This time is different: Morning Brief

Thursday, September 5, 2019

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

The richest companies are getting richer

The four most demonized words in investing are "this time is different."

The reason why is simple — many investors hold that those who do not learn from and respect market history are doomed to repeat it. This argument is the basis for why some believe stock prices will have low returns from current valuation levels. Or why stocks could crash at anytime. It's happened before (once!) so it will happen again.

But U.S. market history only goes back 150 or so years. There have been just a handful of distinct market cycles. Each of these were different. And this time literally is different. It doesn't make you a fool to say this out loud.

In his latest investor letter published this week, GMO's head of asset allocation Ben Inker outlined what I think is an important but often overlooked part of how the current cycle is different — corporate inequality.

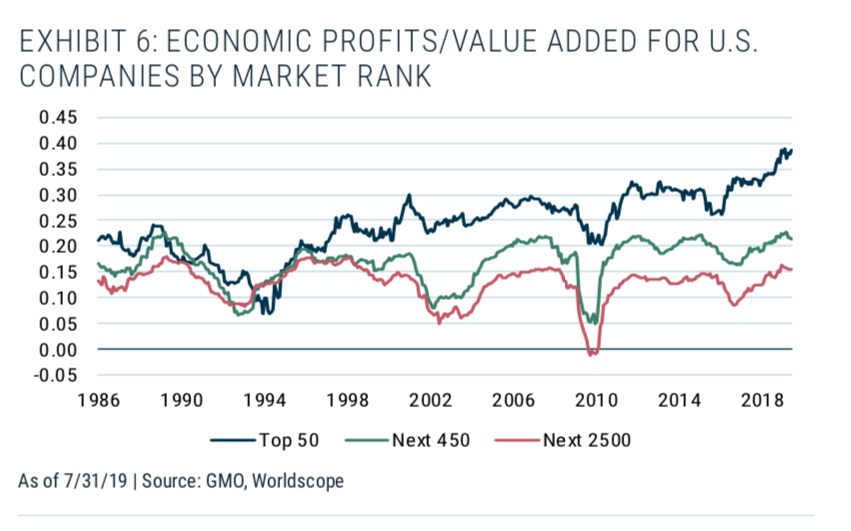

Corporate earnings as a percent of U.S. GDP have been elevated since 2004, even accounting for the ups and down profits seen during economic cycles. But Inker highlights that this elevated profitability has not been evenly distributed among corporations. Because just as the richest citizens have gotten richer in the last several decades, so too have the richest corporations gotten richer.

From 1986-1995, the 50 biggest companies were responsible for 15% of profit growth seen by the 3,000 largest companies in the stock market. From 2006-2019, that percentage increased to 24%. In both periods, companies 2,500 through 3,000 accounted for around 11% of increased profitability. The fortunes of smaller companies, in other words, have been flat while large companies have flourished.

Inker writes that this extended period of outperformance from large companies "suggests this effect is not something we should expect to correct over a single business cycle." Though he adds that, "my guess is that the world in the future will be less favorable to these large, dominant companies than is true of the current environment."

Growing scrutiny of large tech companies and the increasing support Medicare For All has gained are just part of how Inker sees the tide potentially turning against the market's profit hogs. It is why he argues that, "the wiser bet is to assume the world will not remain entirely safe for dominant companies."

But whether you agree with Inker's vision of the future doesn't really matter. What matters is that his work shows how this cycle is different. The fortunes of big and small companies have diverged markedly and the divergence has been sustained.

Like negative interest rates, trade wars, and Brexit, corporate inequality is a defining part of this cycle. Each factor is unique to this market moment and each leaves investors perhaps less able to lean on history for guidance about what the future holds.

And all of these factors should make you confident saying this time is different. Don’t let a well-worn investor cliché change your mind.

By Myles Udland, reporter and co-anchor of The Final Round. Follow him @MylesUdland

What to watch today

Earnings

Post-market

4:05 p.m. ET: Lululemon (LULU) analysts expect adjusted earnings of 89 cents per share on $845.30 million in revenue

Other notable

4:05 p.m. ET: DocuSign (DOCU), 4:15 p.m. ET: PagerDuty (PD), 4:15 p.m. ET: Zoom Video Communications (ZM)

Economy

8:15 a.m. ET: ADP Employment Change, August (146,000 expected, 156,000 in July)

8:30 a.m. ET: Initial Jobless Claims, week ended August 31 (215,000 expected, 215,000 prior)

8:30 a.m. ET: Continuing Claims, week ended August 24 (1.688 million expected, 1.698 million prior)

9:45 a.m. ET: Bloomberg consumer comfort

9:45 a.m. ET: Markit US Services PMI, August final (51.0 expected, 50.9 in July)

9:45 a.m. ET: Markit US Composite PMI, August final (50.9 in July)

10 a.m. ET: Factory Orders, July (1.0% expected, 0.6% in June)

10 a.m. ET: Durable Goods Orders, July final (2.1% expected, 2.1% in June); Durable Goods excluding Transportation, July final (-0.4% expected, -0.4% in June)

10 a.m. ET: ISM Non-Manufacturing Index, August (54.0 expected, 53.7 in July)

From Yahoo Finance

Reporter Julia La Roche will interview Starbucks CEO Kevin Johnson. Catch the interview live at noon today on On the Move and segments of the interview throughout the afternoon on YFi PM, The Ticker and The Final Round.

To kick-off NFL season, former NFL player Rashad Jennings and NFL Network’s Ian Rapoport will chat with Julie Hyman and Adam Shapiro on On the Move.

Top news

China, U.S. to hold trade talks ‘in October’ as mistrust remains [Bloomberg]

Slack beats on top and bottom line, stock slumps [Yahoo Finance]

UK lawmakers take big step in Brexit showdown with Johnson [AP]

YAHOO FINANCE HIGHLIGHTS

We need a Republican climate plan

‘The outlook has been darkening’: JPMorgan predicts 3 more rate cuts

'Politics are not good for us in any way,' says Cowboys owner Jerry Jones

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.