Things to Note as Guess? (GES) Lines Up for Q1 Earnings

Guess?, Inc. GES is likely to register growth in the top and the bottom line when it reports first-quarter fiscal 2023 earnings on May 25. The Zacks Consensus Estimate for revenues is pegged at $585.2 million, suggesting a rise of 12.5% from the prior-year quarter’s reported figure.

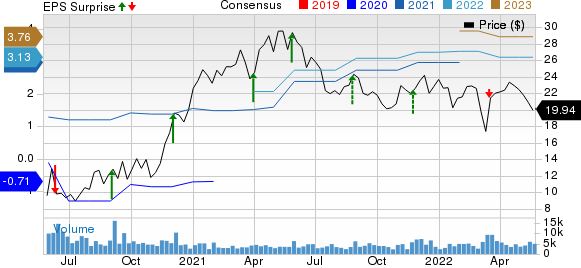

The Zacks Consensus Estimate for earnings has remained unchanged in the past 30 days at 29 cents per share, indicating growth of 38.1% from the figure reported in the prior-year period. Guess?, which designs, markets, distributes and licenses lifestyle collections of apparel and accessories, has a trailing four-quarter earnings surprise of 70%, on average. GES reported a negative earnings surprise of 0.9% in the last reported quarter.

Guess, Inc. Price, Consensus and EPS Surprise

Guess, Inc. price-consensus-eps-surprise-chart | Guess, Inc. Quote

Things To Note

In its last earnings call, management highlighted that Guess? expects revenues to be up in the low-teens year over year in the first quarter of fiscal 2023. The upside can be attributed to the year-ago period’s temporary store closures, wholesale growth and positive store comps.

Guess? has been benefiting from its focus on six key strategies. These include organization and culture, functional capacities, brand relevance with three main consumer groups (heritage, Millennials and Generation Z customers), customer focus, product brilliance and international footprint. The company’s solid digital business has been a driver. Guess? is on track to progress in its customer-centric initiatives, including omnichannel capabilities, advanced data analytics and customer segmentation. The persistence of these factors is likely to have been an upside to Guess?’s performance in the to-be-reported quarter.

Yet, management highlighted that it expects fiscal first-quarter gross margin to decline by roughly 70 basis points, owing to increased inbound freight and raw material costs. The company expects its operating margin to have been almost in line with the year-ago quarter’s levels.

What the Zacks Model Unveils

Our proven model doesn’t conclusively predict an earnings beat for Guess? this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Guess? currently carries a Zacks Rank #3 and has an Earnings ESP of 0.00%.

Stocks With a Favorable Combination

Here are some companies you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat:

Ralph Lauren Corporation RL currently has an Earnings ESP of +26.67% and a Zacks Rank of 3. RL is expected to register top-line growth when it reports fourth-quarter fiscal 2022 numbers. The Zacks Consensus Estimate for quarterly revenues is pegged at $1.45 billion, which indicates growth of 12.8% from the year-ago quarter’s reported figure. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Ralph Lauren’s fiscal fourth-quarter earnings is pegged at 30 cents per share, which suggests a decline of 21.1% from the year-ago quarter’s reported figure. RL delivered a trailing four-quarter earnings surprise of 94.1%, on average.

lululemon athletica LULU currently has an Earnings ESP of +0.18% and a Zacks Rank of 3. The company is expected to register top-and bottom-line growth when it reports first-quarter fiscal 2022 numbers. The Zacks Consensus Estimate for LULU’s quarterly revenues is pegged at $1.55 billion, suggesting growth of 26.1% from the prior-year quarter’s reported figure.

The Zacks Consensus Estimate for lululemon’s quarterly earnings has moved up by a penny in the past 30 days to $1.43 per share, suggesting 23.3% growth from the year-ago reported number. LULU has delivered a trailing four-quarter earnings surprise of 20.9%, on average.

Vail Resorts MTN currently has an Earnings ESP of +1.00% and a Zacks Rank #3. MTN is anticipated to register top and bottom-line growth when it reports the third-quarter fiscal 2022 results. The Zacks Consensus Estimate for Vail Resorts’ quarterly revenues is pegged at $1.15 billion, indicating an improvement of 29.7% from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for Vail Resorts’ bottom line has moved up 0.3% in the past 30 days to $9.13 per share. The consensus estimate suggests growth of 35.9% from the prior-year quarter’s levels. MTN has delivered a trailing four-quarter earnings surprise of 1.7%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

Guess, Inc. (GES) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

Vail Resorts, Inc. (MTN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research