Things to Note Ahead of Helen of Troy's (HELE) Q3 Earnings

Helen of Troy Limited HELE is slated to report third-quarter fiscal 2020 results on Jan 8. This leading consumer products player delivered a positive earnings surprise of 13.7% in the last reported quarter. Further, its earnings have outperformed the Zacks Consensus Estimate by 12.9%, on average, in the trailing four quarters.

The Zacks Consensus Estimate for fiscal third-quarter earnings has been steady at $2.51 over the past 30 days. This suggests an increase of 4.6% from the year-ago period’s reported figure.

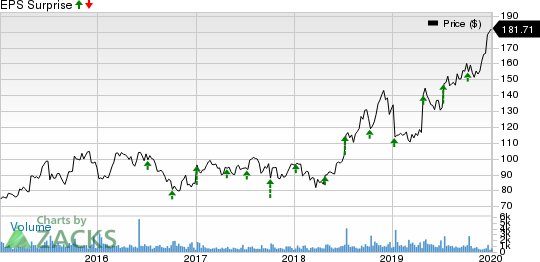

Helen of Troy Limited Price and EPS Surprise

Helen of Troy Limited price-eps-surprise | Helen of Troy Limited Quote

Key Factors to Note

Helen of Troy has long been benefiting from focus on Leadership Brands and strong digital endeavors. Notably, Leadership Brands account for a significant chunk of the company’s sales, with solid margins and volumes. Helen of Troy has been on track with investments in product launches, marketing efforts and e-commerce strategies for Leadership Brands, which have been delivering robust results. Further, the company has been gaining from its consistent online sales and digital marketing efforts. Management’s constant investments in this arena to keep pace with the evolving consumer environment bode well.

Out of the three segments, Helen of Troy’s Houseware unit has been doing particularly well. Net sales in the segment advanced 22.1% in the second quarter, backed by growth in point of sale, increased distribution with brick-and-mortar customers, higher online sales, and improved international sales and innovation. In its last earnings call, management raised its sales view for this unit, which is expected to see growth of 13-15% in fiscal 2020 (compared with 6-8% growth projected earlier). This gives out positive signals for the quarter under review as well.

On the contrary, the company’s Health & Home segment sales are expected to witness a low-single-digit decline in fiscal 2020 (against the previous expectation of 2-3% growth). Also, Helen of Troy has been facing escalated costs related to greater growth investments along with higher incentive compensation expenses, and freight and distribution costs.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Helen of Troy this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Although Helen of Troy carries a Zacks Rank #1, its Earnings ESP of 0.00% makes surprise prediction difficult.

Stocks With Favorable Combinations

Here are some companies you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat:

e.l.f. Beauty Inc. ELF currently has an Earnings ESP of +23.03% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Tyson Foods TSN currently has an Earnings ESP of +1.77% and a Zacks Rank #3.

Hain Celestial HAIN presently has an Earnings ESP of +6.67% and a Zacks Rank #3.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

e.l.f. Beauty Inc. (ELF) : Free Stock Analysis Report

Helen of Troy Limited (HELE) : Free Stock Analysis Report

Tyson Foods, Inc. (TSN) : Free Stock Analysis Report

The Hain Celestial Group, Inc. (HAIN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research