Theravance, Mylan Report Positive Data on COPD Drug Yupelri

Theravance Biopharma, Inc. TBPH and partner Mylan N.V. MYL announced positive new data from the phase III program on Yupelri (revefenacin) inhalation solution at the European Respiratory Society (ERS) International Congress 2018 in Paris.

The phase III program on Yupelri comprised three trials. Data from the trials showed that treatment with Yupelri for up to 52 weeks resulted in reduction in the rates of chronic obstructive pulmonary disease (COPD) exacerbations ranging from 15% to 18% in moderate to very severe COPD patients as compared to placebo and Spiriva HandiHaler.

The pooled data from the two replicate 12-week pivotal phase III efficacy trials demonstrated that the mean annualized rate of all COPD exacerbations was 0.47 for Yupelri dosed at 175 mcg/day and 0.45 for Yupelri dosed at 88 mcg/day. Data from the 12-month phase III safety trial demonstrated that the estimated annualized rate of all COPD exacerbations was 0.38 for Yupelri dosed at 175 mcg/day and 0.57 for Yupelri dosed at 88 mcg/day compared to 0.46 for Spiriva HandiHaler dosed at 18 mcg/day.

The researchers were interested in a post-hoc analysis of data from the studies to identify trends in this area.

We remind investors that Yupelri, an investigational long-acting muscarinic antagonist (LAMA), is currently under review by the FDA for the treatment of COPD. The FDA has set an action date of Nov 13, 2018.

Per the company, upon approval, Yupelri would be the first once-daily, long-acting nebulized bronchodilator for the treatment of COPD.

Both the companies had previously reported that Yupelri demonstrated statistically significant and clinically meaningful improvements as compared to placebo in trough forced expiratory volume in one second (FEV1) and in overall treatment effect on trough FEV1 (OTE FEV1), after 12 weeks of dosing in two replicate pivotal phase III efficacy studies. Additionally, the companies completed a 12-month phase III safety study, in which no new safety issues were identified.

Theravance and Mylan have entered into a strategic collaboration to develop and commercialize nebulized revefenacin products for COPD and other respiratory diseases. Per the terms, Theravance is conducting the development program for the revefenacin inhalation solution product in the United States, with all costs related to the registrational program reimbursed by Mylan, up until the approval of the first new drug application, after which costs will be shared.

On the other hand, Mylan is responsible for ex-US development and commercialization. Theravance is entitled to receive up to $220 million in development and sales milestone payments as well as a profit-sharing arrangement with Mylan on sales in the United States and double-digit royalties on ex-US sales.

Additionally, Theravance retains worldwide rights to revefenacin delivered through other dosage forms, such as a metered dose inhaler or dry powder inhaler (MDI/DPI) and the rights to nebulized revefenacin in China.

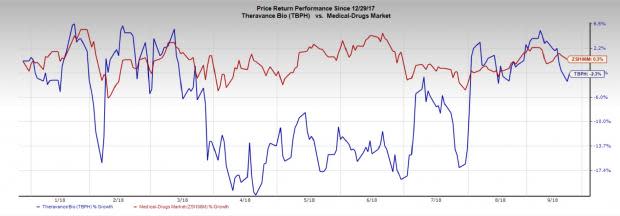

Theravance’s stock has decreased 2.3% so far this year, lagging the industry’s gain of 0.3%.

A tentative approval of Yupelri will boost Theravance’s growth prospects and reduce its dependence on its sole marketed product, Vibativ.

Glaxo’s GSK once-daily, single inhaler triple combination therapy, Trelegy Elipta is also approved for the long-term, once-daily, maintenance treatment of COPD patients.

Zacks Rank & Key Pick

Theravance Biopharma carries a Zacks Rank #3 (Hold). A better-ranked stock in the healthcare sector is Gilead Sciences Inc. GILD which sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Gilead’s earnings per share estimates have increased from $6.15 to $6.58 for 2018 and from $6.33 to $6.48 for 2019 over the past 60 days. The company delivered a positive earnings surprise in three of the trailing four quarters with an average beat of 6.43%.

5 Companies Verge on Apple-Like Run

Did you miss Apple's 9X stock explosion after they launched their iPhone in 2007? Now 2018 looks to be a pivotal year to get in on another emerging technology expected to rock the market. Demand could soar from almost nothing to $42 billion by 2025.

Reports suggest it could save 10 million lives per decade which could in turn save $200 billion in U.S. healthcare costs. A bonus Zacks Special Report names this breakthrough and the 5 best stocks to exploit it. Like Apple in 2007, these companies are already strong and coiling for potential mega-gains.

Click to see them right now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GlaxoSmithKline plc (GSK) : Free Stock Analysis Report

Gilead Sciences, Inc. (GILD) : Free Stock Analysis Report

Theravance Biopharma, Inc. (TBPH) : Free Stock Analysis Report

Mylan N.V. (MYL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research