before noon Eastern, the Nasdaq was down 0.6%, or down about 40 points. The Dow and S&P 500 had also pared some losses, with the Dow off 40 points and the S&P down about 6.

Shortly after the market open, the Nasdaq had been down more than 1.3%, or 85 points, far outpacing losses from the Dow and the benchmark S&P 500. Near 9:50 a.m. ET the Dow was off 62 points, or 0.3%, and the S&P 500 was down 9 points, or 0.4%. On Friday, the Nasdaq fell 1.8% while the Dow actually finished in the green.

Major tech names selling off early Monday included Nvidia (NVDA), down over 4%, AMD (AMD), down 5%, Microsoft (MSFT), down about 3%, and Amazon (AMZN) also off about 3%. Near noon Eastern, Nvidia shares had erased all of their early losses while AMD, Microsoft, and Amazon were still in the red.

Tech stocks in the U.S. were also taking their lead from European equities, as Europe’s tech index fell 3.5% on Monday, its biggest drop since the day after Brexit in June 2016.

Friday’s sell-off in the tech sector was attributed, in part, to a report from analysts at Goldman Sachs, who published a note wondering if the big tech stocks powering the market — what it called the FAAMG stocks, including Facebook (FB), Apple (AAPL), Amazon, Microsoft, and Google parent-company Alphabet (GOOGL) — were creating a mispricing in the market. (The most popular acronym for the big tech stocks powering the market has been ‘FANG’, coined by Jim Cramer and including Facebook, Amazon, Netflix (NFLX), and Google.)

Perhaps most concerning to investors was Goldman’s reference to the “Nifty Fifty” stocks of the 1960s and 70s and the performance of major tech companies in 1999-2000, two periods for stock returns that preceded brutal bear markets.

Also on Friday, shares of Amazon — which are 30% this year alone, flash-crashed just before 3:00 p.m., trading down to $927 per share from $960 in a matter of seconds before recovering. Shares of the online retailer closed at $978 on Friday.

On Monday, the market’s focus will likely be on news that General Electric (GE) would replace CEO Jeff Immelt after a 16-year tenure which saw the company’s stock significantly underperform relative to the Dow and the S&P 500.

As Barclays analyst Scott Davis told CNBC on Monday, Immelt’s tenure at the top of the industrial giant was “an unmitigated disaster for shareholders.”

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: