Teladoc and Livongo: Merging While the Iron Is Hot

On Wednesday, Aug. 6, Teledoc Health Inc. (NYSE:TDOC) announced that it intends to acquire Livongo Health Inc. (NASDAQ:LVGO) in a cash and stock deal that values Livongo at $18.5 billion.

According to the announcement, the merger is intended to create a company that can provide "high quality, personalized, technology-enabled longitudinal care that improves outcomes and lowers costs across the full spectrum of health."

Teladoc CEO Jason Gorevic noted that with the Covid-19 telehealth boom, "it makes sense" to do the deal now, as it will bring greater engagement and referrals to the combined company.

The strategic advantages here are undeniable, as the telehealth boom is creating a rare opportunity for an industry leader to emerge rapidly and grab the largest share of the market. However, the stocks of both companies fell more than 10% following the announcement before recovering slightly on Thursday, indicating that some investors may find the valuation too high.

With profitability still eluding both companies, it is not hard to see why investors might be cautious. On the other hand, the merger will combine a general telehealth company (Teladoc) with a peer that focuses more on the managing of chronic conditions (Livongo), which makes it quite a harmonious deal. Both companies are well known, and the potential for market dominance following the merger should not be ignored.

The terms of the deal

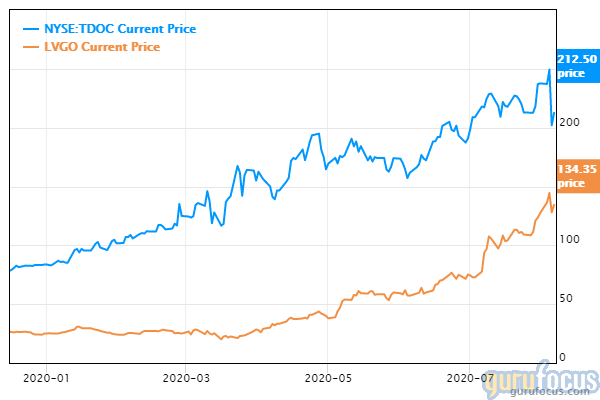

Teladoc and Livongo, two of the largest companies in the U.S. digital health field, have seen their share prices skyrocket, with Teladoc's stock having tripled year to date while Livongo's increased fivefold.

These sharp increases in valuation would make the deal the third largest this year. As Longbow Asset Management CEO Jack Dollarhide pointed out, "Stock prices have gotten so high with these tech companies and Covid-19 plays that they're going to use their stock as currency to make acquisitions like this."

Accordingly, Teladoc plans to pay $11.33 in cash and 0.592 of a Teladoc share for each share of Livongo, valuing the acquisition at approximately $18.5 billion. The deal is set to close in the fourth quarter of 2020, subject to regulatory approval.

In terms of management, Teladoc's CEO will be in charge of the combined company, while the board of directors will consist of eight members from Teladoc and five from Livongo.

According to the executives of both companies, the two had been talking about potentially building a partnership for years. The talks accelerated three months ago, but with record numbers of new customers signing up for both companies' services, it took a while for a deal to be struck.

It is important to note that the deal is not meant to get rid of a competitor, but rather to combine complementary operations in two similar businesses that ultimately provide very different products, making it value accretive.

Teladoc provides an alternative to in-person office visits in the case of illnesses that can be easily diagnosed (by doctors) without lab work or long-term monitoring, such as heartburn, common skin conditions and viruses. Livongo, on the other hand, provides remote monitoring and coaching for chronic conditions that have traditionally forced patients to spend significant amounts of time at their doctor's office. Both businesses greatly increase the accessibility of health care for patients with both long-term and short-term mobility and chronic health issues.

Of course, if Teladoc and Livongo were to continue operating separately, it is likely that they would eventually move into each other's spheres of business. If the two are to merge, then, a better opportunity to do so is unlikely to appear in the future. As Gorevic told CNBC, "Our two companies were either on a path of convergence or collision."

Value potential

Teladoc visits surged 203% in the second quarter of 2020 compared to the same period of the prior year, contributing to an 85% increase in revenue. Meanwhile, Livongo saw a 113% surge year over year in new diabetes patients, helping revenue improve 125% over the same period.

How much of that growth will stick in the short term, and how much will demand for these services continue to grow in the long term? We will only know in hindsight, but Teladoc expects annual sales growth of between 30% and 40% for the next few years. Livongo's "Estimated Value of Agreements," which is the amount of revenue expected in the future from agreements signed with clients, grew 46% year over year in the second quarter.

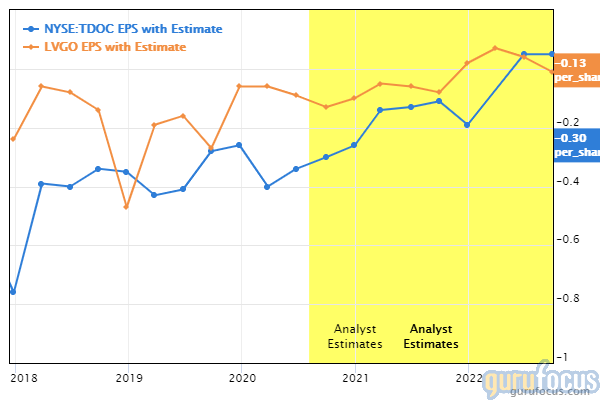

So far, the two companies have yet to become profitable, with earnings per share remaining firmly in the negative range. According to Morningstar analysts, earnings per share is expected to remain in the red for both companies until around 2022. Teladoc has also provided negative GAAP earnings per share guidance for full-year 2020.

With the cost of revenue reaching approximately a fourth of Livongo's revenue and half of Teladoc's revenue, it's safe to say that a focus on growth is one of the biggest contributing factors to the lack of profitability at both companies. Given the timing of the merger and the executives' comments, it seems the companies intend to maintain the focus on growth even after merging.

However, despite the lack of profitability so far, both companies are maintaining stable balance sheets. GuruFocus gives Teladoc a financial strength rating of 5 out of 10, with a cash-debt ratio of 1.34 and an Altman Z-Score of 9.27. Livongo's financial strength rating is 7 out of 10, with a cash-debt ratio of 20.09 and a current ratio of 10.66.

Conclusion

The Covid-19 pandemic has accelerated the demand for telemedicine services, greatly increasing the value that the market and clients alike place on companies within this space. From the perspective of increasing market share and establishing a dominant position, there has never been a better opportunity for a merger in the telemedicine space.

Thus, ahead of the merger, Teladoc and Livongo could potentially prove to be profitable long-term macro bets on the telemedicine field. As with many high-growth companies, they have yet to turn a profit, but that could change with a big enough boost in popularity and market share.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Investors should always conduct their own careful research and/or consult registered investment advisors before taking action in the stock market.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.