Thermo Fisher (TMO) Q1 Earnings Beat Estimates, '18 View Up

Thermo Fisher Scientific Inc. TMO reported better-than-expected performance in first-quarter 2018. Adjusted EPS came in at $2.50, beating the Zacks Consensus Estimate by 3.3% and the year-ago quarter figure by 20.2%. On a reported basis, the EPS of $1.43 marked a 2% increase year over year.

Revenues in the quarter logged $5.85 billion, up 22.6% year over year. The top line also outpaced the Zacks Consensus Estimate of $5.63 billion.

Quarter in Detail

Organic revenues in the reported quarter grew 7% year over year while acquisitions increased revenues by 12%. Currency translation positively impacted total revenues by 4%.

Thermo Fisher operates under four business segments: Life Sciences Solutions, Analytical Instruments, Specialty Diagnostics and Laboratory Products and Services.

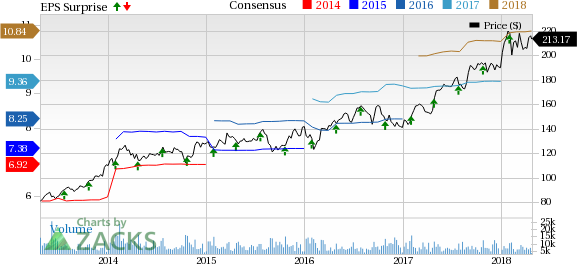

Thermo Fisher Scientific Inc. Price, Consensus and EPS Surprise

Thermo Fisher Scientific Inc. Price, Consensus and EPS Surprise | Thermo Fisher Scientific Inc. Quote

Revenues at the Life Sciences Solutions segment (25.6% of total revenues) improved 10% year over year to $1.50 billion while Analytical Instruments Segment sales (21.5%) rose 19% to $1.26 billion.

Revenues at the Laboratory Products and Services segment (41.2%) surged 42% to $2.41 billion, reflecting the buyout of Patheon in August 2017. The Specialty Diagnostics segment (16.2%) recorded a 9% rise to $0.95 billion.

Gross margin of 46.3% during the first quarter was down 238 basis points (bps) year over year despite a 16.8% improvement in gross profits. Adjusted operating margin however, expanded 55 bps to 21.8% on a 25.9% rise in operating profit.

The company exited the first quarter of 2018 with cash and cash equivalents of $950 million compared with $1.34 billion at the end of 2017. As of Mar 31, 2018, net cash provided by operating activities was $78 million compared with $361 million in the year-ago period.

2018 Guidance

Based on a solid first-quarter performance, a more significant impact from acquisitions and a more favorable foreign exchange environment,Thermo Fisher has raised its 2018 revenue and earnings guidance. Revenues are expected in the range of $23.62-$23.86 billion (compared with the company’s earlier projected band of $23.42-$23.72 billion) enhancing 13-14% revenue growth from the year-ago period. The Zacks Consensus Estimate of $23.59 billion remains below the guided range.

Adjusted EPS view has been lifted to a new range of $10.80-$10.96 (compared with the previous forecast of $10.68-$10.88), reflecting 14-15% growth from the year-earlier period. The Zacks Consensus Estimate of $10.84 per share falls below the company’s prediction.

Bottom Line

Thermo Fisher ended the first quarter on a promising note with both adjusted earnings and revenues surpassing the consensus mark.

We are encouraged by the company’s solid international performance with strong year-over-year growth in the emerging markets of China, South Korea and India.

Also, a series of product launches along with major progress in precision medicine initiatives aided the company’s performance. In the quarter under review, the company has launched Vanquish Duo UHPLC systems for pharma QA/QC, the Chromeleon XTR Laboratory Management System and the Ion GeneStudio S5 Series of next-generation sequencing instruments.

Moreover, substantially adding an impetus to the company’s value proposition for biopharma customers, the Patheon buyout has already started to prove accretive to the company’s laboratory products and its services segment.

Zacks Rank & Key Picks

Thermo Fisher has a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader medical sector are Abaxis, Inc. ABAX, Bio-Rad Laboratories, Inc. BIO and ResMed Inc. RMD. While Abaxis and Bio-Rad sport a Zacks Rank #1 (Strong Buy), ResMed carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Abaxis is expected to release fourth-quarter fiscal 2018 results on Apr 26. The Zacks Consensus Estimate for adjusted EPS is 32 cents while for revenues, the same stands at $67 million.

Bio-Rad is expected to report first-quarter 2018 results on May 3. The Zacks Consensus Estimate for adjusted EPS is 90 cents and for revenues, $529.5 million.

ResMed is slated to release third-quarter fiscal 2018 results on Apr 26. The consensus mark for adjusted EPS is 83 cents and the same for revenues is pegged at $564.9 million.

Investor Alert: Breakthroughs Pending

A medical advance is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating substantial revenue, and even more wondrous products are in the pipeline.

Cures for a variety of deadly diseases are in sight, and so are big potential profits for early investors. Zacks names 5 stocks to buy now.

Click here to see them >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

Abaxis,Inc. (ABAX) : Free Stock Analysis Report

Bio-Rad Laboratories, Inc. (BIO) : Free Stock Analysis Report

To read this article on Zacks.com click here.