Time To Worry? One Analyst Just Downgraded Their Sabaf S.p.A. (BIT:SAB) Outlook

The analyst covering Sabaf S.p.A. (BIT:SAB) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative.

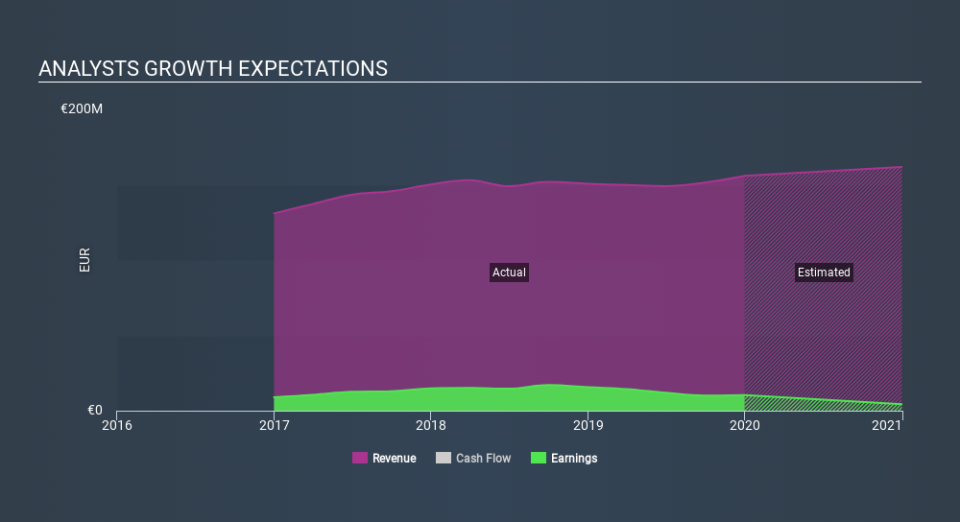

Following the downgrade, the most recent consensus for Sabaf from its solitary analyst is for revenues of €162m in 2020 which, if met, would be a satisfactory 3.8% increase on its sales over the past 12 months. Prior to the latest estimates, the analyst was forecasting revenues of €184m in 2020. The consensus view seems to have become more pessimistic on Sabaf, noting the measurable cut to revenue estimates in this update.

See our latest analysis for Sabaf

Of course, another way to look at these forecasts is to place them into context against the industry itself. The analyst is definitely expecting Sabaf'sgrowth to accelerate, with the forecast 3.8% growth ranking favourably alongside historical growth of 3.0% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 3.5% next year. Sabaf is expected to grow at about the same rate as its industry, so it's not clear that we can draw any conclusions from its growth relative to competitors.

The Bottom Line

The most important thing to take away is that the analyst cut their revenue estimates for this year. They're also forecasting for revenues to grow at about the same rate as companies in the wider market. Given the serious cut to this year's outlook, it's clear that the analyst has turned more bearish on Sabaf, and we wouldn't blame shareholders for feeling a little more cautious themselves.

A high debt burden combined with a downgrade of this magnitude always gives us some reason for concern, especially if these forecasts are just the first sign of a business downturn. You can learn more about our debt analysis for free on our platform here.

Another thing to consider is whether management and directors have been buying or selling stock recently. We provide an overview of all open market stock trades for the last twelve months on our platform, here.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.