TechnipFMC Wins Pluto Upgrade Award From Woodside Petroleum

TechnipFMC plc FTI was recently awarded a contract from the Australian operator, Woodside Petroleum Limited, for platform upgrade of the Pluto project. Per the contract, TechnipFMC will carry out engineering, procurement, construction, installation and commissioning of the Pluto water handling module. The module will be installed on the Pluto Alpha Gas Production Platform, and provide water separation and treatment facilities, along with upgraded power-generation units.

Located offshore Western Australia, the gas produced from Pluto facility will be transferred to the Pluto LNG Offshore Plant. The Pluto offshore facility is chiefly operated by Woodside Petroleum, with 90% stake. The other partners in the project include Kansai Electric and Tokyo Gas, each carrying 5% stake. While the value of the contract is kept under wraps, it reinforces the close association of TechnipFMC with Woodside Petroleum, one of the major oil and gas operators in Australia.

Notably, this inbound order had been included in TechnipFMC’s onshore/offshore segment along with Energean Karish Project offshore Israel in the last earnings report. With recovering crude strength, TechnipFMC looks poised to boost backlog, revenues and profitability in its offshore segment, which is primarily responsible for design, manufacture and installation of fixed and floating platforms, for producing and processing oil and gas reserves.

In fact, the inbound order in the onshore/offshore segment (accounting for 53% of the total inbound orders) in the last reported quarter stood at $1850 million, beating the Zacks Consensus Estimate of $1,412 million. The revenues of $1,573 million from the segment also surpassed the estimates of $1,536 million. Operating income rose to $202.9 million versus $142.8 million recorded in the first quarter of 2017 on strong project execution.

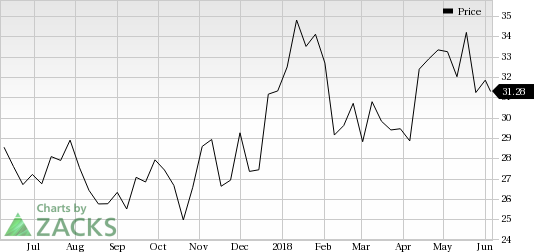

TechnipFMC plc Price

TechnipFMC plc Price | TechnipFMC plc Quote

Zacks Rank and Stocks to Consider

TechnipFMC currently carries Zacks Rank #3 (Hold). Some better-ranked players in the same industry include Archrock, Inc. AROC, Newpark Resources, Inc. NR and SEACOR Holdings, Inc. CKH, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Archrock’s 2018 earnings are anticipated to grow 210% year over year.

Newpark’s earnings for 2018 are anticipated to grow 310% year over year.

SEACOR delivered an average positive earnings surprise of 11.22% in the trailing four quarters.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TechnipFMC plc (FTI) : Free Stock Analysis Report

Newpark Resources, Inc. (NR) : Free Stock Analysis Report

SEACOR Holdings, Inc. (CKH) : Free Stock Analysis Report

Archrock, Inc. (AROC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research