Third Avenue Management Cuts Essex Property, Lennar

- By Tiziano Frateschi

Third Avenue Management (Trades, Portfolio) sold shares of the following stocks during the third quarter, which ended on Sept. 30.

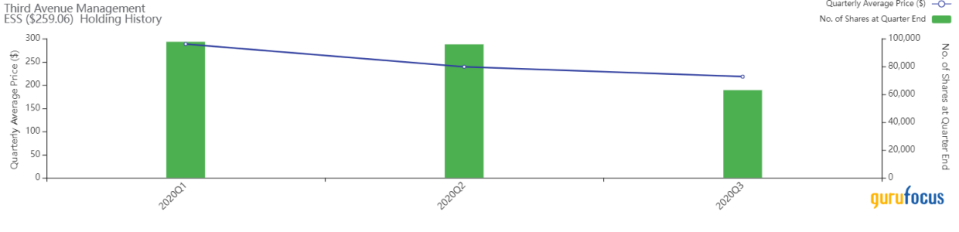

Essex Property

The firm reduced its stake in Essex Property Trust Inc. (ESS) by 34.3%. The trade had an impact of -1.06% on the portfolio.

The company has a market cap of $16.62 billion and an enterprise value of $22.93 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 9.73% and return on assets of 4.58% are outperforming 77% of companies in the REITs industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.08 is below the industry median of 0.09.

The company's largest guru shareholder is Pioneer Investments (Trades, Portfolio) with 0.65% of outstanding shares, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.50% and Chris Davis (Trades, Portfolio) with 0.11%.

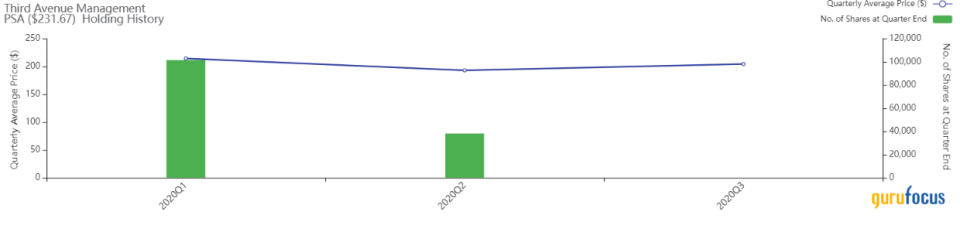

Public Storage

The Public Storage (PSA) position was closed, impacting the portfolio by -1.03%.

The company has a market cap of $40.92 billion and an enterprise value of $46 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 12.8% and return on assets of 11.93% are outperforming 89% of companies in the REITs industry. Its financial strength is rated 7 out of 10. The cash-debt ratio 0.12 is above the industry median of 0.08.

The largest guru shareholder of the company is Simons' firm with 0.69% of outstanding shares, followed by Diamond Hill Capital (Trades, Portfolio) with 0.44% and Pioneer Investments (Trades, Portfolio) with 0.12%.

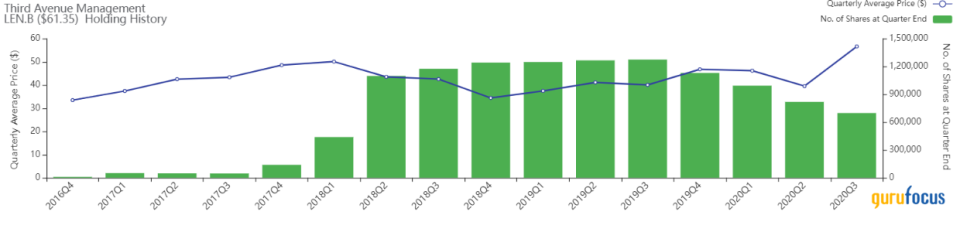

Lennar

The firm trimmed its position in Lennar Corp. (LEN.B) by 14.72%.The portfolio was impacted by -0.78%.

The U.S homebuilder has a market cap of $23.11 billion and an enterprise value of $29.09 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity 13.76% and return on assets of 7.7% are outperforming 67% of companies in the homebuilding and construction industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.28 is below the industry median of 0.48.

