Time to Make a Move? Wedbush Offers 3 Stocks to Buy

Yesterday was a historic day on Wall Street. The S&P 500 plummeted 12%, its worst day since 1987. The Dow recorded its worst one-day point drop in history, closing 2,997 points down, or 12.9%, lower. Recent measures and assurances by top brass have failed to halt the decline, and as the world prepares for lockdown in order to mitigate the viral threat, the possibility of a recession is more tangible than ever.

“Depending on how far the virus spreads and how long these changes persist, there is a good chance that ripple effects from these changes push the U.S. economy into a recession after more than a decade of economic expansion,” said Wedbush analyst Seth Basham.

In a recent report titled, Finding Opportunity in the Coronavirus Refuse, Basham warns that as the virus spreads exponentially “the potential for a more protracted risk-off period remains.” Amongst the debris of crashed and smashed stocks, though, the investment firm finds particular names that currently present “deep value opportunities.”

So here we take a better look at three stocks from Wedbush's list worth keeping an eye on. We used TipRanks data in an attempt to compare Wedbush's sentiment to those of the rest of the analyst community, and the results are interesting. Let's take a closer look.

Autozone (AZO)

Autozone is the largest U.S. seller of aftermarket automotive parts and accessories, with over 6000 stores spread across the country, as well as in Mexico and Brazil. In yesterday’s historic bloodbath, Autozone lost 16% of its value. extending the cumulative loss of its share price in 2020 to 28.5%.

At first, to think that anything vehicle or transport related in these stationary times is a sound investment rings peculiar. Fears of the coronavirus spreading any further are indicating extended periods of social distancing are on the way. These measures will instigate a sharp slowdown in driving as commuting to work, school and events decreases significantly. The results of which are less car related failures, which in turn leads to a reduced need for repairs and maintenance, hurting Autozone’s core business. Sounds negative for Autozone, right? Not necessarily, Wedbush's Basham argues.

“While it is tough to gauge the extent of this slowdown, we believe it will last only a couple of quarters if the Great Recession is any precedent, as that trend could be overcome by more consumers trading down to their own repairs by late calendar 2020 (FY21),” the analyst noted.

In other words, following the economic slowdown, people will be reluctant to upgrade their vehicles. This will lead to more purchases of Autozone parts for repairs and maintenance later this year and in 2021, thus, supporting sales growth.

Basham added, “With consumers more likely to do repairs themselves in times of economic necessity, AZO is best positioned of the auto parts retailers given its higher DIY sales mix (~75% vs. ~55% for ORLY, ~40% for AAP and ~20% for GPC’s U.S. NAPA). This is a key reason we expect AZO to outperform in a downturn.”

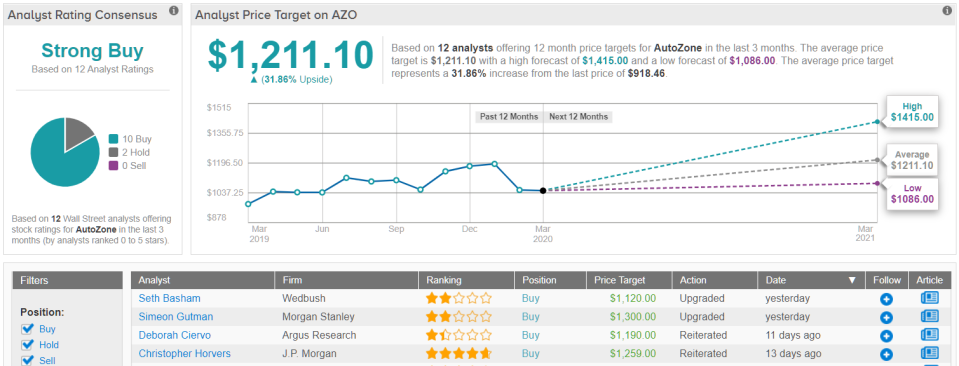

As a result, Basham tacks an upgrade on Autozone, bumping the rating from Neutral to Outperform. The analyst’s price target slightly moves up from $1100 to 1120. This conveys Basham’s confidence in Azo adding an extra 31.5% in the year ahead. (To watch Basham’s track record, click here)

