Textron (TXT) Q3 Earnings Beat Estimates, Revenues Rise Y/Y

Textron Inc. TXT reported third-quarter 2022 earnings of $1.06 per share, which surpassed the Zacks Consensus Estimate of 94 cents by 12.8%. The bottom line also improved by 24.7% from the year-ago quarter’s figure.

Revenues

Total revenues came in at $3,078 million, which missed the Zacks Consensus Estimate of $3,207.6 million by 4%. However, the reported figure increased 2.9% from the year-ago quarter’s $2,990 million.

Manufacturing revenues improved by 2.9% in the third quarter to $3,067 million, while revenues in the Finance division remained flat at $11 million.

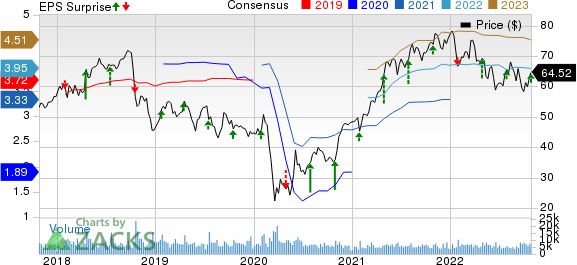

Textron Inc. Price, Consensus and EPS Surprise

Textron Inc. price-consensus-eps-surprise-chart | Textron Inc. Quote

Segmental Performance

Textron Aviation: In the quarter under review, revenues in this segment decreased 1.2% year over year to $1,167 million. The decrease was primarily due to the lower Citation jet and pre-owned volume.

The company delivered 39 jets, down from 49 in the year-ago quarter. It also delivered 33 commercial turboprops, down from 35 in the third quarter of 2021.

The segment generated an operating profit of $139 million in the quarter compared with the $98 million earned in the year-ago quarter due to a higher volume and a favorable pricing impact.

The order backlog at the end of the quarter was $6.4 billion.

Bell: Revenues in this segment declined 1.9% to $754 million. Lower revenues were mainly due to lower military revenues.

The segment delivered 49 commercial helicopters in the quarter, up from 33 last year.

The segment’s profit was down 19% to $85 million due to a lower volume and mix. Bell’s order backlog at the end of the quarter was $4.9 billion, down sequentially from $5.3 billion.

Textron Systems: Revenues in this segment came in at $292 million, down 2.3% from the year-ago period. The deterioration can be attributed to lower volumes.

Segmental profits declined 17.8% year over year to $37 million in the third quarter due to a lower volume and mix.

Textron Systems’ backlog at the end of the third quarter was $2 billion.

Industrial: Revenues in this segment improved by 16.3% to $849 million due to a favorable pricing impact as well as a higher volume and mix, primarily on the Specialized Vehicle product line.

Moreover, the segment’s profit was $39 million compared with $23 million in the previous-year quarter. The improvement can be attributed to a higher volume and mix.

Finance: Revenues in this segment remained flat at $11 million compared with the year-ago quarter. The profit came in at $7 million in the third quarter compared with $8 million in the year-ago period.

Financials

As of Oct 1, 2022, cash and cash equivalents totaled $1,817 million compared with $1,922 million as of Jan 1, 2022.

Cash flow from operating activities amounted to $356 million as of Oct 1, 2022 compared with $333 million in the year-ago period.

Capital expenditures were $78 million in the third quarter of 2022 compared with the $76 million recorded in the third quarter of 2021.

The long-term debt was $3,176 million as of Oct 1, 2022 compared with $3,179 million as of Jan 1, 2022.

Zacks Rank

Textron currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Defense Releases

Lockheed Martin Corporation LMT reported third-quarter 2022 adjusted earnings of $6.87 per share, which surpassed the Zacks Consensus Estimate of $6.58 by 4.4%. The bottom line also improved by 4.1% year over year.

Lockheed Martin’s net sales amounted to $16.58 billion, which rose 3.5% from the year-ago quarter. LMT ended the third quarter of 2022 (on Sep 25, 2022) with $139.71 billion in the backlog compared with $134.64 billion at the end of the second quarter of 2022.

Raytheon Technologies Corporation’s RTX third-quarter 2022 adjusted earnings per share of $1.21 beat the Zacks Consensus Estimate of $1.11 by 9%. However, the bottom line dropped 4% from the year-ago quarter’s adjusted earnings of $1.26.

Raytheon Technologies’ third-quarter sales of $16,951 million missed the Zacks Consensus Estimate of $17,003 million by 0.3%. However, the sales figure rose 5% from the $16,213 million recorded in the year-ago quarter.

Hexcel Corporation HXL reported third-quarter 2022 adjusted earnings of 33 cents per share, which exceeded the Zacks Consensus Estimate of 32 cents by 3.1%. The bottom line improved massively from the year-ago earnings of 8 cents per share, reflecting growth of a solid 153.8%.

Hexcel’s net sales totaled $364.7 million in the third quarter, which lagged the Zacks Consensus Estimate of $391 million by 6.8%. However, the top line witnessed an improvement of 9.3% from the year-ago quarter’s $333.8 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Textron Inc. (TXT) : Free Stock Analysis Report

Hexcel Corporation (HXL) : Free Stock Analysis Report

Raytheon Technologies Corporation (RTX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research