TELUS's (TU) Subsidiary Reportedly Drops its Bid for Appen

TELUS Corporation???s TU subsidiary TELUS International, which was looking to acquire Australia-based Appen Ltd has abruptly withdrawn its bid, per Reuters.

The company had reportedly offered to buy Appen for a A$9.50-per-share offer or a cumulative of A$1.2 billion ($830 million). Since the proposed price per share was below the company's trading price in February, Appen was holding discussions with TELUS to improve buyout terms, Reuters reported earlier.

Appen is a well-known leader in data for the AI Lifecycle and boasts an advanced AI-assisted data annotation platform. Appen aids companies across various verticals in launching AI-powered products. Appen???s client base includes tech bigwigs like Facebook owner Meta Platforms.

Canada-based TELUS International is a leading provider of digital technology solutions, including customer experience (CX), back office and automation and AI data solutions, among others.

TELUS International has been focusing on an inorganic strategy to boost its footprint. In 2021, the company acquired Bangalore-based Playment. The company provides data annotation and computer vision tools and services specialized in 2D and 3D image, LiDAR (light detection and ranging) and video.??

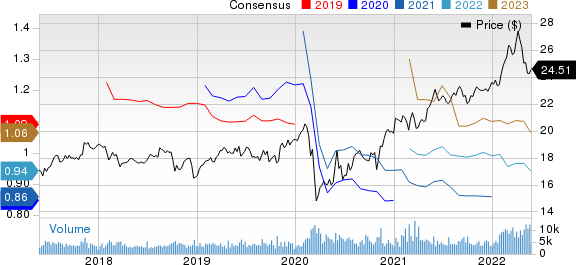

TELUS Corporation Price and Consensus

TELUS Corporation price-consensus-chart | TELUS Corporation Quote

The Playment buyout is complementary to the company???s earlier acquisition of Lionbridge AI. Lionbridge AI?? specializes in offering scalable data annotation services for text, images, videos, and audio to various companies in search, social media, retail and mobile domains.

Prior to that, TELUS International acquired Competence Call Center (2020),?? Xavient Digital (2018) and Voxpro Group (2017)

Currently, TELUS International???s parent company TELUS Corporation carries a Zacks Rank #3 (Hold). Shares of TU have gained 9.2% against the industry???s increase of 6.4% in the past year.

In the last reported quarter, revenues from TELUS Corporation increased 6.4% year over year to C$4,282 million ($3,381 million) driven?? by subscriber growth and double-digit revenue growth across TELUS International, TELUS Health and TELUS Agriculture segments.

Stocks to Consider

A few better-ranked stocks from the broader technology sector worth consideration are InterDigital IDCC Pure Storage PSTG and Flex FLEX. All stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today???s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Flex???s fiscal 2023 earnings is pegged at $2.16 per share, up 6.9% in the past 60 days. The long-term earnings growth rate is pegged at 14.9%.

Flex???s earnings beat the Zacks Consensus Estimate all last four quarters, with the average being 21.1%. Shares of FLEX have declined 12.4% in the past year.

The Zacks Consensus Estimate for InterDigital 2022 earnings is pegged at $3.28 per share, up 5.1% in the past 60 days. IDCC???s long-term earnings growth rate is pegged at 15%.

InterDigital???s earnings beat the Zacks Consensus Estimate in all the preceding four quarters, with the average being 141.1%. Shares of IDCC have lost 23.9% of their value in the past year.

The Zacks Consensus Estimate for Pure Storage fiscal 2023 earnings is pegged at 87 cents per share, unchanged in the past 60 days. The long-term earnings growth rate is 31.3%.

Pure Storage???s earnings beat the Zacks Consensus Estimate all last four quarters, with the average being 99.2%. Shares of PSTG have gained 20.6% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TELUS Corporation (TU) : Free Stock Analysis Report

Flex Ltd. (FLEX) : Free Stock Analysis Report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Pure Storage, Inc. (PSTG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research