Those Who Purchased Streamline Health Solutions (NASDAQ:STRM) Shares Five Years Ago Have A 77% Loss To Show For It

Some stocks are best avoided. It hits us in the gut when we see fellow investors suffer a loss. For example, we sympathize with anyone who was caught holding Streamline Health Solutions, Inc. (NASDAQ:STRM) during the five years that saw its share price drop a whopping 77%. And it's not just long term holders hurting, because the stock is down 23% in the last year. Shareholders have had an even rougher run lately, with the share price down 28% in the last 90 days. However, one could argue that the price has been influenced by the general market, which is down 16% in the same timeframe.

View our latest analysis for Streamline Health Solutions

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Streamline Health Solutions became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

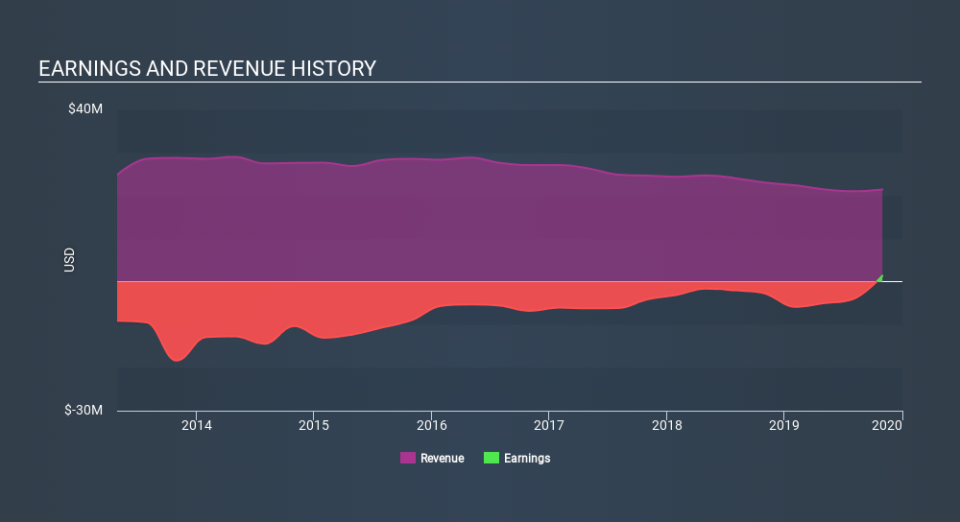

Arguably, the revenue drop of 6.0% a year for half a decade suggests that the company can't grow in the long term. That could explain the weak share price.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. You can see what analysts are predicting for Streamline Health Solutions in this interactive graph of future profit estimates.

A Different Perspective

We regret to report that Streamline Health Solutions shareholders are down 23% for the year. Unfortunately, that's worse than the broader market decline of 4.6%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. However, the loss over the last year isn't as bad as the 26% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Streamline Health Solutions has 5 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.