TEVA Misses on Q3 Earnings, Cuts 2022 Sales View, Stock Down

Teva Pharmaceutical Industries Limited TEVA reported third-quarter 2022 adjusted earnings of 59 cents per share, which missed the Zacks Consensus Estimate of 61 cents. Earnings were flat year over year as lower revenues were offset by lower costs.

Revenues for the third quarter came in at $3.6 billion, which also missed the consensus estimate of $3.86 billion as well as our estimate of $3.87 billion. Total revenues declined 8% on a reported basis due to currency headwinds. Revenues were hurt by currency changes due to the appreciation of the U.S. dollar as around 47% of Teva’s revenues come from sales denominated in currencies other than the U.S. dollar.

On a constant-currency basis, sales declined 2%.

Segment Discussion

The company reports through the following segments based on three regions — North America (comprising the United States and Canada), Europe and International markets.

North America segment sales were $1.81 billion, down 4% year over year due to lower sales of Copaxone, Bendeka/Treanda as well as generic products. In the United States, sales declined 4% from the prior-year quarter to $1.69 billion. Revenues in the North America segment missed our estimates of $1.88 billion.

Copaxone posted sales of $105 million in North America, down 21% year over year due to generic erosion in the United States and lower market share due to increased competition.

Combined sales of Bendeka and Treanda declined 20% from the year-ago quarter to $77 million. Sales of Bendeka and Treanda were hurt due to the availability of alternative therapies and continued competitive pressure.

Austedo recorded sales of $260 million in North America, up 30% year over year due to volume growth as prescription trends continue to grow.

Ajovy, Teva’s migraine treatment, recorded sales of $57 million for the quarter, up 23% year over year, driven by higher volumes.

Generic/biosimilar product revenues declined 6% from the year-ago period to $806 million in the North America segment due to increased competition. The North America Generic revenues were less than our estimates of $902 million.

Distribution revenues, generated by Anda, rose 2% year over year for the quarter to $371 million due to higher demand.

The Europe segment recorded revenues of $1.07 billion, down 12% year over year on a reported basis due to currency headwinds. Sales rose 1% in constant currency, driven by higher demand for generic and OTC products and higher sales of new generic products.

In the International Markets segment, sales declined 10% year over year to $475 million. In constant currency terms, sales declined 3% from a year ago due to the recognition of a $35 million milestone payment received from partner Otsuka in Japan in the year-ago quarter.

The Other segment (comprising the API manufacturing business and certain contract manufacturing services) recorded revenues of $241 million, down 8% year over year on a reported basis and 3% in constant currency terms.

Costs Discussion

Adjusted gross margin declined 60 basis points (bps) to 53% for the quarter.

Adjusted research & development expenses declined 21.1% year over year to $171 million due to a decline in the neuroscience, immunology and generic area and an accounting adjustment related to a contract with an R&D partner, which offset higher costs related to biosimilar pipeline candidate projects. Selling and marketing expenditure declined 10% from the year-ago level to $510 million. General and administrative expenses declined 9% from the prior-year level to $250 million.

Adjusted operating income declined 6% year over year in the quarter to $977 million due to lower gross profit. The adjusted operating margin rose 40 bps to 27.2% in the quarter.

2022 Guidance Lowered

Teva lowered its revenue guidance from a range of $15.0 billion - $15.6 billion to $14.8 billion - $15.4 billion, mainly due to currency headwinds.

Sales of Copaxone in all regions are expected to be approximately $700 million (same as before).

Teva maintained its Ajovy and Austedo revenue guidance of approximately $400 million and approximately $1.0 billion, respectively.

Adjusted earnings guidance was maintained the range of $2.40-$2.60 per share. Adjusted operating income is still expected in the range of $4.2-$4.5 billion.

The adjusted tax rate is expected to be in the range of 12% to 14% compared with 13% to 14% guided previously.

Free cash flow is expected to be in the range of $1.9-$2.2 billion (maintained).

Our Take

For the third quarter, Teva missed estimates for earnings as well as sales. It also lowered its total revenue guidance for the third time this year. Teva’s shares were down 1.7% on Nov 3 due to the dismal earnings performance and the guidance cut.

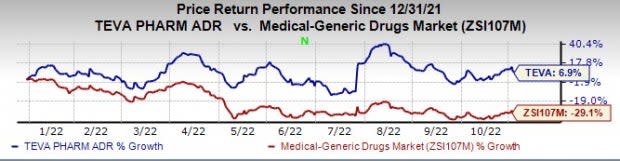

Teva’s share price has risen 6.9% this year so far against the industry’s 29.1% decline.

Image Source: Zacks Investment Research

Teva is seeing continued growth of Austedo prescriptions and market share growth for key growth driver, Ajovy. Revenues of generic products are improving in some countries like Europe and International markets. However, a strong foreign exchange headwind is hurting the top line

In July, Teva reached a $4.25 billion nationwide settlement in principle to resolve most of its opioid-related litigation. However, the agreement is pending participation by states and subdivisions. The required number of states and local governments need to agree to deal terms before the settlement can be finalized. Teva is optimistic that it will see a high participation rate in this nationwide settlement to fully resolve the lawsuits. Also, along with the earnings release, Teva announced that it has reached a settlement with the state of New York, which ends the opioid litigation in the state.

The nationwide settlement for the costly opioid litigations removes a significant overhang for Teva. The company had been pursuing settlement talks for more than two years to resolve the lawsuits.

Zacks Rank & Stock to Consider

Teva currently has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Teva Pharmaceutical Industries Ltd. Price, Consensus and EPS Surprise

Teva Pharmaceutical Industries Ltd. price-consensus-eps-surprise-chart | Teva Pharmaceutical Industries Ltd. Quote

Some better-ranked generic/biotech stocks are Dr. Reddy's Laboratories Limited RDY, Vertex Pharmaceuticals Incorporated VRTX and Gilead Sciences GILD, each of which carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Estimates for Dr. Reddy's earnings per share have risen from $2.65 to $3.09 for fiscal 2023 and from $3.03 to $3.47 for fiscal 2024 in the past 60 days. Shares of Dr. Reddy's have plunged 14.6% in the year-to-date period.

In the last reported quarter, Dr. Reddy's delivered an earnings surprise of 38.98%.

Vertex’s stock has risen 34.4% this year so far. While Vertex’s earnings estimates for 2022 have risen from $14.21 to $14.61 per share in the past 60 days, estimates for 2023 have increased from $15.12 to $15.60 per share during the same period.

Vertex beat earnings estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 3.16%. In the last reported quarter, VRTX delivered an earnings surprise of 8.67%.

Gilead’s stock has risen 9.5% this year so far. While Gilead’s earnings estimates for 2022 have risen from $6.61 to $7.02 per share in the past 60 days, estimates for 2023 have increased from $6.32 to $6.79 per share during the same period.

Gilead beat earnings estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 0.36%. In the last reported quarter, GILD delivered an earnings surprise of 31.94%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dr. Reddy's Laboratories Ltd (RDY) : Free Stock Analysis Report

Teva Pharmaceutical Industries Ltd. (TEVA) : Free Stock Analysis Report

Gilead Sciences, Inc. (GILD) : Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research