Here’s the Technical Roadmap for Marathon Oil Speculators

Presently, the bullishness in the oil market may represent the biggest disconnect between investor sentiment and reality. Primarily, new daily novel coronavirus cases have soared to all-time records, according to the Centers for Disease Control and Prevention. Of course, this implies further restrictive (and draconian) measures. Yet oil prices have risen, bolstering Marathon Oil (NYSE:MRO) and specifically MRO stock.

Source: IgorGolovniov / Shutterstock.com

What gives? In my opinion, the biggest catalyst for “black gold” was the Thanksgiving holiday. According to CouponFollow.com, most Americans planned on traveling long distances. Not only that, most within the willing-to-travel segment indicated they would drive to their destination.

Put another way, rather than one fixed expense, the beleaguered oil industry would enjoy individual cash outlays.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Moreover, the American public made good on their intentions. According to the Bureau of Transportation Statistics, individual trips longer than 100 miles spiked up noticeably during Thanksgiving week. However, total commercial flights in the U.S. dipped from the week prior. Perhaps in anticipation of this widely distributed demand (more cars carrying more people than air passengers), both oil prices and MRO stock jumped higher.

Source: Chart by Josh Enomoto

But should investors jump on this rally? Here, I believe some caution is prudent. You must remember that over the long haul, oil has been mired in a down-trending channel. Therefore, you want to have some reasonable confidence that there’s substance behind the rally.

From looking at the technical chart, the oil price (based on the West Texas Intermediate index) must first hit $50 and establish support there. Next, it must successfully challenge the $60 upper resistance level. Failure to achieve these price thresholds could see the index falling back to the $30s.

Plus, aside from holiday-related travel, Americans are just not getting out of their homes. Should coronavirus cases worsen, that could hurt the sector, leaving MRO stock seeing red again.

Can MRO Stock Go Against the Grain?

To be upfront about Marathon Oil or other fossil-fuel-related names, I’ve lost my appetite. Of course, that doesn’t necessarily mean you should avoid this market altogether. So, just what is the likelihood that MRO stock can beat the implications of its underlying industry?

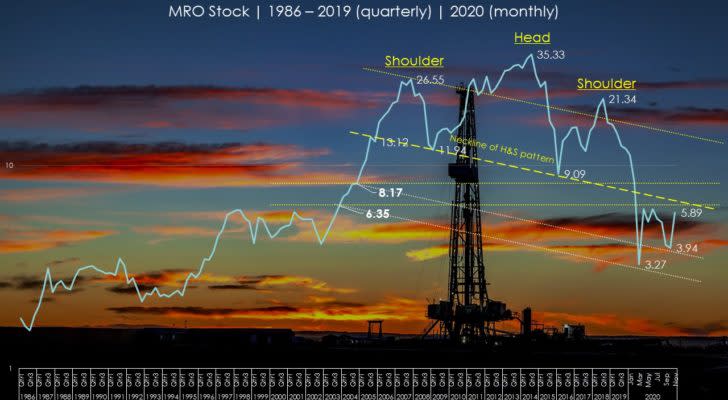

While both MRO and oil prices have printed decidedly negative trend channels, the former has an intriguing setup. As you can eyeball from its long-term chart, Marathon shares have inked a head-and-shoulders (H&S) pattern. You’re probably familiar with this formation as it’s one of the most oft cited in technical analysis.

Source: Chart by Josh Enomoto

Sure enough, MRO stock plummeted immediately after hitting the peak which represents the second shoulder. More critically, shares dropped below the H&S pattern’s “neckline,” which is a line drawn through the points represented by the drop of the first shoulder and the drop of the head.

At time of writing, MRO stock is trading hands at $6.19. This is roughly where the neckline extends out to. Let’s pause right here. If you believe that Marathon shares can move higher from here, it’s vital that they maintain support around $6. Otherwise, the bears can punish MRO, pushing it to lower levels of support.

Now, moving forward, the next logical target for Marathan Oil is $8. This is approximately the price where MRO was trading in late 2004 before it soared to the first shoulder of the aforementioned H&S pattern. I’m virtually certain that Wall Street traders will be eyeballing this level as the next point of resistance.

If Marathon Oil stock breaks above $8 and establishes horizontal support at $9 or so, we could be in business. This could signal a fresh rethink for the market. However, I believe the next few weeks will be crucial. If MRO can’t hold $6, it could get ugly.

Marathon Will Move Somewhere

Personally, my gut tells me that oil prices will turn negative within the next three months. No, it’s not necessarily about President-elect Joe Biden’s incoming administration. Rather, I don’t see the case for increased demand. Covid-19 cases are rising, and so too are hospitalizations and deaths.

Logically, we may see shutdowns across the nation. Do the politicians that run impacted states – liberal, conservative, or otherwise – have any choice? Let people die or let the economy crumble … what an awful predicament. Again, my appetite for investments like MRO stock has weakened considerably.

But the one thing I’m confident about is that MRO will go somewhere. If you’re thinking about Marathon, just know that at best, this is an options trade on volatility. For that, I highly recommend our resident expert, InvestorPlace contributor Chris Tyler.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) any positions in the securities mentioned in this article.

A former senior business analyst for Sony Electronics, Josh Enomoto has helped broker major contracts with Fortune Global 500 companies. Over the past several years, he has delivered unique, critical insights for the investment markets, as well as various other industries including legal, construction management, and healthcare.

More From InvestorPlace

The post Hereâs the Technical Roadmap for Marathon Oil Speculators appeared first on InvestorPlace.