Third Avenue Value Fund Exits Several Positions in 1st Quarter

- By Tiziano Frateschi

The Third Avenue Value Fund (Trades, Portfolio) sold shares of the following stocks during the first quarter.

Warning! GuruFocus has detected 1 Warning Sign with XPAR:FP. Click here to check it out.

The intrinsic value of XPAR:FP

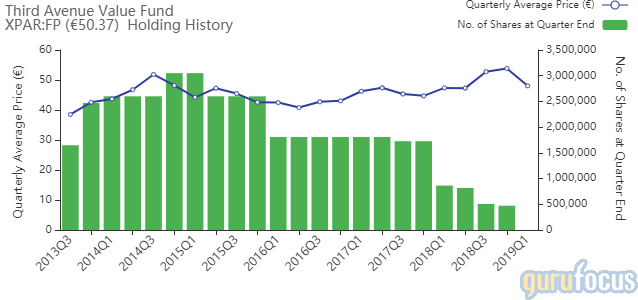

The fund sold out of Total SA (FP.PA). The trade had an impact of -3.14% on the portfolio.

Third Avenue's Ocean Rig UDW Inc. (ORIG) position was dissolved following its merger with Transocean Ltd. (RIG). The trade had an impact of -3% on the portfolio.

The offshore drilling contractor has a market cap of $2.54 billion and an enterprise value of $2.22 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 3.79% and return on assets of 3.05% are outperforming 64% of companies in the Global Oil and Gas Drilling industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 1.93 is above the industry median of 0.40.

The fund closed its Bank of New York Mellon Corp. (BK) holding. The trade had an impact of -2.78% on the portfolio.

The investment bank has a market cap of $48.97 billion.

GuruFocus gives the company a profitability and growth rating of 3 out of 10. While the return on equity of 9.85% is outperforming the sector, the return on assets of 1.18% is underperforming 55% of companies in the Global Asset Management industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 2.85 is far below the industry median of 480.

The company's largest guru shareholder is Warren Buffett (Trades, Portfolio) with 8.48% of outstanding shares, followed by Dodge & Cox with 5.26%, First Eagle Investment (Trades, Portfolio) with 2.03% and Chris Davis (Trades, Portfolio) with 1.83%.

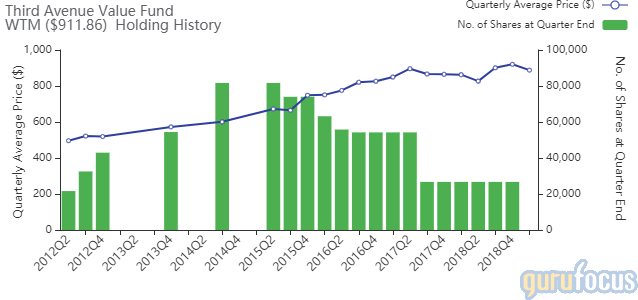

The fund divested of its White Mountains Insurance Group Ltd. (WTM) holding, impacting the portfolio by -2.69%.

The specialty property and casualty insurance provider has a market cap of $2.9 billion and an enterprise value of $2.64 billion.

GuruFocus gives the company a profitability and growth rating of 2 out of 10. The return on equity of -4.52% and return on assets of -4.06% are outperforming 89% of companies in the Global Insurance - Property and Casualty industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.57 is below the industry median of 2.82.

The company's largest guru shareholder is Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.48% of outstanding shares, followed by the Hotchkis & Wiley with 0.07% and Chuck Royce (Trades, Portfolio) with 0.07%.

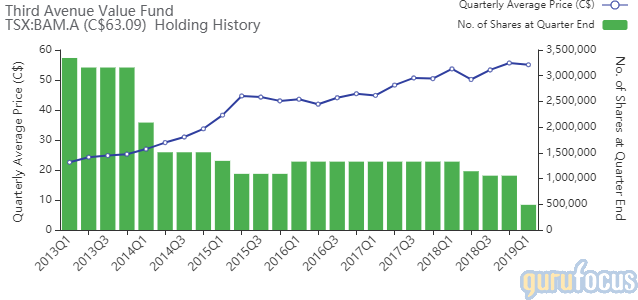

The Value Fund trimmed 53.65% off Brookfield Asset Management Inc. (BAM.A) holding, impacting the portfolio by -2.62%.

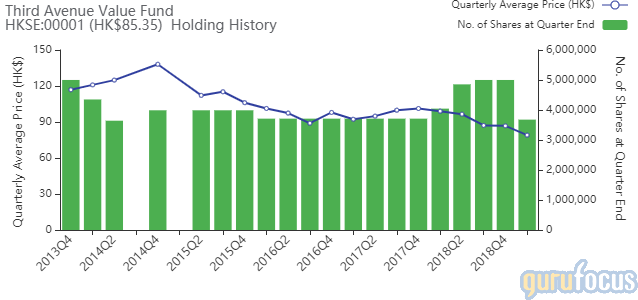

Third Avenue reduced its CK Hutchison Holdings Ltd. (HKSE:00001) stake by 26.43%, impacting the portfolio by -1.51%.

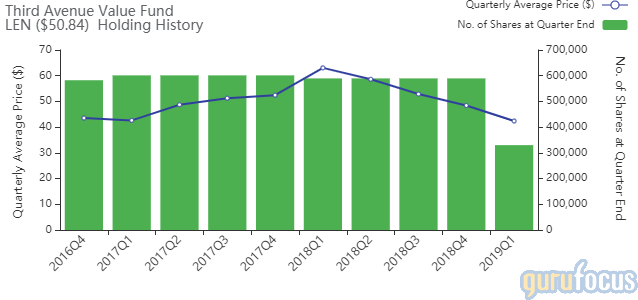

The fund reduced its position in Lennar Corp. (LEN) by 44.02%, impacting the portfolio by -1.26%.

The homebuilder has a market cap of $16.04 billion and an enterprise value of $25.49 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 12.74% and return on assets of 6.34% are outperforming 66% of companies in the Global Residential Construction industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.10 is below the industry median of 0.35.

The company's largest guru shareholder is Glenn Greenberg (Trades, Portfolio) with 1.06% of outstanding shares, followed by Barrow, Hanley, Mewhinney & Strauss with 0.80%, Ken Fisher (Trades, Portfolio) with 0.52%, Simons' firm with 0.50% and the Smead Value Fund (Trades, Portfolio) with 0.28%.

Third Avenue curbed its Bayerische Motoren Werke AG (BMW) holding by 5.12% . The trade had an impact of -0.25% on the portfolio.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Companies Paying High Dividend Yields

5 Guru Stocks Growing Earnings

6 Predictable Guru Stocks

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here .

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 1 Warning Sign with XPAR:FP. Click here to check it out.

The intrinsic value of XPAR:FP