Texas Capital Bancshares Inc (TCBI): Hedge Funds Heading For The Exits

The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We at Insider Monkey have plowed through 821 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds' and investors' portfolio positions as of March 31st, a week after the market trough. In this article we look at what those investors think of Texas Capital Bancshares Inc (NASDAQ:TCBI).

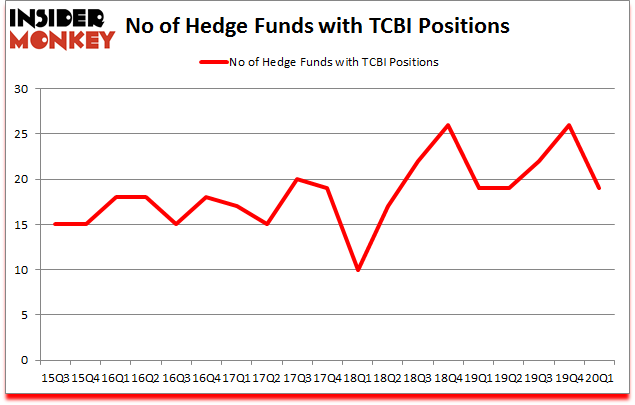

Texas Capital Bancshares Inc (NASDAQ:TCBI) was in 19 hedge funds' portfolios at the end of the first quarter of 2020. TCBI investors should be aware of a decrease in activity from the world's largest hedge funds in recent months. There were 26 hedge funds in our database with TCBI positions at the end of the previous quarter. Our calculations also showed that TCBI isn't among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

Today there are a lot of signals investors employ to size up publicly traded companies. A pair of the most under-the-radar signals are hedge fund and insider trading interest. We have shown that, historically, those who follow the top picks of the elite hedge fund managers can beat the market by a very impressive amount (see the details here).

[caption id="attachment_30621" align="aligncenter" width="400"]

Cliff Asness of AQR Capital Management[/caption]

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We interview hedge fund managers and ask them about their best ideas. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind let's review the key hedge fund action regarding Texas Capital Bancshares Inc (NASDAQ:TCBI).

How have hedgies been trading Texas Capital Bancshares Inc (NASDAQ:TCBI)?

At the end of the first quarter, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -27% from the previous quarter. The graph below displays the number of hedge funds with bullish position in TCBI over the last 18 quarters. So, let's examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, D E Shaw was the largest shareholder of Texas Capital Bancshares Inc (NASDAQ:TCBI), with a stake worth $15 million reported as of the end of September. Trailing D E Shaw was Alpine Associates, which amassed a stake valued at $9.4 million. Renaissance Technologies, Fisher Asset Management, and Arrowstreet Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Spindletop Capital allocated the biggest weight to Texas Capital Bancshares Inc (NASDAQ:TCBI), around 0.61% of its 13F portfolio. Alpine Associates is also relatively very bullish on the stock, dishing out 0.38 percent of its 13F equity portfolio to TCBI.

Since Texas Capital Bancshares Inc (NASDAQ:TCBI) has faced falling interest from the aggregate hedge fund industry, it's easy to see that there is a sect of hedgies who sold off their positions entirely in the first quarter. It's worth mentioning that Ken Griffin's Citadel Investment Group dropped the biggest investment of all the hedgies monitored by Insider Monkey, comprising about $65.3 million in stock. Andrew Kurita's fund, Kettle Hill Capital Management, also dropped its stock, about $18.4 million worth. These transactions are intriguing to say the least, as total hedge fund interest was cut by 7 funds in the first quarter.

Let's now take a look at hedge fund activity in other stocks - not necessarily in the same industry as Texas Capital Bancshares Inc (NASDAQ:TCBI) but similarly valued. We will take a look at Scorpio Tankers Inc. (NYSE:STNG), Flagstar Bancorp Inc (NYSE:FBC), Covanta Holding Corporation (NYSE:CVA), and Pacific Premier Bancorp, Inc. (NASDAQ:PPBI). All of these stocks' market caps are similar to TCBI's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position STNG,25,87700,-8 FBC,15,66195,-5 CVA,25,55880,6 PPBI,8,30230,-4 Average,18.25,60001,-2.75 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.25 hedge funds with bullish positions and the average amount invested in these stocks was $60 million. That figure was $52 million in TCBI's case. Scorpio Tankers Inc. (NYSE:STNG) is the most popular stock in this table. On the other hand Pacific Premier Bancorp, Inc. (NASDAQ:PPBI) is the least popular one with only 8 bullish hedge fund positions. Texas Capital Bancshares Inc (NASDAQ:TCBI) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 13.4% in 2020 through June 22nd but still beat the market by 15.9 percentage points. Hedge funds were also right about betting on TCBI as the stock returned 50.9% in Q2 (through June 22nd) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

[company-follow-email id=1077428][/company-follow-email]

Disclosure: None. This article was originally published at Insider Monkey.

Related Content