Thermo Fisher: A High Growth Health Care Name

Thermo Fisher Scientific Inc. (NYSE:TMO) is a leading life sciences, diagnostics and laboratory products company. The company has worked to become customers' go-to name for life science products and consumables. This has been accomplished through organic growth as well as acquisitions. This strategy has been incredibly successful, and Thermo Fishers business has flourished. While it has benefitted from the Covid-19 pandemic, its core business has also continued to grow.

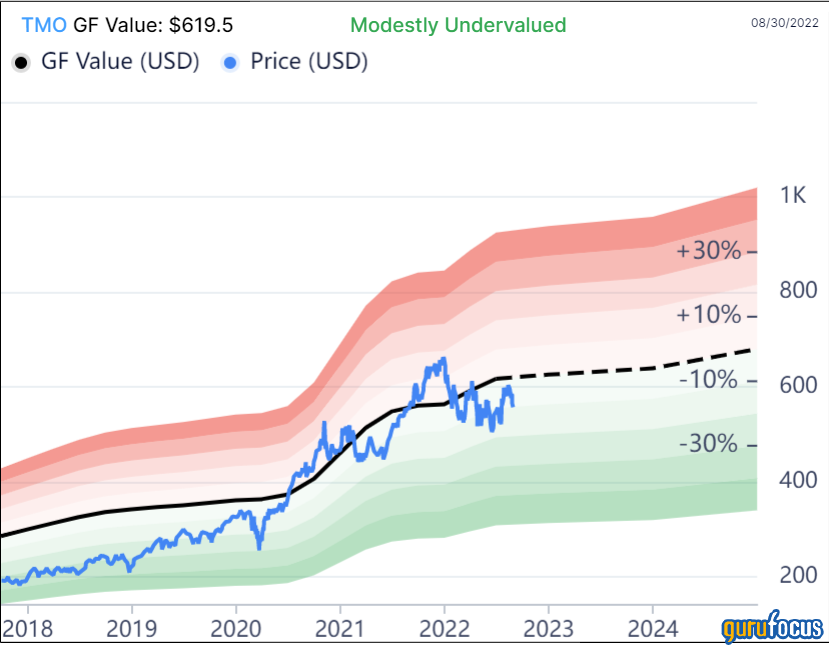

Despite its market leadership and growth, Thermo Fisher is currently trading at a double-digit discount to its GF Value, which could provide an opportunity for those interested in the stock.

Company background and recent earnings highlights

Thermo Fisher operates a fairly diverse business. The company is composed of four segments: Laboratory Products and Biopharma Services, Life Science Solutions, Analytical Instruments and Specialty Diagnostics. Laboratory Products and Biopharma Services contribute about half of revenues, but Life Sciences Solutions account for 40% of operating income. Thermo Fisher generated revenue of $39 billion in 2021 and is presently valued at close to $217 billion.

Shares of the company are flat over the last six months, but this has to more to do with general market sentiment then anything related to Thermo Fisher. The company has produced multiple excellent quarters in a row.

Most recently, Thermo Fisher reported second-quarter earnings results on July 28. Revenue grew 18.3% year-over-year to just under $11 billion, but came in an impressive $1 billion better than expected by Wall Street analysts. Core organic revenue growth was 13% for the quarter. Adjusted earnings per share of $5.51 was down slightly from $5.60 in the prior-year period, but was still above estimates by 53 cents.

By segment, Laboratory Products and Biopharma grew 55% to $5.5 billion, while Analytical Instruments improved 8.5% to $1.6 billion. Growth in the former was driven by acquisitions and gains in research, safety and laboratory products while the latter benefited from strength in areas such as electron microscopy, mass spectrometry and chromatography.

Life Science Solutions declined 7.5% to $3.3 billion, mostly due to weaker testing revenue. This was partially offset by the bioproduction business. Specialty Diagnostics was lower by almost 11% to $1.1 billion on lower Covid-19-related revenue.

Following second-quarter results, leadership provided revised guidance for 2022. The company is now expecting to produce revenue of $43.15 billion, compared to $42.45 billion previously. Adjusted earnings per share is now projected to be $22.93, up from $22.65.

