Tesla Shares Rally Despite Musk Selling Over $1 Billion of His Stake

Elon Musk has sold billions of dollars worth of his shares in Tesla to pay taxes. However, TSLA has been rallying higher over the past 24 hours.

The rally could mean that the market has adjusted to the news of Musk selling his shares in the electric company.

Musk Sold $1.05 Billion in Tesla Shares

Financial filings have revealed that Tesla CEO Elon Musk sold $1.05 billion worth of Tesla shares earlier this week. This latest development has brought his total share sales to more than $9 billion over the past few days.

Per the filing, Musk sold $9.85 billion in Tesla stock this month. The Tesla CEO sold $6.9 billion worth of the stocks in the second week of the month before selling another $1.9 billion on November 15.

Musk sold some of the shares to satisfy tax obligations related to an exercise of stock options. Despite selling nearly $10 billion worth of his shares in Tesla, Musk and his trust still hold over 169 million shares in the company.

The shares of Tesla experienced massive losses on November 10 after Musk’s Twitter poll resulted in him selling more than $6 billion worth of TSLA. However, the recent sale hasn’t affected TSLA’s price as the stock is up by nearly 1% over the past few hours.

TSLA Could Reach $1,200 Soon

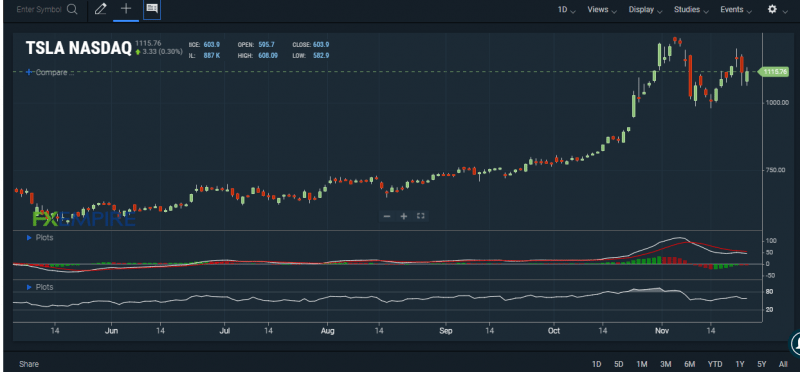

Tesla remains one of the best-performing stocks in the United States over the past few months. Year-to-date, TSLA is up by more than 58%. In the past month, the stock price has added nearly 9% to its value. Thus, indicating that Tesla remains attractive to investors despite Musk selling some of his shares.

The TSLA chart shows that the stock is positive. At the time of writing, Tesla’s MACD line is above the neutral zone, indicating that the stock is currently bullish. Furthermore, its RSI of 61 shows that TSLA is heading into the overbought region.

If TSLA can continue with its recent momentum, the stock price could rally towards the $1,200 level before the end of the year.

This article was originally posted on FX Empire