Tilray Is Down 55% In 2019: What Do The Fundamentals Say?

Tilray Inc (NASDAQ: TLRY)'s meteoric rise immediately after its July 2018 IPO wowed analysts and investors alike.

From an IPO price of $17, the stock rose to an intraday high of $300 on Sept. 19, an astronomical gain of about 1,700% from the offer price.

Since topping out at $300, the stock has been on a broader downtrend.

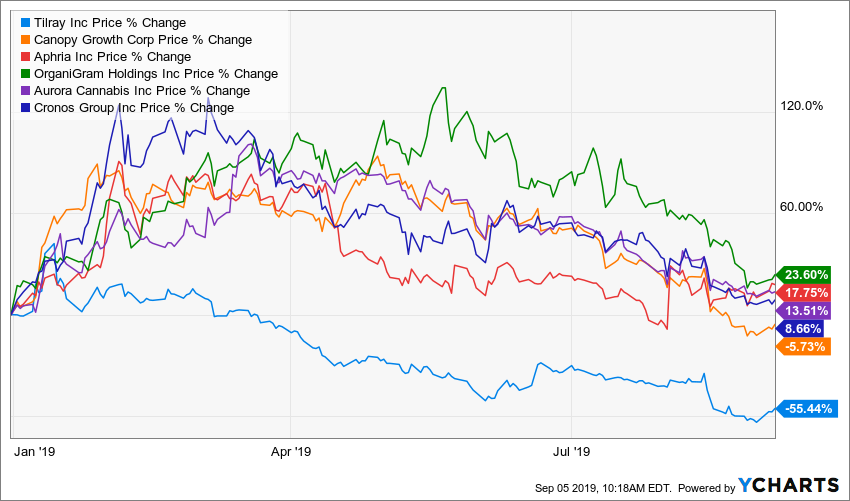

Tilray shares are down about 55% year to date. The vertically integrated Canadian medical cannabis company has underperformed most of its peers listed on U.S. exchanges.

Source: Y Charts

Revenue Outperformance Not Flowing Through To Bottom Line

Tilray has struggled to meet investor expectations, reporting a wider-than-expected loss in each of the four quarters it has reported as a public company.

Yet the cannabis company's revenue growth has been commendable.

Following a 62% jump in 2017, revenue climbed 110% to $43.13 million in fiscal year 2018. The company reported year-over-year revenue growth of over 370% in the second quarter of 2019 to $45.9 million, thanks to contributions from its Manitoba Harvest acquisition.

The net loss, however, widened from 17 cents in the second quarter of 2018 to 36 cents in the second quarter of 2019. Analysts, on average, had estimated a loss of 25 cents per share for the quarter. Cash, cash equivalents and short-term investments totaled $220.87 million at the end of the second quarter.

Click here for more information about the upcoming Benzinga Cannabis Capital Conference Oct. 22-23 in Chicago.

The company sells dried cannabis and cannabis extracts, including full-spectrum and purified oil drops and capsules. In the three months ended June 30, it harvested 11,474 kg of cannabis and sold 5,588 kg equivalents of cannabis, with an average net selling price per gram of $4.61 compared to the average cost per gram sold at $3.86.

The Manitoba Harvest acquisition has enabled the company to sell food products such as shelled hemp seed, ground hemp and oil. The average selling price per unit of food products was $6.48 in the second quarter.

The margin has remained under pressure, as Tilray is heavily reliant on third-party suppliers. Although the metric has ticked up in recent quarters, it is still well below that of peers.

As the company expands its production in Canada through its recent acquisition of Natura, margins could be on the mend. International expansion is also a huge prospect for Tilray.

"Some of the company's ongoing investments in the large European market include 60 acres of outdoors facilities and a large greenhouse property that can export product within the European Union," CEO Brendan Kennedy said in an interview with CNBC. "The investments will be apparent in the coming quarters, when exports are expected to begin to the German market."

See Also: Tilray CEO Talks Global Cannabis Interest, New Participants In Bloomberg Interview

Low-Float Volatile Stock

Tilray's float — or, in other words, shares freely available for trading — is around 21.89 million shares, and about 28.6% of the float is shorted. The short ratio is 3.7.

Most analysts remain sidelined on Tilray, and the average price target for the shares is $64.40, suggesting roughly 115% upside.

Recently, Cowen analyst Vivien Azer slashed the price target on Tilray from $150 to $60, although she maintained her bullish view.

With the valuation looking attractive as shares trade close to their all-time lows, it might be time to revisit the stock.

If the company can consistently grow its top-line through production boost and manage its margins, the stock could break out of the recent lackluster phase and return to its winning ways.

Tilray's stock last closed at $32.08 per share.

See more from Benzinga

The Daily Biotech Pulse: Regeneron's Bad Cholesterol Drug Aces Late-Stage Trial, Oncolytics Offering

© 2019 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.