Technical Overview Of USD/CHF, GBP/CHF, NZD/CHF & CAD/CHF: 12.10.2017

USD/CHF

Following its failure to surpass 200-day SMA, the USDCHF dropped to week’s low; however, the 0.9700 round-figure triggered the pair’s pullback which presently helps it to aim for 0.9770 and the 0.9805 nearby resistances. Given the pair’s ability to surpass 0.9805, the 0.9820-30 region, comprising the said SMA, becomes crucial for traders to watch, which if cleared could help accelerate the pair’s recovery to 0.9860 and then to the descending TL resistance of 0.9930. On the downside, a daily close below 0.9700 can fetch the quote to 0.9685 prior to reigniting the importance of 100-day SMA level of 0.9650. During the pair’s sustained break of 0.9650, the 0.9610 and the 0.9550 numbers might be sellers’ favorite.

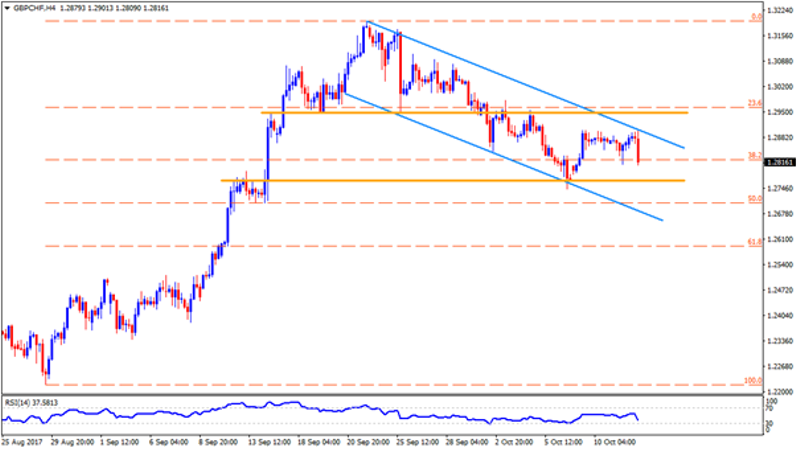

GBP/CHF

Unlike USDCHF, the GBPCHF has a different story. The pair seems witnessing a downside pressure from resistance-line of a short-term downward slanting trend-channel. As a result, chances of its dip to 1.2800 and then to the 1.2765-60 horizontal-line are brighter but its following south-run may be confined by support-line of the channel, at 1.2680 now. If at all Bears refrain to respect 1.2680, the 1.2620 and the 1.2560 can appear in their radar. In case of the pair’s break of channel-resistance, at 1.2905, the 1.2945-50 horizontal-line could restrict its additional upside, breaking which 1.3000 mark can be expected as next level. Should prices successfully trade above 1.3000, the 1.3070 and the 1.3115 may be targeting by buyers.

NZD/CHF

NZDCHF’s bounce from five-month old ascending trend-line helped it to clear the near-term descending TL resistance, which in-turn favors its upside to 0.6960 and the 50-day SMA level of 0.6990. During the pair’s extended recovery after 0.6990, the 0.7035 and the descending TL resistance-mark of 0.7090 become crucial. Meanwhile, a daily close below 0.6915 can keep supporting the importance of 0.6880-85 TL support, break of which can quickly fetch the pair to 0.6840 and then to the 0.6800 round-figure. Moreover, pair’s sustained downturn beneath 0.6800 might raise concerns for May low, around 0.6720, to reappear on the chart.

CAD/CHF

Even if six-week old upward slanting trend-line triggered CADCHF’s U-turn, the pair is less likely to surpass the 0.7830 TL resistance and may re-test 0.7790 support. Should the quote declines below 0.7790, the 0.7770 support-line gains market attention, breaking which could open the door for the pair’s drop towards 0.7740, the 0.7715 and the 0.7690 rest-points. Alternatively, break of 0.7830 enable buyers to claim 0.7850 and the 0.7890 resistances, clearing which they can target 0.7920, the 0.7940 and the September high near 0.7960. However, the 0.8000 psychological-mark could confine the pair’s following advances.

Cheers and Safe Trading,

Anil Panchal

This article was originally posted on FX Empire