Is Theralase Technologies's (CVE:TLT) 132% Share Price Increase Well Justified?

When you buy shares in a company, there is always a risk that the price drops to zero. But if you pick the right stock, you can make a lot more than 100%. For example, the Theralase Technologies Inc. (CVE:TLT) share price had more than doubled in just one year - up 132%. It's also good to see the share price up 70% over the last quarter. Also impressive, the stock is up 40% over three years, making long term shareholders happy, too.

View our latest analysis for Theralase Technologies

Theralase Technologies isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year Theralase Technologies saw its revenue grow by 9.6%. That's not a very high growth rate considering it doesn't make profits. In contrast, the share price took off during the year, gaining 132%. The business will need a lot more growth to justify that increase. It's quite likely that the market is considering other factors, not just revenue growth.

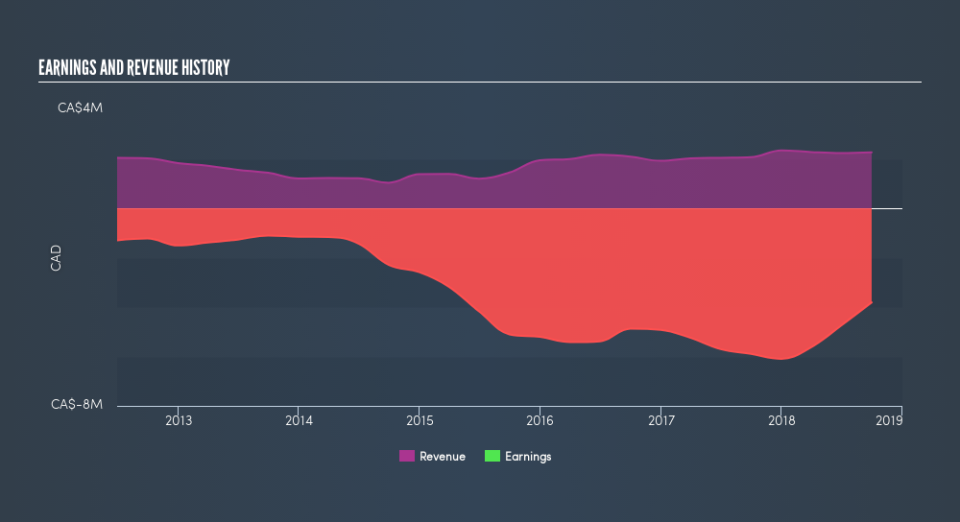

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think Theralase Technologies will earn in the future (free profit forecasts)

A Different Perspective

It's nice to see that Theralase Technologies shareholders have received a total shareholder return of 132% over the last year. That gain is better than the annual TSR over five years, which is 10%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

Theralase Technologies is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.