The largest guru shareholder is Mario Gabelli (Trades, Portfolio)'s GAMCO Investors with 0.26% of outstanding shares, followed by Third Avenue Management (Trades, Portfolio) with 0.22% and Third Avenue Value Fund (Trades, Portfolio) with 0.06%.

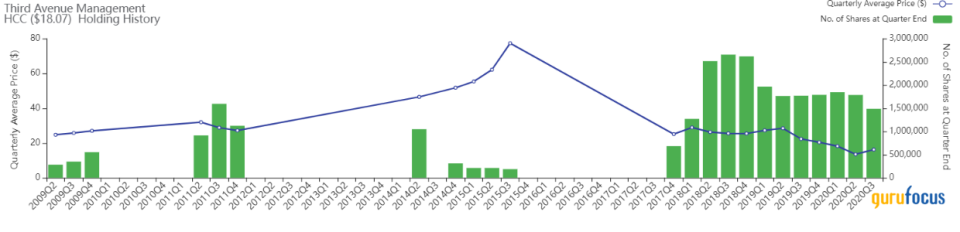

Warrior Met Coal

The firm reduced its Warrior Met Coal Inc. (HCC) holding by 16.61%, impacting the portfolio by -0.64%.

The U.S. company, which produces and exports met coal, has a market cap of $888 million and an enterprise value of $1.08 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. While the return on equity of 2.44% is underperforming the sector, return on assets of 1.35% is outperforming 77% of companies in the steel industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.54 is above the industry median of 0.4.

The largest guru shareholder of the company is Simons' firm with 3.96% of outstanding shares, followed by Third Avenue Management (Trades, Portfolio) with 2.91% and Third Avenue Value Fund (Trades, Portfolio) with 2.57%.

FTI Consulting

The investment firm reduced its FTI Consulting Inc. (FCN) position by 99.69%. The trade had an impact of -0.53% on the portfolio.

The U.S. company, which provides professional business advisory services, has a market cap of $3.77 billion and an enterprise value of $3.94 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 12.49% and return on assets of 6.77% are outperforming 75% of companies in the business services industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 0.65 is below the industry median of 0.85.

The largest guru shareholder of the company is Simons' firm with 0.95% of outstanding shares, followed by Joel Greenblatt (Trades, Portfolio) with 0.01% and Jeremy Grantham (Trades, Portfolio) with 0.01%.

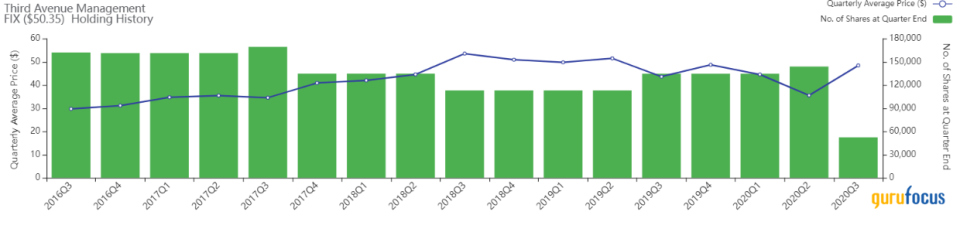

Comfort Systems USA

The investment firm curbed its Comfort Systems USA Inc. (FIX) position by 63.6%. The trade had an impact of -0.52% on the portfolio.

The U.S. company, which provides mechanical contracting services, has a market cap of $1.83 billion and an enterprise value of $2.07 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 23.31% and return on assets of 8.9% are outperforming 91% of companies in the construction industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.23 is below the industry median of 0.66.

The largest guru shareholder of the company is Chuck Royce (Trades, Portfolio) with 1% of outstanding shares, followed by Simons with 0.27% and HOTCHKIS & WILEY with 0.22%.

Disclosure: I do not own any stocks mentioned.

Read more here:

Third Point Exits Baxter, Raytheon Technologies

Fisher Asset Management Cuts Total, Mastercard

Capital Growth Management Exits KB Home, Dollar Tree

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.