Those Who Purchased Second Chance Properties (SGX:528) Shares Five Years Ago Have A 49% Loss To Show For It

For many, the main point of investing is to generate higher returns than the overall market. But every investor is virtually certain to have both over-performing and under-performing stocks. At this point some shareholders may be questioning their investment in Second Chance Properties Ltd (SGX:528), since the last five years saw the share price fall 49%.

View our latest analysis for Second Chance Properties

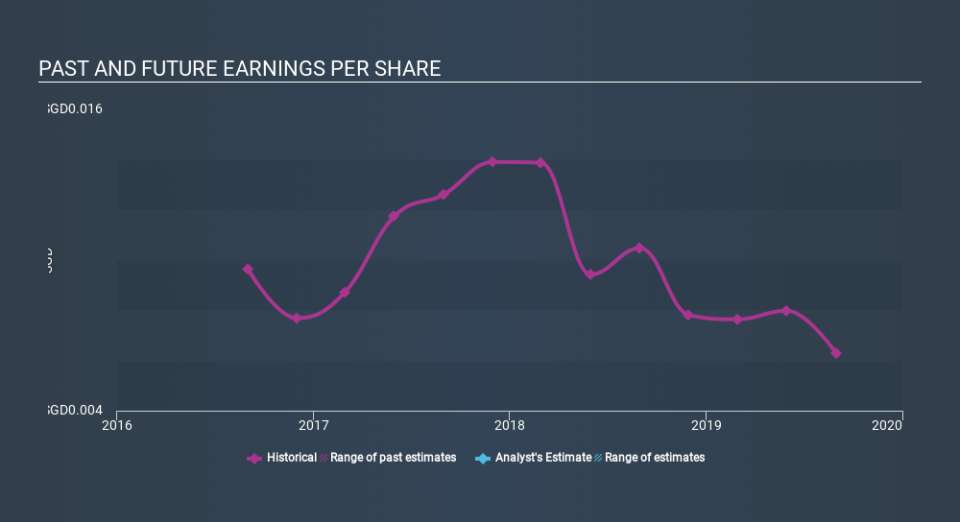

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the five years over which the share price declined, Second Chance Properties's earnings per share (EPS) dropped by 24% each year. The share price decline of 13% per year isn't as bad as the EPS decline. So investors might expect EPS to bounce back -- or they may have previously foreseen the EPS decline.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into Second Chance Properties's key metrics by checking this interactive graph of Second Chance Properties's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Second Chance Properties's TSR for the last 5 years was -38%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's good to see that Second Chance Properties has rewarded shareholders with a total shareholder return of 7.8% in the last twelve months. Of course, that includes the dividend. That certainly beats the loss of about 9.1% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. Before forming an opinion on Second Chance Properties you might want to consider these 3 valuation metrics.

Of course Second Chance Properties may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.