Tetra Tech (TTEK) Surpasses Q1 Earnings Estimates, Ups View

Tetra Tech, Inc. TTEK reported better-than-expected results for the first quarter of fiscal 2020 (ended December 29, 2019), with earnings surpassing estimates by 9.1%. This was the tenth consecutive quarter of impressive results.

The company’s adjusted earnings per share in the reported quarter were 84 cents, surpassing the Zacks Consensus Estimate of 77 cents. Also, its earnings grew 20% from the year-ago quarter’s 70 cents on sales growth and margin improvement.

Revenues & Segmental Performance

In the reported quarter, Tetra Tech generated adjusted revenues of $797.5 million, reflecting year-over-year growth of 11.4%. Alternatively, adjusted net revenues (adjusted revenues minus subcontractor costs) were $614 million, reflecting growth of 11.1% from the year-ago quarter.

Further, the company’s revenues surpassed the Zacks Consensus Estimate of $608.7 million by 0.9%.

Backlog at the end of the quarter was $3,165.8 million, reflecting growth of 13.3% from the year-ago figure.

Revenues from the U.S. Federal customers (accounting for 28% of the quarter’s revenues) rose 12% year over year on growth in environmental and water programs. Conversely, U.S. Commercial sales (24% of the quarter’s revenues) grew 5% year over year, driven by an increase in the U.S. renewable energy and environmental remediation businesses. Also, the U.S. State and Local sales (14% of the quarter’s revenues) decreased 7% due to weakness in disaster response business, partially offset by gain in the water infrastructure business. International sales (34% of the quarter’s revenues) improved 25% on growth in renewable energy and UK environmental businesses.

The company reports revenues under the segments discussed below:

Net sales of Government Services Group were $329.7 million, up 8.7% year over year. The improvement was driven by healthy growth in broad-based environmental and water programs, partially offset by a decline in disaster response business.

Revenues from Commercial / International Services Group totaled $284.3 million, reflecting year-over-year growth of 13.9%. Results were driven by healthy growth in environmental consulting in the U.K. and the strengthening of renewable energy sales in North America.

Operating Margin

In the reported quarter, Tetra Tech’s subcontractor costs totaled $183.6 million, reflecting growth of 11.9% from the year-ago quarter. Other costs of revenues were $504.3 million, up 10.9% year over year. Selling, general and administrative expenses were $46.4 million, up 8.1% year over year.

Adjusted operating income in the reported quarter grew 12.2% year over year to $62.5 million, while adjusted margin increased 10 basis points year over year to 10.2%.

Balance Sheet and Cash Flow

Exiting the fiscal first quarter, Tetra Tech had cash and cash equivalents of $110.8 million, down 8.2% from $120.7 million recorded at the end of the last reported quarter. Long-term debt was up 22.2% sequentially to $322.5 million.

In the fiscal first quarter, the company generated net cash of $18 million from operating activities, 17.8% above the prior-year quarter. Capital expenditure was $3.3 million, down 13.5% year over year.

Shareholder-Friendly Policy

During the quarter, the company bought back shares worth $21.2 million and distributed dividends totaling $8.2 million.

A couple of days before the earnings release, the company’s board of directors approved a quarterly dividend payout of 15 cents per share to shareholders of record as of Feb 12. The payment will be made on Feb 28.

Moreover, the company’s board of directors approved a new $200-million share buyback program. Additionally, it has $104-million authorization left under the previous buyback program.

Outlook

For fiscal 2020 (ending September 2020), Tetra Tech anticipates sales from U.S. Federal clients to increase 5-10%, driven by growth in the U.S. Federal budget. It expects sales from U.S. Commercial clients to grow 3-8% on gains from sustainable buildings and environmental services.

Also, it anticipates U.S. State and Local sales to increase 10-15% on strengthening disaster recovery and municipal water infrastructure businesses. It expects International sales growth of 7-12%, driven by environmental and infrastructure programs.

For fiscal 2020, the company anticipates net revenues of $2.4-$2.6 billion, while adjusted earnings are predicted to be $3.40-$3.55, revised from $3.35-$3.55 per share mentioned earlier. For the fiscal year, it expects effective tax rate of 23%.

For the fiscal second quarter (ending March 2020), the company anticipates net revenues of $580-$630 million and earnings per share of 73-78 cents.

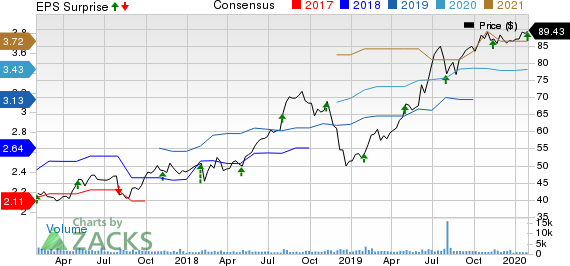

Tetra Tech, Inc. Price, Consensus and EPS Surprise

Tetra Tech, Inc. price-consensus-eps-surprise-chart | Tetra Tech, Inc. Quote

Zacks Rank & Stocks to Consider

With a market capitalization of $4.9 billion, Tetra Tech currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Zacks Industrial Products sector are SPX FLOW, Inc. FLOW, Barnes Group, Inc. B and Tennant Company TNC. While SPX FLOW currently sports a Zacks Rank #1 (Strong Buy), Barnes and Tennant carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, earnings estimates for these companies have improved for the current year. Further, positive earnings surprise for the last four quarters, on average, was 6.95% for SPX FLOW, 4.21% for Barnes and 28.65% for Tennant.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SPX FLOW, Inc. (FLOW) : Free Stock Analysis Report

Barnes Group, Inc. (B) : Free Stock Analysis Report

Tennant Company (TNC) : Free Stock Analysis Report

Tetra Tech, Inc. (TTEK) : Free Stock Analysis Report

To read this article on Zacks.com click here.