We Think TopBuild (NYSE:BLD) Can Stay On Top Of Its Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, TopBuild Corp. (NYSE:BLD) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for TopBuild

How Much Debt Does TopBuild Carry?

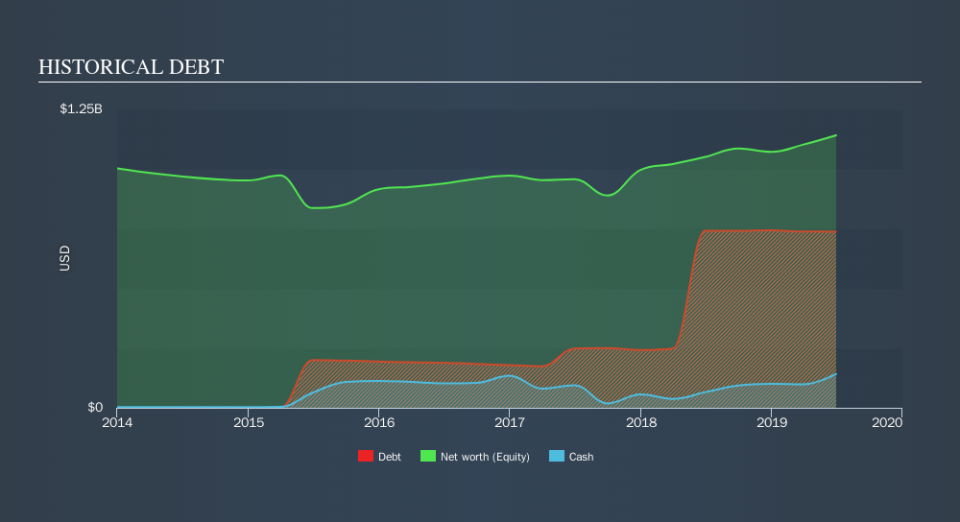

As you can see below, TopBuild had US$737.9m of debt, at June 2019, which is about the same the year before. You can click the chart for greater detail. However, because it has a cash reserve of US$141.8m, its net debt is less, at about US$596.1m.

A Look At TopBuild's Liabilities

According to the last reported balance sheet, TopBuild had liabilities of US$458.1m due within 12 months, and liabilities of US$981.4m due beyond 12 months. Offsetting these obligations, it had cash of US$141.8m as well as receivables valued at US$444.8m due within 12 months. So its liabilities total US$852.9m more than the combination of its cash and short-term receivables.

While this might seem like a lot, it is not so bad since TopBuild has a market capitalization of US$3.21b, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

With a debt to EBITDA ratio of 1.9, TopBuild uses debt artfully but responsibly. And the fact that its trailing twelve months of EBIT was 7.1 times its interest expenses harmonizes with that theme. Importantly, TopBuild grew its EBIT by 43% over the last twelve months, and that growth will make it easier to handle its debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if TopBuild can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, TopBuild produced sturdy free cash flow equating to 56% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

TopBuild's EBIT growth rate suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And its conversion of EBIT to free cash flow is good too. When we consider the range of factors above, it looks like TopBuild is pretty sensible with its use of debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. We'd be motivated to research the stock further if we found out that TopBuild insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.