Time for Investors To Revisit the Pandemic Winners?

A handful of stocks benefited massively during the initial phases of the pandemic. It was a fascinating time to be an investor, and those who targeted the stay-at-home stocks were rewarded handsomely with considerable gains.

In 2022, these once seemingly unstoppable investments have found themselves deep in the red, leaving dents in many portfolios. The Fed's tightening cycle has massively affected many of these high-growth pandemic winners.

Three stocks that gained widespread popularity during the period include Teladoc TDOC, Zoom Video Communications ZM, and Peloton Interactive PTON.

Below is a YTD chart depicting the share performance of all three companies with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

It raises a valid question, are these one-time massive winners still worth investors’ attention? Let’s take a closer look.

Teladoc

Teladoc Health TDOC can diagnose and treat most non-emergency conditions such as flu, seasonal allergies, upper respiratory infections, and more by phone or video conveniently in the comfort of your home.

Analysts have upped their earnings outlook across several timeframes over the last several months. TDOC carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

TDOC’s valuation multiples have fallen significantly amid the adverse price action of shares.

Currently, the company carries a 2.1X forward price-to-sales ratio, a fraction of its 9.8X five-year median and representing a slight 1% premium relative to its Zacks Medical Sector.

Image Source: Zacks Investment Research

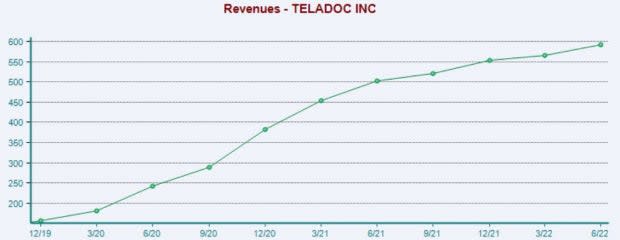

The company’s quarterly reports have been strong as of late – TDOC has exceeded earnings estimates in each of its last four quarters.

Quarterly revenue has also consistently come in above expectations, with the company penciling in nine top line beats over its last ten quarters.

TDOC has a very favorable revenue trend, as we can see in the chart below that illustrates the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Zoom Video Communications

Zoom Video Communications ZM utilizes a cloud-native unified communications platform, which combines video, audio, phone, screen sharing, and chat functionalities, making remote-working and collaboration easy.

Analysts have been overwhelmingly bearish over the last several months, slashing their earnings outlook across the board. ZM carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

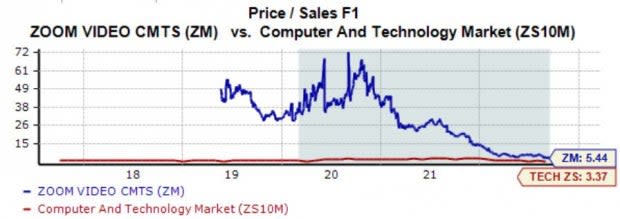

ZM’s valuation levels have fallen extensively but remain elevated – the company’s 5.4X forward price-to-sales ratio is nowhere near its median of 30.9X since its 2019 IPO but represents a steep 62% premium relative to its Zacks Sector.

Image Source: Zacks Investment Research

However, ZM has an impressive earnings track record – the company has exceeded the Zacks Consensus EPS Estimate in each of its last ten quarters.

Top-line results have also been strong; Zoom Video Communications has penciled in nine revenue beats over its last ten quarters.

Image Source: Zacks Investment Research

Peloton Interactive

Peloton’s PTON primary products are internet-connected stationary bicycles and treadmills, enabling monthly subscribers to participate in classes via streaming media remotely.

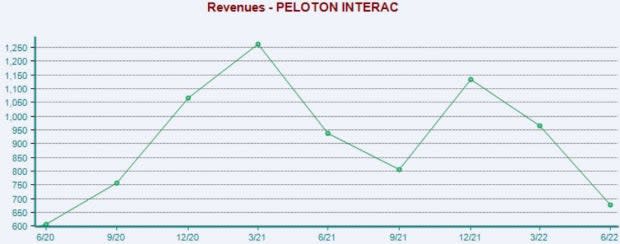

Analysts have dialed back their earnings outlook across nearly all timeframes over the last 60 days. PTON carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

PTON’s valuation multiples have fallen extensively amid the stretch of poor price action; the company’s 1.1X forward price-to-sales ratio is nowhere near its median of 5.9X since its September 2019 IPO and represents a notable 41% discount relative to its Zacks Consumer Discretionary Sector.

Image Source: Zacks Investment Research

As of late, the company’s quarterly reports have left much to be desired – PTON has missed revenue and earnings estimates in each of its previous three quarters. Just in its latest quarter, Teladoc penciled in a wide 85% bottom line miss and a marginal 0.7% revenue miss.

Image Source: Zacks Investment Research

Bottom Line

Once seemingly unstoppable investments, the tide has shifted significantly for the pandemic winners in 2022 amid a Fed pivot to a hawkish nature.

Analysts have dialed back their earnings estimates, and shares have tumbled. However, valuation multiples have fallen significantly, perhaps indicating that long-term investors could consider getting interested.

However, a much better strategy would be for investors to wait until positive earnings estimate revisions start coming in.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Teladoc Health, Inc. (TDOC) : Free Stock Analysis Report

Zoom Video Communications, Inc. (ZM) : Free Stock Analysis Report

Peloton Interactive, Inc. (PTON) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research