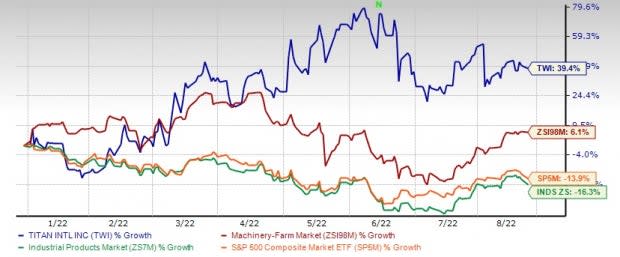

Titan International (TWI) Up 39% YTD: What's Driving It?

Shares of Titan International TWI have surged 39.4% so far this year. The leading global manufacturer of off-highway wheels, tires, assemblies and undercarriage products has outperformed the industry’s growth of 6% in the same time frame. The Industrial Products sector and S&P 500 have declined 16.3% and 13.9% in the same period, respectively.

Let’s look into the factors that are driving this currently Zacks Rank #3 (Hold) stock.

Image Source: Zacks Investment Research

What’s Working in TWI’s Favor?

Titan International’s stock has been gaining from its solid quarterly performances so far in 2022. The upbeat performance was driven by robust segmental upsides. The Agricultural segment is steadily benefiting from increased commodity prices, improved farmer income, replacement demand for an aging large equipment fleet and lower equipment inventory levels.

Betterment of global economic conditions and a recovery in the construction markets continue to drive the Earthmoving/Construction segment’s performance. The Consumer segment has been witnessing higher volumes related to general market improvements for a while. Pricing actions undertaken to offset rising raw material costs and other inflationary impacts in the markets, including freight and savings from productivity improvements across all production facilities, contributed to earnings.

TWI’s net sales were $573 million in the second quarter of 2022, posting a 30.6% year-over-year improvement and a 3% sequential increase. The top-line result also touched the highest quarterly sales figure since the second quarter of 2013. Adjusted earnings per share (EPS) surged 259% to 79 cents from 22 cents in the prior-year quarter. Adjusted EBITDA was up 120% year over year to $82 million in the quarter. Adjusted EBITDA margin climbed to 14% from 9% in the second quarter of 2021.

Titan International generated $56 million of free cash flow in the second quarter of 2022 and managed to take its debt leverage to below two times adjusted EBITDA, with further improvements expected in the back half of the year.

TWI had provided an upbeat outlook for the year, backed by the ongoing demand trends and order levels. Titan International expects to deliver revenues of $2.2 billion in 2022. TWI had reported sales of $1.78 billion in 2021. Management anticipates adjusted EBITDA to range between $240 million and $250 million for the year compared with $135 million in 2021. Free cash flow is projected between $90 million and $100 million. Overall, 2022 is emerging as the strongest year in TWI’s history. This positive momentum is expected to continue in 2023 as well.

Positive fundamentals in the agricultural sector as well as the need to replace old equipment will continue to support TWI’s Agricultural segment’s performance. Titan International will gain from the ramp-up in spending on infrastructure in the United States.

Earnings estimates for TWI have been northbound over the past 90 days. The Zacks Consensus Estimate for 2022 has increased around 139%, while the same for 2023 has gone up 125%. The favorable estimate revisions instill investor confidence in the stock.

Stocks to Consider

Some better-ranked stocks in the Industrial Products sector are Applied Industrial Technologies, Inc. AIT, Greif, Inc. GEF and Valmont Industries, Inc. VMI.

Applied Industrial presently sports a Zacks Rank #1 (Strong Buy). AIT delivered a trailing four-quarter earnings surprise of 22.8%, on average. You can see the complete list of today’s Zacks #1 Rank stocks.

AIT’s earnings estimates have increased 5.8% for fiscal 2023 (ending June 2023) in the past 60 days. Its shares have gained 7% so far this year.

Greif presently has a Zacks Rank #2 (Buy). GEF delivered a trailing four-quarter earnings surprise of 22.9%, on average.

GEF’s earnings estimates have increased 0.4% for fiscal 2022 (ending October 2022) in the past 60 days. Its shares have risen 17% year to date.

Valmont Industries presently has a Zacks Rank of 2. VMI’s earnings surprise in the last four quarters was 13.7%, on average.

In the past 60 days, Valmont’s earnings estimates have increased 3.8% for 2022. The stock has appreciated 12% so far this year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Valmont Industries, Inc. (VMI) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Titan International, Inc. (TWI) : Free Stock Analysis Report

Greif, Inc. (GEF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research