Most of the Street remains unfazed by the coronavirus risk, supporting Basham's huge vote of confidence, as TipRanks analytics exhibit AZO as a Strong Buy. Out of 12 analysts tracked in the last 3 months, 10 are bullish on Autozone stock, while 2 remain sidelined. If that wasn’t enough, the $1,211.10 average price target puts the upside potential at 32%. (See Autozone stock analysis on TipRanks)

Global Payments Inc. (GPN)

Next up is payment processing services provider, Global Payments. The Atlanta, Georgia, based company offers global financial technology services through three segments: Merchant Solutions, Issuer Solutions, and Business and Consumer Solutions.

Last May, Global payments merged with fellow payment provider, TSYS, further expanding its reach. The company now boasts a market cap of $42 billion, and with more than 24,000 employees across the globe, is a growing force in its field.

Wedbush’s Moshe Katri adds the company to the investment firm’s Best Ideas List on account of its “resilient/defensive business model as well as attractive valuation.” Additionally, the analyst has “high confidence” in both revenue/cost synergies from TSYS transactions and the company’s CY20 guidance “despite the macro volatility/uncertainty.” Furthermore, the 5-star analyst notes, GPN’s resilience during the last downturn bodes well in the event of a prolonged recession.

Katri concluded, “GPN likely has the most straightforward path to deriving revenue and cost synergies from the TSS acquisition. As a standalone, this is the most successful merchant processor to date, with a unique focus on successfully building/acquiring a large portfolio of software solutions it monetizes, by selling to SMBs. Q4/CY19’s pro-forma better-than-expected results defied many skeptics especially given TSS’ struggles earlier last year, and we believe there’s more to go in terms of synergies.“

Unsurprisingly, Katri reiterates an Outperform on GPN, along with a $218 price target. The implication? Possible upside of 55%. (To watch Katri’s track record, click here)

The Street swipes a yes on the payment solutions provider, too. GPN’s Strong Buy consensus rating breaks down into 17 Buys and 2 Holds. Should the average price target of $222.58 be met over the coming months, investors stand to see returns in the shape of 55%. (See GPN stock analysis on TipRanks)

Ebay (EBAY)

The market has taken such a beating since the viral outbreak that Ebay’s 7% drop year-to-date stands up well against the S&P 500’s massive decline of 22%.

Indeed, Wedbush’s Ygal Arounian highlights Ebay as “one of, if not the least, directly Covid-19 impacted stocks" within his coverage universe.

It’s easy to see why. While a long-lasting recession will impact Ebay’s growth, in a twisted sort of way, Ebay can actually benefit from the current situation. As more lockdowns are implemented around the world, and more shops and non-essential services are shut down, Ebay will benefit from more people spending time online.

In addition, Arounian also believes the expiration of the PayPal operating agreement in July, which will coincide with the rollout of Ebay managed payments over the next 18 months, as a further catalyst opportunity.

The analyst added, “We view eBay as the least likely to see significant guidance cuts in 1Q and 2Q, and while what happens in 3Q-4Q is more uncertain, the impact will still be more muted in all likelihood than most companies in our coverage. With significant share buybacks coming up for eBay we view valuation as attractive. In addition to the value created from share reduction from the proceeds of the Stubhub and likely Classifieds sales, we view the core marketplace as still under pressure, but also view upside potential from the lapping of more one time in nature 2019 impacts like internet sales tax and marketing headwinds.”

With the online marketplace set to provide “relative safety and fundamental upside,” Arounian upgrades Ebay from Neutral to Outperform. The 12-month price target is raised from $34 to $38, which implies potential upside of 12% from current levels. (To watch Arounian’s track record, click here)

Overall, the current sentiment towards Ebay on the Street is a mixed bag. The consensus rating is currently a Hold, based on 12 Holds, 7 Buys and 3 Sells. That said, the average price target is $39.20, and represents possible upside of 17% from current levels. (See Ebay stock analysis on TipRanks)