Should You Be Tempted To Buy iShares Trust – iShares Nasdaq Biotechnology ETF (IBB) Because Of Its PE Ratio?

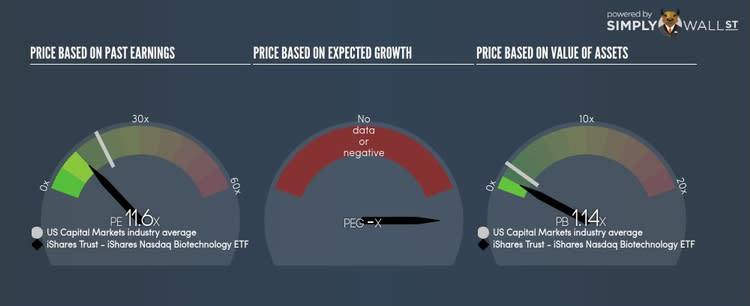

iShares Trust - iShares Nasdaq Biotechnology ETF (NASDAQ:IBB) is trading with a trailing P/E of 11.6x, which is lower than the industry average of 18.6x. Although some investors may jump to the conclusion that this is a great buying opportunity, understanding the assumptions behind the P/E ratio might change your mind. In this article, I will deconstruct the P/E ratio and highlight what you need to be careful of when using the P/E ratio. View our latest analysis for iShares Trust - iShares Nasdaq Biotechnology ETF

What you need to know about the P/E ratio

The P/E ratio is one of many ratios used in relative valuation. By comparing a stock’s price per share to its earnings per share, we are able to see how much investors are paying for each dollar of the company’s earnings.

P/E Calculation for IBB

Price-Earnings Ratio = Price per share ÷ Earnings per share

IBB Price-Earnings Ratio = 333.59 ÷ 28.764 = 11.6x

The P/E ratio isn’t a metric you view in isolation and only becomes useful when you compare it against other similar companies. We preferably want to compare the stock’s P/E ratio to the average of companies that have similar features to IBB, such as capital structure and profitability. One way of gathering a peer group is to use firms in the same industry, which is what I’ll do. IBB’s P/E of 11.6x is lower than its industry peers (18.6x), which implies that each dollar of IBB’s earnings is being undervalued by investors. Therefore, according to this analysis, IBB is an under-priced stock.

Assumptions to watch out for

However, before you rush out to buy IBB, it is important to note that this conclusion is based on two key assumptions. The first is that our “similar companies” are actually similar to IBB, or else the difference in P/E might be a result of other factors. For example, if you are comparing lower risk firms with IBB, then its P/E would naturally be lower than its peers, as investors would value those with lower risk at a higher price. The second assumption that must hold true is that the stocks we are comparing IBB to are fairly valued by the market. If this is violated, IBB's P/E may be lower than its peers as they are actually overvalued by investors.

What this means for you:

Are you a shareholder? Since you may have already conducted your due diligence on IBB, the undervaluation of the stock may mean it is a good time to top up on your current holdings. But at the end of the day, keep in mind that relative valuation relies heavily on critical assumptions I've outlined above.

Are you a potential investor? If you are considering investing in IBB, looking at the PE ratio on its own is not enough to make a well-informed decision. You will benefit from looking at additional analysis and considering its intrinsic valuation along with other relative valuation metrics like PEG and EV/Sales.

PE is one aspect of your portfolio construction to consider when holding or entering into a stock. But it is certainly not the only factor. Take a look at our most recent infographic report on iShares Trust - iShares Nasdaq Biotechnology ETF for a more in-depth analysis of the stock to help you make a well-informed investment decision. Since we know a limitation of PE is it doesn't properly account for growth, you can use our free platform to see my list of stocks with a high growth potential and see if their PE is still reasonable.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.