Tetra Tech (TTEK) Q4 Earnings & Revenues Top Estimates, Up Y/Y

Tetra Tech, Inc. TTEK reported solid fourth-quarter fiscal 2021 (ended Oct 3, 2021) results, with earnings surpassing estimates by 5%. This was the 17th consecutive quarter of better-than-anticipated results.

The company’s adjusted earnings per share in the reported quarter came in at $1.05, outpacing the Zacks Consensus Estimate of $1.00. Earnings increased 15.4% from the year-ago quarter’s 91 cents.

The bottom line also topped management’s projection of 95 cents to $1.00 per share.

In fiscal 2021, the company’s adjusted earnings per share came in at $3.79, up 16.3% year over year.

Revenues & Segmental Performance

In the fiscal fourth quarter, Tetra Tech generated adjusted revenues of $892 million, reflecting a year-over-year increase of 18%. Adjusted net revenues (adjusted revenues minus subcontractor costs) came in at $709.1 million, up 20%. The top line came above the company’s guidance of $650-$700 million.

Tetra Tech’s revenues also exceeded the Zacks Consensus Estimate of $682 million.

Backlog at the end of the quarter was $3,480.3 million, up 7.1% from the previous quarter.

In fiscal 2021, its adjusted net revenues were $2,552.2 million, up 9% year over year.

Revenues from the U.S. Federal customers (accounting for 28% of the quarter’s revenues) were up 11% year over year. Revenues increased from growth in advanced analytics and climate change projects.

The U.S. Commercial sales (22% of the quarter’s revenues) increased 8% year over year on higher environmental programs and renewable energy projects.

The U.S. State and Local sales (16% of the quarter’s revenues) increased 30% on strength across municipal infrastructure and disaster response. International sales (34% of the quarter’s revenues) increased 35% year over year, backed by strength across government projects.

The company reports revenues under the segments discussed below:

Net sales of Government Services Group came in at $372.4 million, up 12.8% year over year.

Revenues from Commercial / International Services Group totaled $336.7 million, underlining a year-over-year increase of 29.6%.

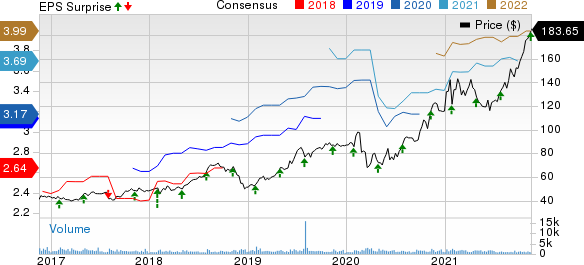

Tetra Tech, Inc. Price, Consensus and EPS Surprise

Tetra Tech, Inc. price-consensus-eps-surprise-chart | Tetra Tech, Inc. Quote

Margin Profile

In the fiscal fourth quarter, Tetra Tech’s subcontractor costs totaled $182.9 million, reflecting a rise of 11.8% from the year-ago quarter. Other costs of revenues were $565.2 million, up 21.7%. Selling, general and administrative expenses were $65.2 million, up 15.8%.

Net income in the reported quarter increased 85.5% year over year to $82.9 million while adjusted margin expanded 340 basis points to 9.3%.

Balance Sheet and Cash Flow

Exiting the fiscal fourth quarter, Tetra Tech had cash and cash equivalents of $166.6 million, down 28.9% from $234.3 million recorded at the end of the prior quarter. Long-term debt was down 14.5% sequentially to $200 million.

In fiscal 2021, it generated net cash of $304.4 million from operating activities compared with $262.5 million a year ago. Capital expenditure was $8.6 million, down 29.5%. In the fiscal year, the company’s proceeds from borrowings amounted to $370.2 million while repayments totaled $414.3 million.

Shareholder-Friendly Policies

In fiscal 2021, the company bought back shares worth $60 million and distributed dividends totaling $40 million.

Exiting the fiscal fourth quarter, the company had $548 million worth of authorization left under its approved buyback programs.

On Nov 15, 2021, the company’s board of directors approved the payment of a quarterly cash dividend of 20 cents per share. The company will pay out the dividend on Dec 20 to shareholders on record as of Dec 2, 2021.

Outlook

For fiscal 2022 (ending September 2022), Tetra Tech anticipates net revenues of $2.60-$2.80 billion, and adjusted earnings are predicted to be $4.00-$4.20.

For the first quarter of fiscal 2022 (ending December 2021), the company estimates net revenues of $630-$680 million and adjusted earnings per share of 98 cents to $1.03.

Zacks Rank & Other Stocks to Consider

The company currently carries a Zacks Rank #2 (Buy).

Some other top-ranked companies in the industry are discussed below.

Heritage-Crystal Clean, Inc HCCI presently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here. Its earnings surprise for the last four quarters was 62.29%, on average.

Heritage-Crystal’s earnings estimates increased 9.3% for 2021 and 23.1% for 2022 in the past 30 days. Its shares have gained 20.1% in the past three months.

Casella Waste Systems, Inc. CWST presently carries a Zacks Rank #1. Its earnings surprise in the last four quarters was 42.11%, on average.

Casella Waste’s earnings estimates have increased 11.4% for 2021 and 10.1% for 2022 in the past 30 days. Its shares have gained 28.7% in the past three months.

Energy Recovery, Inc. ERII presently carries a Zacks Rank #2. Its earnings surprise in the last four quarters was 123.33%, on average.

In the past 30 days, Energy Recovery’s earnings estimates have increased 18.2% for 2021 and 39.3% for 2022. Its shares have gained 22.5% in the past three months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tetra Tech, Inc. (TTEK) : Free Stock Analysis Report

Casella Waste Systems, Inc. (CWST) : Free Stock Analysis Report

Energy Recovery, Inc. (ERII) : Free Stock Analysis Report

HeritageCrystal Clean, Inc. (HCCI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research