Teladoc (TDOC) Q3 Loss Lower Than Estimates, Revenues Beat

Teladoc Inc. TDOC reported third-quarter 2018 loss of 34 cents per share, narrower than the Zacks Consensus Estimate of a loss of 36 cents. The same was also lower than the year-ago quarter’s loss of 55 cents per share.

Strong Operating Performance

The company’s revenues of $111 million surpassed the Zacks Consensus Estimate by 0.76% and soared 61% year over year.

Revenues from subscription access fees (which comprised 87% of total revenues) increased 60% year over year to $96.6 million. Within this, subscription fees from the United States accounted for $65.1 million or 75% of total access fees (up 40% year over year), while international subscription fees accounted for the remaining 25% or $24 million (up 187%).

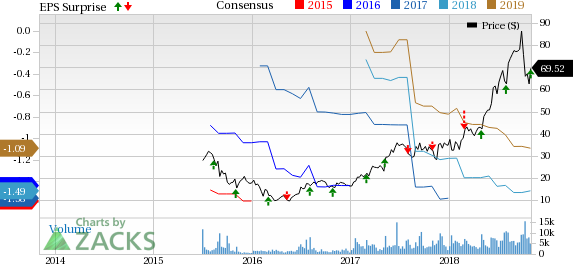

Teladoc, Inc. Price, Consensus and EPS Surprise

Teladoc, Inc. Price, Consensus and EPS Surprise | Teladoc, Inc. Quote

The company generated $12 million in visit fee revenues from general and medical visits, representing an increase of 43% year over year.

Gross margins declined to 69% from 76% in the year-ago quarter as a result of overall revenue mix shift of its virtual healthcare product offerings.

Strong visit volume of approximately 641,000 total visits in the quarter, represented growth of 110% year over year.

U.S. paid membership of 22.6 million, grew 18% year over year.

Total operating expenses in the quarter came in at $94 million, representing a surge of 28% year over year, primarily led by higher marketing and advertising and legal expenses.

Adjusted EBITDA came in at $6.3 million for the quarter, against an adjusted EBITDA loss of $0.6 million in the year-ago period.

The company ended the quarter with approximately $472.5 million in cash and short-term investment.

The company’s total debt, as of the end of the quarter, was $562.5 million.

Guidance Update

For the fourth quarter, the company expects total revenues of $119-$121 million and total adjusted EBITDA of $4-$6 million. The company projects total visits between 720,000 and 20,000. Net loss per share, based on 70.4 million weighted average shares outstanding, is expected to range from a loss of 36 cents to a loss of 38 cents per share.

For full-year 2018, the company expects revenues between $414 million and $416 million and adjusted positive EBITDA between $12 million and $14 million. It projects total U.S. paid membership of approximately 22.6 million to 23.5 million members, while visit fee only access will be available to approximately 9.4 million individuals. Total visits are expected in the band of 2.5-2.6 million and a net loss per share based on 65.9 million weighted average shares outstanding, is expected to range from $1.48 to $1.50.

Zacks Rank and Stocks to Consider

Teladoc carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other players from the healthcare industry that have reported third-quarter earnings, the bottom line of Anthem, Inc. ANTM,Centene Corporation CNC and UnitedHealth Group Inc. UNH beat the respective Zacks Consensus Estimate.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

Anthem, Inc. (ANTM) : Free Stock Analysis Report

Centene Corporation (CNC) : Free Stock Analysis Report

Teladoc, Inc. (TDOC) : Free Stock Analysis Report

To read this article on Zacks.com click here.