Takeaways

Thermo Fisher has strung together an envious streak of quarterly results over the past few years. Revenue results have topped estimates by at least $1 billion in four out of the last seven quarters and by at least $500 million in seven out of the last eight quarters.

Undoubtedly, Covid-19 was a major tailwind to results. The company was one of the first to bring a reliable Covid test to the market, giving Thermo Fisher a first mover advantage in this area. Contributions from this business will be less significant going forward as the virus becomes less of a concern.

The good news is that Covid-19 revenue wasnt as steep of a drop off as some analysts had expected in the most recent quarter. Management even explicitly stated on the conference call that the reason they were lifting guidance was because testing for the virus wasnt declining as fast as they had anticipated, as Covid is here to stay.

An expected obstacle that turned out to not be an obstacle at all for Thermo Fisher was China, which continued Covid lockdowns in the quarter in order to control the spread of the virus. The company had initially thought that the lockdowns would reduce results by $200 million, but China turned out to contribute that amount to the beat of guidance. In local currency, China sales were up 20% year-over-year, a marked accomplishment given the strictness of lockdowns.

Eventually, Covid-19 will be a much small contributor to Thermo Fisher, but the company was still producing robust results prior to the appearance of the virus. For the 2010 to 2019 time period, Thermo Fisher grew earnings per share at a compound annual growth rate of 12% and revenue by a 10% CAGR, according to Value Line.

Besides growing organically, Thermo Fisher has spent a tremendous amount of capital to make acquisitions. The last decade has seen $50 billion deployed to add to the existing company. This includes the $17.4 billion that Thermo Fisher paid for PPD Inc., which is a leading provider of clinical research services to the biopharma and biotech industries, in late 2021. PPD, which is housed in Laboratory Products and Biopharma Services, added $1.72 billion to results and outpaced its segments growth rate.

Valuation and dividend analysis

Thermo Fisher is seeing its business grow at a fast pace, even with pandemic-related revenue beginning to subside.

At the same time, shares of the company look undervalued when consulting the GF Value chart.

With a current share price of $551.45 and a GF Value of $619.50, Thermo Fisher has a price-to-GF-Value ratio of 0.89. Reaching the GF Value could result in a gain of 12.3% from current levels. Shares are rated as modestly undervalued by GuruFocus.

This doesnt include the stocks dividend, which is on the low end at just 0.2% at the moment. The small yield isnt for a lack of growth as the dividend has a compound annual growth rate of 11.5% over the last decade. Thermo Fisher raised its dividend 15.4% for the April 14 payment. With a projected payout ratio of just 5% for the year, the company has an immense amount of room to continue to grow its dividend if it chooses.

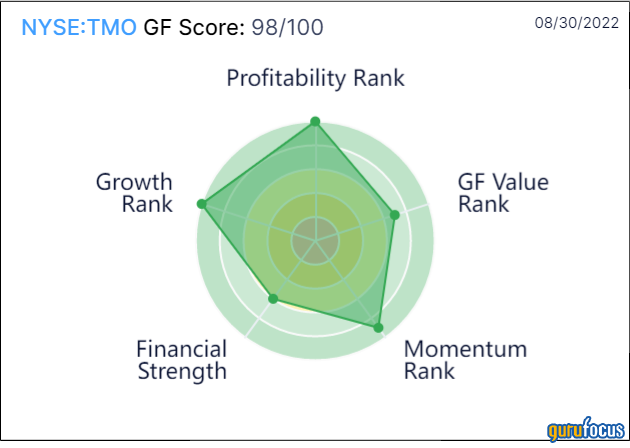

Thermo Fisher also has one of the highest GF Scores in the market at 98 out of 100, powered by a perfect 10 out of 10 for profitability and growth and a 9 out of 10 for momentum.

Final thoughts

Thermo Fisher continues to enjoy strong results even as Covid-19 revenue continues to fall. The companys core businesses are performing fairly well, boosted by timely acquisitions that are paying off. Thermo Fisher rates very highly in a number of areas, leading to one of the highest GF Scores in the market. The stock is also trading a double-digit discount to its GF Value.

This article first appeared on GuruFocus.