Timber (TMBR) Surges on Carcinogenicity Waiver for TMB-001

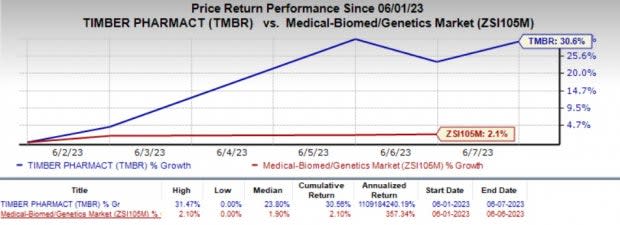

Timber Pharmaceuticals’ TMBR shares were up 30.6% in the past week compared with the industry’s 2.1% growth. A significant part of the upside can be attributed to the dermal carcinogenicity (CARC) waiver granted by the FDA for TMBR’s topical isotretinoin product, TMB-001.

Image Source: Zacks Investment Research

This product is in a late-stage study, being developed for the treatment of moderate-to-severe subtypes of congenital ichthyosis (CI) — a group of rare genetic keratinization disorders characterized by dry, thickened and scaling skin. The candidate is a topical isotretinoin formulation using Timber's patented IPEG delivery system.

The CARC waiver is based on the positive results of a 39-week repeat dose dermal toxicity study, which showed no evidence of skin or organ carcinogenicity in rodents from chronic applications of TMB-001. A carcinogen is a substance, organism or agent capable of causing cancer.

The waiver is a milestone for TMBR, as it allows the company to move forward with the TMB-001 program, quickly and efficiently. It will also eliminate the need for a two-year dermal rodent carcinogenicity study, thereby saving Timber’s time and resources.

Oral isotretinoin is a well-known treatment option for CI. However, its high-dose and chronic therapy often leads to systemic toxicity that many patients fail to tolerate. Timber aims to provide a new topical treatment option for CI patients who cannot undergo oral therapy. By avoiding a costly and time-consuming non-clinical study, the company can focus on advancing the development of TMB-001.

TMBR is making progress in its clinical studies and has enrolled almost 70% of patients in its late-stage ASCEND study evaluating TMB-001.

Additionally, the FDA has granted the Breakthrough Therapy Designation to the candidate in May 2022 for treating CI. The designation helps expedite the review and development of drugs that are intended to treat serious or life-threatening conditions and meet unmet medical needs.

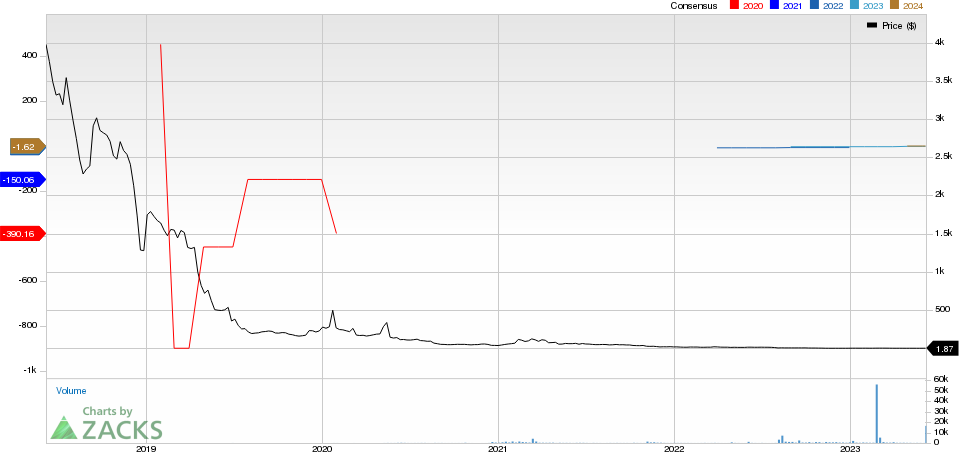

Timber Pharmaceuticals, Inc. Price and Consensus

Timber Pharmaceuticals, Inc. price-consensus-chart | Timber Pharmaceuticals, Inc. Quote

Zacks Rank and Other Stocks to Consider

Timber currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the biotech sector are Akero Therapeutics AKRO, ADMA Biologics, Inc. ADMA and Omega Therapeutics OMGA, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Loss per share estimate for Akero Therapeutics has narrowed from $3.46 to $2.78 for 2023 in the past 90 days. Shares of Akero Therapeutics have risen 12.8% in the past week.

AKRO’s earnings beat estimates in three of the trailing four quarters and missed the mark in one, delivering an average surprise of 7.96%.

Loss per share estimate for ADMA Biologics has narrowed from 19 cents to 9 cents for 2023 in the past 90 days. Shares of ADMA Biologics have rallied 1.2% in the past week.

ADMA’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 19.13%.

Loss per share estimate for Omega Therapeutics has narrowed from $2.51 to $2.05 for 2023 in the past 90 days. Shares of the company have risen 16.5% in the past week.

OMGA’s earnings beat estimates in two of the trailing four quarters, met the mark in one and missed in another, delivering an average surprise of 8.24%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

Akero Therapeutics, Inc. (AKRO) : Free Stock Analysis Report

Timber Pharmaceuticals, Inc. (TMBR) : Free Stock Analysis Report

Omega Therapeutics, Inc. (OMGA) : Free Stock Analysis Report